Myer sales, profit dragged down by store closures and underperforming brands

Department store Myer has blamed a challenging trading environment, inflationary pressures and the closure of two key locations for a slide in full-year profit of as much as $21 million.

Department store Myer has blamed a challenging trading environment, inflationary pressures and the closure of two key locations for a forecast slide in full-year profit by as much as $21 million.

Myer’s new executive chair Olivia Wirth faces an uphill battle as department stores grapple with a more uncertain future with the likes of Amazon and ultra-cheap fashion retailers Shein and Temu rapidly gaining popularity.

In a trading update on Thursday, Myer said it expects net profit for the 2024 financial year to hit between $50m and $54m, compared with the $71.1m reported in the previous year.

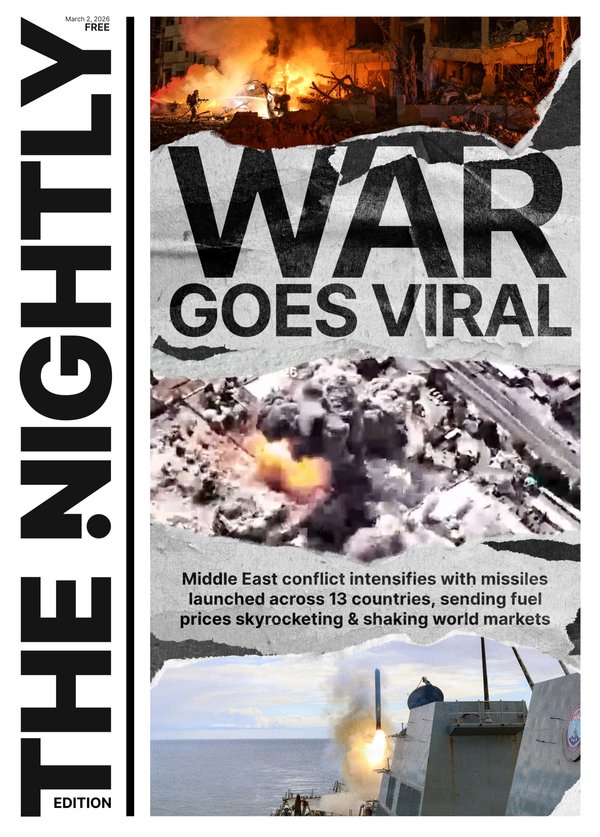

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The underperformance of Myer-owned labels Sass & Bide, Marc and David Lawrence — which were put up for sale earlier this year — is expected to represent about half of the year-on-year decline in profit.

Total sales for the period slipped 2.9 per cent to $3.27 billion as a result of the Brisbane City and Frankston store closures.

Second-half comparable sales are predicted to be up 0.8 per cent on the same time last year, with full-year same-store sales up by just 0.4 per cent.

“Total group inventory is expected to be consistent year-on-year reflecting tight inventory management and increased focus on newness,” Myer said.

Ms Wirth — who took over the top job from John King in June — said Myer was focused on optimising operational performance, including tightly managing costs, inventory and margins, in a tougher trading environment.

It was also leveraging its Myer One loyalty program.

“The second half sales performance demonstrates resilience in the face of a difficult trading environment for Myer and the wider retail sector, coupled most notably with the closure of our Brisbane CBD store and the underperformance of the Sass & Bide, Marcs and David Lawrence brands,” she said.

“We are also positioning the business for growth and are well progressed in a comprehensive strategic review of the business.”

The negative trading update on Thursday sent Myer shares down 7.1 per cent to 78¢.

It also comes as the Myer board explores a tie-up with Solomon Lew’s Premier Investments that would see the department store buy Premier’s apparel brands business, which owns labels Just Jeans, Jay Jays, Portmans, Jacqui E and Dotti.