Nvidia shares hit record as AI chipmaker again becomes world’s most valuable company

AI chipmaker Nvidia’s shares have reached a record on the US stock exchange for the first time since January, making it the largest company in the world by market cap.

Nvidia shares rose more than 4 per cent on Wednesday and closed at a record on the US stock exchange for the first time since January, as investors gain confidence that the company’s leadership in artificial intelligence won’t be dampened by Chinese export controls.

The stock finished at US$154.31, exceeding its prior closing high of $149.43 on Jan. 6.

Nvidia is now worth US$3.77 trillion, making it the largest company in the world by market cap, slightly beating out Microsoft, one of its main customers. Apple is third at about US$3 trillion.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.While Nvidia remains the clear leader in graphics processing units, or GPUs, that are being used to build large language models and run AI workloads, the strength of this year’s rally is surprising given that the company has said it is locked out of the world’s second-biggest economy.

In April, the Trump administration issued new rules that cut off sales of the company’s H20 AI processor that had been developed to meet prior restrictions. Nvidia said last month that the change instituted by the US government would cost the company US$8 billion in sales, and that it had to write off US$4.5 billion in inventory. Now, Nvidia isn’t counting on any sales from China.

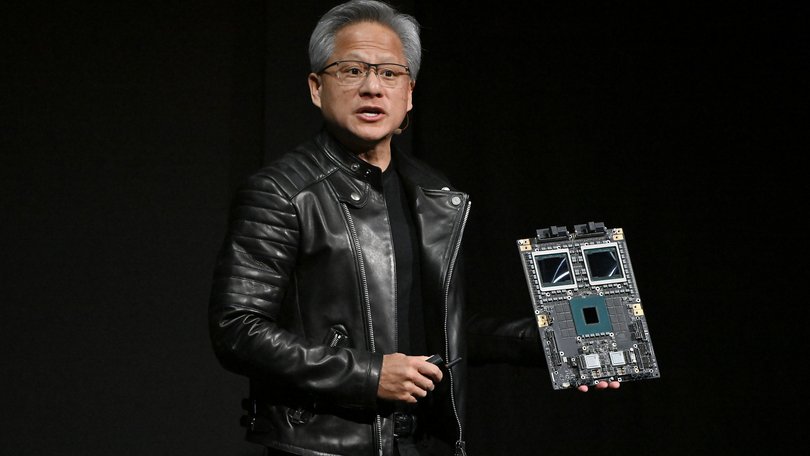

“The $50 billion China market is effectively closed to US industry,” Nvidia CEO Jensen Huang said last month.

There’s another forthcoming rule that will expand export restrictions on AI chips, Trump administration officials previously said.

Still, in its earnings report in May, Nvidia reported a 69 per cent increase in year-over-year revenue, powered by a 73 per cent surge in its data center business. For the full fiscal year, analysts are expecting 53 per cent revenue growth to almost $200 billion, according to LSEG.

Nvidia held its annual shareholder meeting on Wednesday. Huang said at the event that, other than AI, robotics is its biggest growth opportunity.