RBA interest rates live updates: Reserve Bank hands down long-awaited interest rate cut to Aussie homeowners

And that, folks, is a wrap!

In case you missed it, the Reserve Bank today handed out a long-awaited interest rate cut for suffering Aussie homeowners.

The cash rate was cut from 4.35 per cent - where it has been wedged solid since November 2023 - to 4.1 per cent.

Within 20 minutes of the welcomed decision, all four of the big four banks said they would pass on the full cut to variable rate customers. On a mortgage of $600,000, that’ll be an immediate $92-a-month saving when the new lower rates take effect towards the end of the month.

So, the big question now is: Will we get more?

That’s the million-dollar question. RBA governor Michele Bullock highlighted the strength of the labour market when she faced the media after the rates decision and said it would be a crucial factor considered before there’s any further cuts this year.

Market watchers, who had priced in a reduction - but had showed some signs of hesitation early today about whether the board would actually go through with it - will be adjusting their models overnight and we should hear more tomorrow on their forecasts for the rest of the year.

Some are already banking on two more cuts that will take the official cash rate to 3.6 per cent by December.

And that’s where it could stay, with Bullock warning those who reaped massive rewards with record low interest rates during the pandemic that the cash rate would be returning to a more neutral setting.

But, in this day and age, a saving’s a saving.

Use it wisely.

Thaks for joining us today.

And for all the news on what you may have missed, what it means for your budget and your mortgage, what it means for the timing of the Federal election and what the experts are saying, check out the feed below ...

Key events

18 Feb 2025 - 01:37 PM

RBA rate cut ‘won’t impact election timing’: PM

18 Feb 2025 - 01:23 PM

Labour market data key to next cut: RBA’s Bullock

18 Feb 2025 - 12:33 PM

Business groups welcome cuts and call for reforms

18 Feb 2025 - 12:29 PM

Where is the economy going?

18 Feb 2025 - 12:09 PM

Will this mean an election gets called soon?

18 Feb 2025 - 12:05 PM

Much-hyped rate cut will renew speculation of early election

18 Feb 2025 - 11:53 AM

How much will you save?

18 Feb 2025 - 11:49 AM

What now?

18 Feb 2025 - 11:46 AM

‘Very welcome news’: Treasurer responds to rate cut

18 Feb 2025 - 11:43 AM

Major banks follow rate cuts with mortgage drops

18 Feb 2025 - 11:38 AM

So how many cuts will we get now there’s been a first move?

18 Feb 2025 - 11:36 AM

Here’s what the RBA had to say ...

18 Feb 2025 - 11:31 AM

At long last ...

18 Feb 2025 - 11:21 AM

Will it be champagne or the tissues?

18 Feb 2025 - 11:01 AM

This graph says it all ...

18 Feb 2025 - 10:32 AM

Give ... and take (and why bank loyalty could be robbing you blind)

18 Feb 2025 - 09:57 AM

The ‘for’ and ‘against’ case for a cut (or a hold)

18 Feb 2025 - 09:43 AM

There’s a first time for everything ... even mortgage relief!

18 Feb 2025 - 09:25 AM

The RBA cuts rates ... so, what do you do next?

18 Feb 2025 - 08:55 AM

Why the RBA’s possible cash rate cut impacts all Australians

18 Feb 2025 - 08:47 AM

Could interest rate cut spark banking mortgage war?

18 Feb 2025 - 08:39 AM

RBA board meets to begin deliberation

18 Feb 2025 - 08:32 AM

What does your bank think will happen with rates today?

18 Feb 2025 - 08:21 AM

When will the RBA make an interest rate announcement?

18 Feb 2025 - 06:23 AM

Albanese shares ‘respect’ for RBA ahead of rate decision

18 Feb 2025 - 05:54 AM

Interest rate outcome set to influence election timing

18 Feb 2025 - 04:57 AM

How much would a rate cut save the average loan?

18 Feb 2025 - 04:54 AM

D Day for RBA rates call as economists warn cut not certain

So how many cuts will we get now there’s been a first move?

That’s hard to say. And it will depend on the data. Read into this from the RBA’s statement what you will ..

So, while today’s policy decision recognises the welcome progress on inflation, the board remains cautious on prospects for further policy easing.

Here’s what the RBA had to say ...

The RBA board says its monetary policy ”has been restrictive and will remain so after this reduction in the cash rate”.

“Some of the upside risks to inflation appear to have eased and there are signs that disinflation might be occurring a little more quickly than earlier expected. There are nevertheless risks on both sides.”

It’s statement, released just minutes ago, also warned of potential risk - pointing a finger at the US.

“Uncertainty about the outlook abroad also remains significant,” it said.

“Geopolitical and policy uncertainties are pronounced and may themselves bear down on activity in many countries if households and firms delay expenditures pending greater clarity on the outlook.

“Most central banks have been easing monetary policy as they become more confident that inflation is moving sustainably back towards their respective targets.

“But market expectations for further easing have moderated somewhat in recent months, particularly in the United States.”

At long last ...

There’s finally relief for long-suffering mortgage holders! A 25 basis point cut to the official rate!

Will it be champagne or the tissues?

We won’t have to wait long - we’re just 10 minutes away.

The big question is this: If the RBA does choose to hold, how much longer will homeowners have wait for relief?

Remember, rates have not moved since November 2023. The RBA has consitently maintained it will not budge until inflation is “sustainably” within its 2 to 3 per cent target range.

We’re not there yet. Almost, but not yet.

Does that iron resolve from governor Michele Bullock give her cover to wait longer?

We’ll find out in a few minutes.

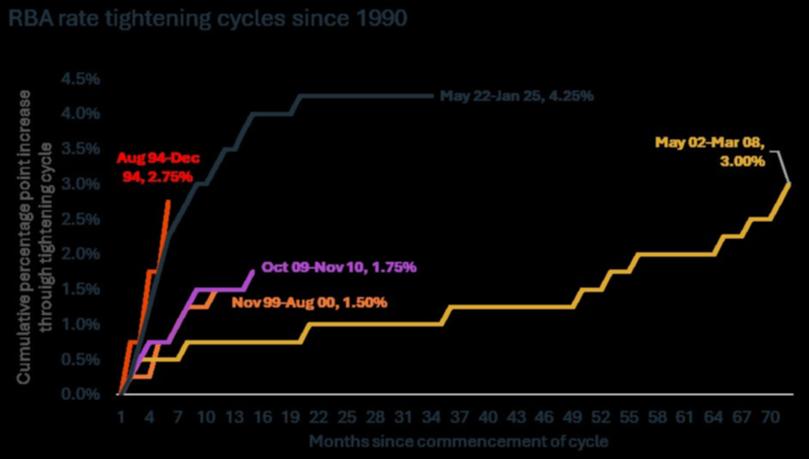

This graph says it all ...

We love a good graph - but maybe not this one from research house CoreLogic.

Sure, the colours are great but it shows just how quickly things changed for millions of homeowners in the fight against inflation ...

ASX holds breath for rates call

The local share market is on track for its second day of losses as traders wait to see if the Reserve Bank cuts rates for the first time in more than four years.

The S&P/ASX200 was down 51.1 points, or 0.6 per cent, to 8486.0 atmidday, while the all ordinaries was down 48.1 points, or 0.55 per cent, to 8762.8.

Capital.com analyst Kyle Rodda said that the eyes of the world would temporarily be on Australia forthe rates call.

Read more here

Countdown is on!

We’re an hour away from finding out what the RBA will do - hold or cut.

Stay tuned.

Give ... and take (and why bank loyalty could be robbing you blind)

A cut in official interest rates today will put a little cash back in your pocket each month.

But before you head out and blow it all on such extravagances as a takeaway or trip to the movies, there’s two things to remember, warns Compare the Market’s economic director David Koch.

The first is private health insurance premiums that are due to rise on April 1. The second will impact east coast households if wholesale electricity prices rise.

“Health insurers are due to announce their annual rate rise in the coming weeks, meanwhile, there’s speculation electricity prices could surge again with energy regulators expected to consult on new draft pricing early next month,” Koch said.

He also cautioned that it’s not guaranteed all banks or lenders would pass on the reduced rate.

“These rate cuts have been a long time coming and it’s going to give some breathing room in the household budget for Aussies already grasping for air,” Koch said.

“But some banks may not pass on a rate cut right away, while some may not pass it on at all. This is why Australians have to be on the ball, push to be moved onto better rates or move to a lender who is offering a better deal.

“Your loyalty could be costing you. It simply doesn’t make sense to be paying a cent more than you need to.”

Haggling with your bank or finding a new lender may seem like a chore and a bore but the savings can ben eye-watering.

Shifting from a variable rate of 7.24 per cent to 5.84 per cent on a $500,000 loan can put $461 a month back in your pocket. It jumps to a staggering $922 saving is you have a mortgage of $1 million.

“If you are interested in refinancing, be aware that there usually are some costs involved, so make sure the savings to switch outweigh these fees,” Koch said.

“While new lenders may try to lure you with deals, incentives, cashbacks or rewards, also make sure these are actually giving you bang for your buck.”

Lights, camera, (hopefully) action as RBA allows entry to film talks

The Reserve Bank’s board has let in cameras to film day two of their deliberations in Sydney on a long hoped-for interest rate cut.

Far from the grand boardroom you may have pictured, the meeting is taking place in far more humble (and temporary) digs at Chifley Square.

The ‘for’ and ‘against’ case for a cut (or a hold)

For:

- Inflation is falling faster that even the RBA had expected.

- The central bank’s own updated economic forecast, also due out today, is likely to reflect that.

- There’s also signs of cooling pressure in rents, new home purchases and insurance.

- We’ve all had enough (in fairness, that’s less likely to be a factor in the RBA’s deliberations.

- Luci Ellis, chief economist at Westpac - who was an assistant governor at the central bank - said this ...

If I were still at the RBA, I’d struggle to write a board paper justifying rates on hold given how much inflation has come down, given the likely near-term trajectory and given how much the RBA is going to have to revise its forecasts in the new round.

Against:

- There has been a recent pick-up in consumer spending, underpinned by stage three tax cuts that came into effect last July and energy subisides.

- Cooling inflation has also helped some household budgets recover, with a little extra spending money already floating around.

- The Aussie dollar has fallen more than 5 per cent since the US election in November, increasing the cost of imported goods.

- The local jobs market is defying expectations and remains strong.

- There’s also been strong credit growth.