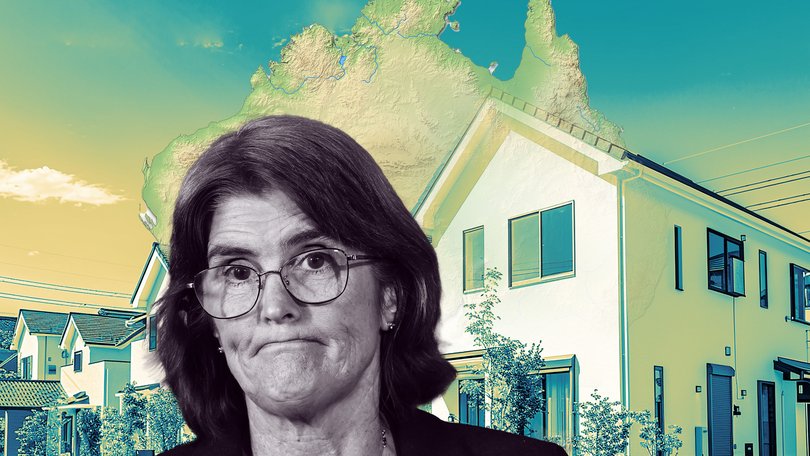

Reserve Bank chief declares it will be years before housing crisis is solved, explains it’s not her problem

Reserve Bank of Australia governor Michele Bullock has revealed how long it will take to solve Australia’s housing crisis - and declared it wasn’t her problem.

Australia’s chief central banker has declared it will be years before housing supply even comes close to catching up with demand, as home building approvals collapsed in the nation’s most overcrowded States.

Reserve Bank of Australia governor Michele Bullock made the call about poor housing supply after new data showed building approvals fell by 6 per cent in August, producing the weakest annual growth pace since mid-2024.

Apartment building activity plunged in Sydney and Melbourne, which receive the biggest share of overseas migrants in cities with tight rental vacancies.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.“It’s going to take time. I’m not confident it’s going to make any impact in the next two years,” she told reporters.

Asked about a dual-income family of renters unable to get into the property market for a first home, the RBA chief acknowledged it was a bad situation.

“It’s a very, very difficult situation and as an individual and as a citizen, we’re in a very difficult position with the property market and I don’t actually think that, most reasonable people think that this is a good outcome,” she said.

But she argued unaffordable housing wasn’t her responsibility, even though COVID-era rate cuts — taking the RBA cash rate to 0.1 per cent — led to double-digit annual surges in house prices across Australia.

“Having said that, there’s nothing that I can do personally about it,” Ms Bullock said. “We don’t target housing prices. It’s true that part of the transmission mechanism for monetary policy is through the housing market.”

Housing target shortfall

The National Housing Accord, that came into effect in July 2024, requires 1.2 million homes to be build over five years.

That would equate to an average of 20,000 a month but in August, just 14,744 new homes were approved, the Australian Bureau of Statistics revealed on Tuesday.

On a progress-to-date basis, the accord between the Federal and State governments is more than 60,000 short of the target.

Westpac is forecasting 189,000 approvals for 2025, which would be well below the 240,000 needed a year to be on track.

Council approvals fell for both apartments and detached housing, despite the efforts of State governments in NSW and Victoria to fast track new approvals near train stations.

“The problem in the housing market is a structural deficit of supply. Governments now get that. You are seeing some action on that but it’s going to be slow to work its way through,” Ms Bullock said.

Big State plunge

Victoria suffered the biggest monthly fall of 11.8 per cent — its capital Melbourne receives a big share of overseas migration.

New South Wales, another State receiving a big overseas influx flowing into Sydney, suffered a monthly approvals plunge of 11.4 per cent.

Westpac economist Neha Sharma said the drop in new apartment developments was driving the weakness in building approvals and stalling a recovery earlier in the year.

“High-rise and low-to-mid-rise approvals contributed almost equally to the August decline,” she said.

Sydney’s median apartment price of $873,838 is so expensive someone would need to earn more than $130,000 just to qualify for a mortgage with a 20 per cent deposit, Cotality data showed.

The city’s mid-point house price of $1.5 million is beyond the reach of many working couples, making apartments the only option for those wanting to be a reasonable commute from the city.

But Ms Bullock said housing affordability wasn’t an issue the RBA could address.

“Can we impact housing prices or should we impact housing prices? No. We have to focus on our mandate which is inflation,” she said.

“All I can do is make sure I keep inflation low and stable and I keep employment as strong as possible because that gives people the best opportunities to get jobs and be able to possibly get into the market.”

The Institute of Public Affairs think tank estimated the National Housing Accord was 61,697 dwellings or 22 per cent short of reaching its 2029 target.

“Despite the massive and out-of-control influx of people into Australia, the capacity to build new houses is not expanding, with housing approvals and net supply flatlining,” director of research Morgan Begg said.