Reserve Bank interest rates: Bullock won’t be bearing Christmas gifts on Tuesday

A pre-Christmas interest rate cut looks unlikely after a poll of more than 30 economists unanimously tipped the Reserve Bank would stay put on Tuesday.

A pre-Christmas interest rate cut looks unlikely after a poll of more than 30 economists unanimously tipped the Reserve Bank would stay put on Tuesday.

All 32 experts surveyed by investor service Bloomberg predicted the RBA would hold the official cash rate at 4.35 per cent in its final scheduled board meeting of 2024.

The hawkish chorus comes despite fresh data showing Australia’s economy grew just 0.8 per cent through the year to September — close to the slowest rate in decades, outside the COVID pandemic.

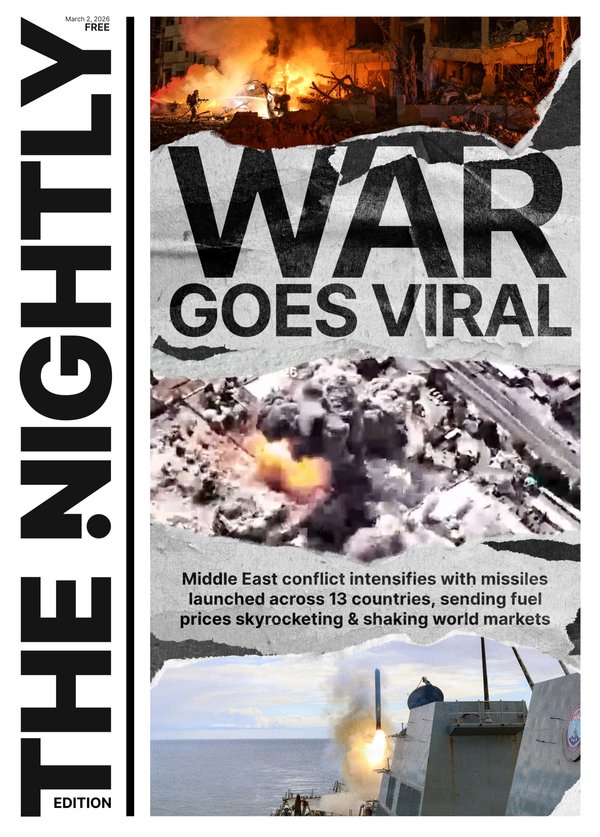

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Weaker economic activity generally eases inflation pressure and leads to rising job losses, which would push the RBA to ease the pain.

Financial markets are a little more optimistic than the pundits and have judged the bleak growth numbers as a sign the Reserve might take its foot off the brakes.

They have fully priced in one rate reduction before the end of April, with a Federal election due by May.

Judo Bank chief economist Warren Hogan said weaker growth and forecasts of slowing inflation had led markets to anticipate earlier rate relief.

So too had speculation that the RBA’s board could be shaken up following parliament’s passage of new laws reforming the central bank’s structure.

But he said markets were ignoring the Reserve’s messaging — after Governor Michele Bullock recently repeated her declaration that there will be no cuts just yet.

Mr Hogan’s view of the economy is more bullish, as retail spending recovers and following a 2.3 per cent rise in take home pay through the past year. Stronger activity would reduce the incentive for the RBA to lower rates.

“The worst appears to be behind the Australian consumer, with the most significant rise in household real disposable income growth in two years,” he said.

“Retail trade figures for October surprised to the upside, as did the broader Household Spending Indicator, which rose by 0.8 per cent in the month.

“Ahead of Black Friday sales, early discounting from retailers saw an increase in retail trade through October, up 0.6 per cent over the month.”

HSBC chief economist Paul Bloxham warned last week’s weak growth numbers may not draw the RBA into easing the pressure.

Both sides of the economy were expanding slowly: spending, known as demand; and production capacity, referred to as supply.

“Although the (September quarter) GDP figures showed weaker than expected growth in demand, they also showed weaker than expected productivity growth, and hence a weaker supply side of the economy,” he said in a Monday note.

“Keep in mind, the RBA’s aim is to keep demand growing sustainably in line with supply, so both matter.

“While weaker demand would normally be thought of as meaning lower inflationary pressures, this is not necessarily the case when supply is weaker too.”

Government spending dominated activity, with cash splashed on defence, roads and green energy.

The splurge helped keep the economy above water but is likely adding to inflation, keeping rates higher and sucking energy out of the private sector.

“Although weak private demand is a clear sign that tightened monetary policy is working, if this is being offset by strong public spending, it still leaves demand running too strongly for supply in the economy,” Mr Bloxham said.

“Whether inflation is being boosted by private or public spending should make little difference to the central bank, unless one is deemed to be more temporary than another.”