Senate told Chris Ellison’s voluntary disclosure laws would fail if suspected tax crimes sent to plods

Top official says Chris Ellison’s voluntary disclosure laws would fail if confessions routinely referred to cops.

Australia’s top tax official says no one would voluntarily confess under rules used by Chris Ellison if suspected tax crimes were routinely referred to the cops.

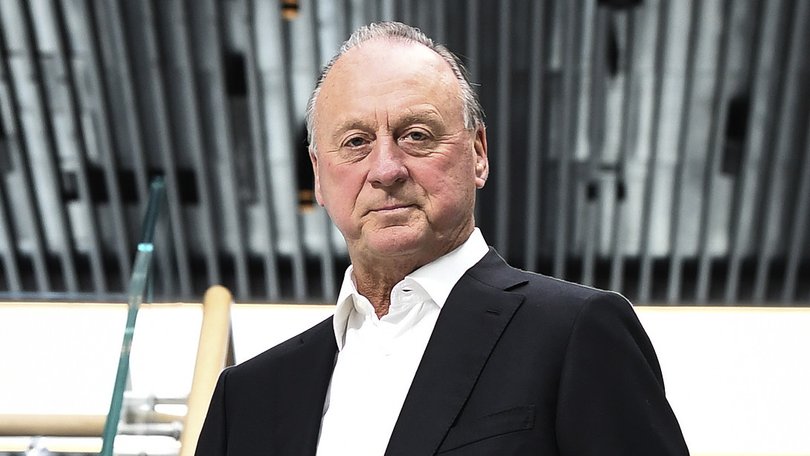

While refusing to directly answer a senator’s questions about a deal with Mr Ellison, tax commissioner Rob Heferen spoke “in the abstract, in the hypothetical” about voluntary disclosure provisions reportedly protecting the Mineral Resources boss.

“’I’m aware that I probably shouldn’t be talking about hypotheticals, but in this case, I think maybe useful,” Mr Heferen told a Senate economics committee on Wednesday night.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Mr Heferen said “there’d be no voluntary disclosures” if taxpayers were referred to the Australian Federal Police for tax crimes after coming forward and paying their overdue tax, interest and penalties.

To potential enjoy the protection under voluntary disclosure provisions, the taxpayer or their representatives had to come forward to “make good what happened in the past” before the Australian Taxation Office had communicated with them about a matter or commenced audit activity.

Mr Heferen said the taxpayer would have to pay the tax plus interest — and just 20 per cent of the usual penalty.

“The law is very clear on the 80 per cent remission of the penalty that might otherwise apply — which I know, has been picked up in some commentary in the MinRes case,” he said.

MinRes confirmed this week that Mr Ellison paid a total of $3.9 million to the ATO including interest and administrative penalties, in May 2023 after having volunteered information to the tax office two years earlier.

That information related to a deal where a British Virgin Islands company linked to Mr Ellison and business associates sold equipment to a MinRes subsidiary before its 2006 float.

MinRes paid the tax haven company a total of $3.79m in 2006 and 2008, it told the stock exchange this week.

When asked by Senator Barbara Pocock about the accuracy of reports that Mr Ellison’s lawyers had come forward to “disclose a decade-long tax evasion scheme running from 2003 and 2014”, Mr Heferen said “confidential taxpayer information needs to be confidential”.

Senator Pocock later asked about “hypothetical agreements” being made to not refer matters to the AFP and other regulatory agencies.

Mr Heferen said the tax office could not commit to not pass information on to other agencies if the income arose from illegal activity or there was a non-tax crime related to the dealings.

But even where there appeared to be tax evasion and, therefore, potentially a tax crime, the self-assessment provisions of tax law were designed to take matters out of a judicial framing and into “administrative penalty framing”.

“What’s important is to collect the revenue, to collect the money and make sure the interest is paid,” he said.