SGH and US partner launch revised $15 billion bid for BlueScope Steel

The revised bid is a “best and final” $32.25 a share offer that values Australia’s biggest steel maker at $15 billion.

The Stokes family’s SGH and US group Steel Dynamics have launched a new tilt at BlueScope Steel, increasing their bid to a “best and final” $32.25-a-share offer that values Australia’s biggest steel maker at $15 billion.

The bidding partners said the cash offer was equivalent to $34 a share before the deduction of $1.65 of special and interim dividends declared by BlueScope in recent weeks.

The revised bid is up 14 per cent on the $30-a-share proposal lobbed on BlueScope in late-2025 and rejected by the steelmaker’s board as “very significantly” undervaluing the company.

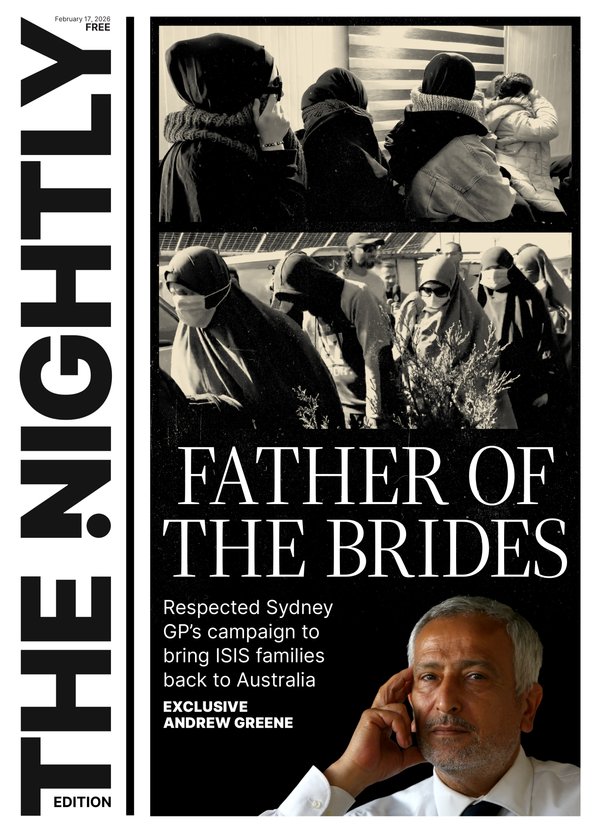

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.It “represents a compelling value proposition and highly attractive premium for BlueScope shareholders,” SGH and Steel Dynamics said on Wednesday.

“The increased purchase price represents SGH and SDI’s best and final offer in the absence of a superior competing proposal for all or a material part of BSL.”

The companies “look forward to productive engagement with BSL to progress our customary due diligence requirements”.

BlueScope shares were nearly 3 per cent better at $28.82 as at 7.55am.

The new offer represents a 47 per cent premium to BlueScope’s share price before SGH and Steel Dynamics interest was revealed in January.

However, BlueScope investors have suggested they believe the company is worth $35-a-share or more, particularly now that an extended investment program by the target is beginning to deliver.

BlueScope said the board would consider the new offer but there was no guarantee of a transaction being agreed.

Under the bidders’ plan, SGH would buy BlueScope and then on-sell the latter’s US steel business to Steel Dynamics and retain the Australian operations, principally the Port Kembla steelworks in NSW.

Steel Dynamics tried to interest BlueScope in a takeover three times before deciding to make a new attempt with an Australian partner, recruiting SGH to its cause last year.

BlueScope on Monday announced a doubling in interim profit and flagged $3-a-share in shareholder returns this financial year. That includes January’s $1 special dividend and higher payouts for the full year.

The profit was led by BlueScope’s North Star business in the US, which lifted earnings before interest and tax to $447m from $182m. Australian profit was down seven per cent to $122m.

Originally published as SGH and US partner launch revised $15 billion bid for BlueScope Steel