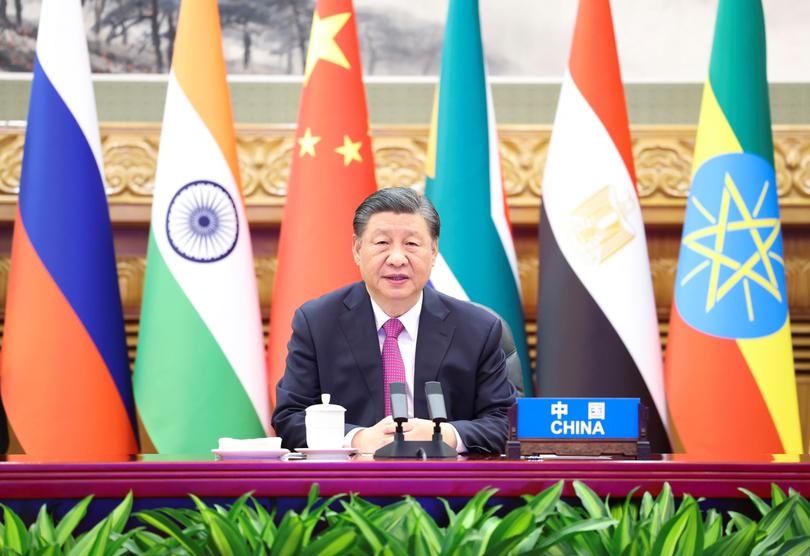

The Economist: China’s leader wants to lead the next industrial revolution but will Xi Jinping’s plan work?

The Chinese president may have a plan to revive the nation, but will it actually work?

Last year Xi Jinping, China’s leader, paid a visit to Heilongjiang in the country’s north-east. Part of China’s industrial rust belt, the province exemplifies the problems besetting China’s economy.

Its birth rate is the lowest in the country. House prices in its biggest city are falling. The province’s GDP grew by only 2.6 per cent in 2023. Worse, its nominal GDP, before adjusting for inflation, barely grew at all, suggesting it is in the grip of deep deflation.

Never fear: Mr Xi has a plan. On his visit, he urged his provincial audience to cultivate “new productive forces”. That phrase has since appeared scores of times in state newspapers and at official gatherings. It was highlighted in last month’s “two sessions”, annual meetings of China’s rubber-stamp Parliament and its advisory body.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.In the preface of a new book on the subject, Wang Xianqing of Peking University likens the term to “reform and opening up”, the formula that encapsulated China’s embrace of market forces after 1978. Those words “shine” even today, he wrote, implying that “new productive forces” will have similar staying power.

What do the shiny words mean?

Chinese officials are hunting for ways to power the country’s economy. For many years its productive forces drew on the mobilisation of labour and accumulation of capital. The country’s workforce grew by 100 million people from 1996 to 2015. Its stock of capital rose from 258 per cent of GDP in 2001 to 349 per cent two decades later, according to the Asia Productivity Organisation think tank. After the global financial crisis of 2007-09, much of this capital accumulation took the form of new property and infrastructure.

China’s workforce is now shrinking and demand for property has slumped: fewer people are moving to China’s cities, speculative gains on real estate are no longer assured and potential homebuyers are reluctant to purchase flats in advance in case distressed developers run out of cash before building is complete. The property downturn has hurt consumer confidence and deprived local governments of crucial revenues from land sales.

Even after China abandoned its strict COVID controls, the economic recovery has been muted and uneven. Spending has not been strong enough to fully employ China’s existing productive forces. As a consequence, according to one measure, deflation has persisted for three quarters in a row.

At China’s stage of development, economies typically pivot towards services. But the Government’s heart lies elsewhere. The pandemic boosted demand for China’s manufactured goods, from surgical masks to exercise bikes. US export controls on “chokepoint technologies” have also created a need for homegrown alternatives, from lithography machines to aviation-grade stainless steel. China’s 14th five-year plan, which spans 2021-25, promised to maintain manufacturing’s share of GDP, which had declined from almost a third in 2006 to just over a quarter in 2020.

In its quest for a sophisticated, yet self-contained, manufacturing system, China has long employed a variety of helpful policies. Its Ministry of Education, for example, recently approved a new undergraduate concentration in high-end semiconductor science and engineering. China’s spending on more explicit industrial policies, including subsidies, tax breaks and cheap credit, amounted to 1.7 per cent of GDP in 2019, more than three times the percentage spent by the US, according to think tank the Centre for Strategic and International Studies.

“What China really wants to be is the leader of the next industrial revolution,” says Tilly Zhang of consultancy Gavekal Dragonomics.

That will require it to upgrade traditional industries, break foreign strangleholds on existing technologies and forge a new path in industries of tomorrow. Although the central Government’s ambition is impressive, even unsettling, it cannot succeed without the help of local governments, which are short on cash, and private entrepreneurs, who are short on confidence.

As such, the new slogan may betray a damaging hyperopia — long-sightedness that is blinding the leadership to more immediate economic concerns.

The owl spreads its wings

To Barry Naughton of the University of California, San Diego, the phrase “new productive forces” evokes the “dialectical” idea that an accumulation of quantitative changes can result in a qualitative break or sudden leap, as Hegel put it, like when an incremental increase in temperature turns water into steam.

Marx, meanwhile, noted that when new productive forces achieve sufficient weight in the economy, they can remake the social order: “The handmill gives you society with the feudal lord, the steam-mill, society with the industrial capitalist.” New productive forces, then, can be a big deal.

But in presenting the concept, Mr Xi has said that the test for new productive forces will be improvements in “total factor productivity”, a term lifted not from Marx, but from mainstream economics. It refers to increases in output that cannot be attributed to increases in measurable inputs, such as capital, labour and human capital. In mixing Marxist and neoclassical concepts, new productive forces is a “strange hybrid beast”, Mr Naughton says.

According to Mr Xi, the new productive forces will flow from the application of science and technology to production. The phrase is a signal that China’s technology push should be even more ambitious than it is today and more tightly integrated into economic production. China’s leaders have promised a “whole of nation” effort to boost technological self-reliance. The central Government’s budget, unveiled in March, increased spending on science and technology by 10 per cent, to ¥371 billion ($78.7b), the largest percentage increase of any division. Frugal innovation, this is not.

Nor is it China’s first assault on the problem. In 2006, a 15-year plan set national targets to increase research-and-development spending, cut dependence on foreign technology and lift technology’s contribution to growth. It also identified 16 “megaprojects”, such as building China’s own large passenger aircraft and landing a probe on the moon. These were largely attempts to replicate existing technologies. In 2010, after the global financial crisis, China changed tack, lavishing some of its heavy stimulus on a variety of “strategic emerging industries”, including new kinds of information technology, renewable energy and electric vehicles — many of which were still embryonic.

Six years later, China shifted emphasis again. Its “innovation-driven development strategy” expressed faith that the world was in the midst of another industrial revolution. Advances in digital technologies, the internet of things, green technologies and artificial intelligence promised breakthroughs across swathes of the economy. Rather than pick a miscellany of emerging industries, China’s new strategy emphasised this cluster of mutually reinforcing technologies. China aimed to become a “world power” in innovation by the middle of this century.

By 2020, it was spending almost ¥2.9 trillion (2.8 per cent of GDP) on science and technology, according to Rhodium Group, a consultancy. The Government’s contribution exceeded 60 per cent if generous tax breaks are included. Of the recipients, a sixth ended up with universities or research institutes. Roughly 60 per cent flowed to companies.

Mr Naughton has called China’s innovation strategy “the greatest single commitment of government resources to an industrial policy objective in history”. What does the country have to show for it? The results have so far been better than any middle-income country could expect. But they are not quite as impressive as China’s leaders might have hoped.

In e-commerce, fintech, high-speed trains and renewable energy, China is at or near the technological frontier. The same is strikingly apparent in EVs, success with which helped the country last year become the world’s biggest exporter of cars. In a list of 64 “critical” technologies identified by think tank the Australian Policy Research Institute, China leads the world in all but 11, based on its share of the most influential papers in the fields.

The country is No. 1 in 5G and 6G communications, as well as biomanufacturing, nanomanufacturing and additive manufacturing. It is also out in front in drones, radar, robotics and sonar, as well as post-quantum cryptography.

White heat

China has also made good progress in broader measures of a country’s innovation “ecosystem”. The Global Innovation Index, published by the World Intellectual Property Organisation, combines about 80 indicators, spanning infrastructure, regulations and market conditions, as well as research effort, patent awards and citation counts. A middle-income country with China’s GDP per person would expect to rank in the 60s. China ranks 12th.

The economic impact of these achievements is harder to measure. China’s list of “strategic emerging industries” has kept evolving since its introduction in 2010, making it tough to track progress. Two members of China’s National Bureau of Statistics once lamented that the criteria for inclusion, especially at the level of products, are “vague”. How to know if a boiler counts as “energy saving” or a composite material counts as “high performing”?

Nonetheless, China’s statisticians estimate that strategic emerging industries accounted for 13.4 per cent of GDP in 2021, up from 7.6 per cent in 2014 but below the original target for 2020 of 15 per cent. By comparison, the value added by property building and services (ignoring upstream links to steel, iron-ore and other such industries) was about 12 per cent.

Although these gains are impressive, China’s leaders are not content. They have been alarmed both by the US’ technological embargoes and its recent technological triumphs. Sweeping export controls on the sale of chips and chipmaking equipment have revealed China’s dependence on foreign components, software and equipment.

America’s advances in AI have also prompted reflection. It was an industry in which China thought it had an edge. The country’s leaders were shocked by the introduction in 2022 of ChatGPT, a large language model developed by OpenAI.

China’s progress has also been hurt by its own leaders. They cracked down heavily on many of the nation’s leading tech companies in 2021, accusing them of mishandling data, thwarting competition and exploiting gig workers. This regulatory storm targeted consumer-facing “platform” companies, such as Alibaba and Meituan, rather than advanced manufacturers or other firms in “hard tech”. However, the damage to investor confidence was hard to contain.

The disfavoured platform companies, with their huge troves of data, are also leading investors in many frontier technologies, such as AI, that China’s leaders are keen to foster. The country’s big internet firms cut their R&D spending by almost 7 per cent in the first half of 2023, compared with a year earlier, according to Rhodium.

Total-factor productivity growth — Mr Xi’s preferred test of new productive force — has also slowed. China’s tech program, introduced in 2006, implied that its contribution to growth should rise to 60 per cent. Instead, it has fallen to less than a third, according to calculations by Louis Kuijs of credit ratings agency S&P Global Ratings. China is thus suffering from its own version of the “Solow paradox”: you can see a new technological age everywhere but in the productivity statistics. These setbacks and shortcomings may explain the perceived need for a fresh slogan to shake things up.

The country’s innovation push now seems split into three. It is determined to replicate “chokehold” technologies that the rest of the world might seek to deny it. A second goal is to invent technologies the rest of the world has yet to create. In January, the Ministry of Science and Technology, along with six other ministries, issued a list of “future industries”, many of which are even more pathbreaking than the strategic emerging industries of the past. They include photonic computing, brain-computer interfaces, nuclear fusion and digital twins — digital simulacra of patients that doctors can monitor for illnesses that might arise in their real-life counterparts.

China’s Government is encouraging laboratories and research institutes to spend more than half of their basic research money on scientists under 35 years of age, in the belief they are more likely to make the breakthroughs the country needs.

These moonshots could be seen as a folly China can ill afford — a distraction from the dogged pursuit of self-reliance, which requires homegrown versions of technologies that China can no longer count on importing from abroad. But according to Ms Zhang of Gavekal, China’s leaders hope that futuristic industries will contribute indirectly to the country’s technological sovereignty by giving it “bargaining chips” in the tech battles ahead. If the US threatens to cut off its access to a vital input, China can retaliate in kind.

Round the bend

Chinese commentators often talk about “overtaking at the curve”. China’s success in EVs, following its longstanding failure to displace incumbent makers of traditional vehicles, demonstrates that it can sometimes be easier to make advances in fields that are not already occupied by well-entrenched incumbents.

According to Jie Mao, of the University of International Business and Economics in Beijing, and his co-authors, China’s science-and-technology policies from 2000-2012 boosted productivity the most in industries in ferment, rather than industries that had reached maturity either at home or abroad. In fighting a guerilla war, Mao Zedong famously believed in occupying the countryside before advancing on the cities. In the same way, China may be marching into wilder and woollier areas of technological discovery, where its long-entrenched adversaries have a smaller advantage.

A third objective is to upgrade existing industries. “Even the most traditional agriculture can form new productive forces,” Wang Yong of Peking University has argued, so long as it employs revolutionary technologies. He cites automated planting or selective breeding using big data. At the two sessions, the annual meetings of China’s Parliament and its advisory body, a delegate from a prominent state-owned distillery even argued that the new productive forces can be found in hard spirits.

The pursuit of these goals will be expensive. One lesson of the past 10 to 15 years is that large quantities of money cannot guarantee a Hegelian transformation of production. But a lack of spending will surely preclude one.

It must therefore worry China’s leaders that local governments’ budgets are stretched and animal spirits are low. In the past, much of the money for the tech push has come from local-government funds that raise money from land sales and “special bonds”. Their revenues fell by more than a fifth from 2020 to 2023.

When the economy is booming and local authorities are flush with cash, they are at liberty to invest in ventures that might not pay off for five or 10 years, points out Matt Sheehan of the Carnegie Endowment for International Peace think tank. In 2010, for example, growth was rebounding and stimulus money could flood into EVs, solar panels and other evolving technologies.

But for local governments in today’s more straitened times, “economic firefighting is going to end up overwhelming attempts to think long term”, he predicts. Companies will be urged to invest in projects that offer short-term payoffs. They may also be pestered and harassed for taxes and fees to help their provincial or municipal patron balance its books.

At this year’s two sessions, Li Qiang, China’s Prime Minister, set out the country’s “major tasks” for the year ahead. First on Mr Li’s list was “to modernise the industrial system” and develop “new quality productive forces”. Expanding domestic demand, which is necessary to dispel deflation, ranked only third. If the mood and markets do not revive, local governments will struggle to refill their coffers and private investment may fall short.

Mr Xi is determined to reinvent China’s economy. To do so, he needs to reinflate it first.