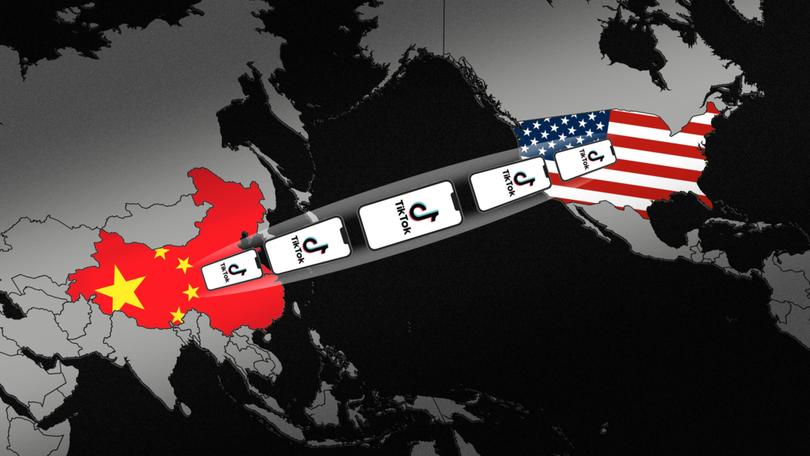

US-China trade war sees Asian factory owners hit TikTok to combat Trump tariffs

Staring down a nightmare scenario in which they lose their largest customer base, China’s factory owners are rising up via the hugely popular video platform.

Chinese manufacturers are rising up.

Staring down a nightmare scenario in which they lose their largest customer base, factory owners or those claiming to be are now going direct to consumers via TikTok, the Chinese app with more than 1.5 billion users globally.

Their videos, mostly targeting the global luxury and fashion industry, feature supposed factory owners breaking down the unit costs of products ranging from activewear to handbags that retail for tens of thousands of dollars.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.One user going by the handle SenWang took apart a Birkin bag by luxury house Hermès - retail price $US38,000 ($60,000) - piece by piece. He named the three leather suppliers, the thread manufacturer, the zipper and handle manufacturers, and revealed the labour cost, claiming the bag could be made for $US1000, a full $US37,000 less, minus the Hermès logo.

TikTok removed SenWang’s posts, but not before they were viewed millions of times. He has since started a new account, threatening to continue to “spill the tea” - i.e. expose the true cost of luxury goods - a move that attracted 1.7 million views in just one day.

“I have support from people all over the world. People who are now already awakened, who now refuse to be brainwashed any longer, who now refuse to be ripped off any longer,” SenWang posted.

“Chinese people are not afraid of hard work and sacrifice. Otherwise, we wouldn’t have become who we are now. China will take the lead in the world, not by ripping off other people and countries, but by honestly and equally developing with other countries and peoples.”

It is a new front in the trade war, with repercussions far beyond what Donald Trump likely envisaged.

While the standoff between Mr Trump and President Xi Jinping continues, hundreds of millions of consumers are coming face to face with the very workers and factory owners behind some of the world’s most iconic brands, all on a Chinese app.

American consumers are posting their own responses.

Former Real Housewives of New York celebrity Bethenny Frankel garnered 1 million views in a day with a video discussing “how big the price gouging has been” on luxury items. “This is a luxe goods revolution,” she said.

Once you stumble across one of these videos, TikTok’s algorithm floods your feed with Chinese manufacturers spruiking everything from clothing to electronics, even dishwasher pods.

In between, an endless stream of American TikTokkers showcase their hauls of high-quality dupes or post tutorials on how to search product codes on labels to identify a brand’s original supplier. These videos have been watched tens of millions of times.

Yoga brand Lululemon has come under particular scrutiny, with young yogis aghast that their $US100 leggings can be sourced for $US5.

Plenty of other TikTokkers, incensed that billionaire Mr Trump and his advisory cabal of hedge fund managers and tech bros created this mess, are turning full anti-capitalist, enraged by brand markups amid rising recession fears.

“It’s a crisis-rich environment for brands,” said Stephanie Huang, Professor of Marketing at Macquarie Business School.

“Marketers have ceased to be the only source of information for consumers, and worse, they’re losing consumers’ trust. The biggest competitor for marketers isn’t necessarily other brands, but consumers themselves.”

It comes at a dire time for retail, as the cost-of-living crisis continues to push major high street names into collapse.

The latest in Australia is 100-year-old Wittner Shoes, which entered administration on Wednesday, placing at risk 25 branded outlets and another 25 store concessions within Myer and David Jones.

Huang said mid-tier brands were particularly vulnerable to the influx of cheap Chinese exports seeking new markets as US tariffs escalate.

“Brand loyalty is largely habitual, consumers stick with what’s familiar out of convenience. But once they explore alternatives, that habit can break,” she said.

“That’s especially problematic for mid-tier brands, where consumers are often unclear about what the brand actually stands for.”

Dr Kane Koh, Lecturer in Marketing at RMIT, said the trend could also reshape how consumers perceive the value embedded in high-end goods, with serious implications for how brands are valued by investors.

“As with the rise of counterfeit markets, brands are likely to suffer in sales. Look at the stock prices of any brands mentioned in viral TikToks, there’s a clear downward trend,” he said.

Dr Koh said social media now acts as a “connective tissue” between businesses and consumers, accelerating the direct-to-consumer model that has proliferated in China.

“What’s different is the level of detail and transparency these manufacturers offer in describing what constitutes a fair price,” he said.

“This could lay the groundwork for a new factory-to-consumer pricing model that challenges the premium prices justified by symbolic brand value.”

Will Zhao, chief executive of Yaru Ventures, an intermediary for Australian companies in China, said the moment offers foreign buyers a glimpse into China’s craftsmanship.

While Mr Zhao believes many of the TikTok accounts claiming to be the actual factories behind major brands are likely fake, he said consumers are still receiving well-made products.

“From the most basic T-shirt to the most sophisticated products, the quality level is phenomenal,” he said.

Mr Zhao, who visited several Chinese factories last week, said manufacturers were “not in panic mode yet”, believing tariffs will eventually be lifted, but they aren’t sitting idle either.

“It’s incredible how many businesses are looking to diversify,” he said.

He also sees a silver lining for Australia. With Chinese sentiment turning sharply against US brands, Australian companies may be well placed to fill the gap.

“The sentiment towards American products in China is terrible,” he said. “There’s a lot of opportunity for foreign businesses, especially Australian ones, to take over American shelf space.”