JACKSON HEWETT: Donald Trump win is likely to stump RBA delivering interest rate relief

JACKSON HEWETT: Unhappy with the RBA failing to deliver a Melbourne Cup rate cut? You’ll be even less happy with the outcome of America’s two-horse race.

If you were disappointed that the Reserve Bank didn’t look down the home straight of declining inflation and deliver a Melbourne Cup rate cut, you’ll be even less happy with the likely outcome of America’s two-horse race.

With Mr Trump seemingly set to become President-Elect Trump, the chances of an Australian rate cut look even more distant.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.President Trump wants a trade war with China. A key plank of his plan to make the world’s strongest economy great again is to impose tariffs of 60 to 100 per cent or more on Chinese goods.

After successfully tapping into voter dissatisfaction with high prices — especially bacon — Mr Trump is about to make a lot more American goods much more expensive.

He’ll argue that tax cuts will ease that pain (they will, but only for the wealthy who are less concerned about inflation anyway), that extra drilling for oil will bring down energy costs (unlikely in the short term), and that it will lead to more high-paid manufacturing jobs (it might, but again, not for a while). Unfortunately, economic reality doesn’t bend to populist fantasy.

Shovelling tax cuts into consumers’ pockets while raising the cost of Chinese goods is a recipe for runaway prices. That means higher American interest rates as the Federal Reserve looks to prevent inflation from spiralling out of control.

Currency markets are already starting to price in higher American interest rates. As the numbers came in strongly for Mr Trump, the Aussie dollar dropped 1.6 per cent against the greenback in morning trade. The yen, euro, and Swiss franc also fell.

For Australia, a lower dollar is bad news when it comes to our own inflation worries.

Inflation has been moderating here but not enough, with Reserve Bank chair Michelle Bullock stating the bank must “remain vigilant to upside risks.”

A lower dollar will not help the cause. Instead, imported goods will become more expensive, meaning our inflation rate is also likely to rise.

For borrowers already hanging on by their fingernails for a fall in interest rates the wait will go on until prices return to target.

“If (tariff) shocks materialise, they could have significant effects on the outlook for activity and inflation in Australia,” said Ms Bullock at Tuesday’s briefing.

Canberra is worried too.

Speaking at Senate Estimates this morning, Treasury Secretary Dr Steven Kennedy admitted that the “disruptive” nature of Mr Trump’s tariff policies called for a special cabinet briefing.

Treasury shares the view that tariffs will be inflationary and is concerned that by constraining Chinese trade, Australian exports — and ultimately, growth — will suffer.

It’s a nightmare scenario for Jim Chalmers, who may go into an election with rates stuck at 4.35 per cent and growth that could be starting to sag.

Economy hangs on China’s response

Already in the doldrums, China will be sweating on how quickly Mr Trump delivers on his campaign rhetoric.

The recent round of stimulus designed to ease the jitters of real estate investors looks like being swamped by a massive spending spree that could be as much as $2 trillion, and possibly more if tariffs are particularly steep.

Ordinarily, that would be a boon for Australian iron ore exports, as China’s stimulus traditionally goes into infrastructure.

This time may be different, however, with a hangover of unsold apartments and a lack of eligible infrastructure investments.

Beijing may prop up their consumers instead, which would do less for our major export of iron ore, but could help boost tourism and agricultural products like red meat.

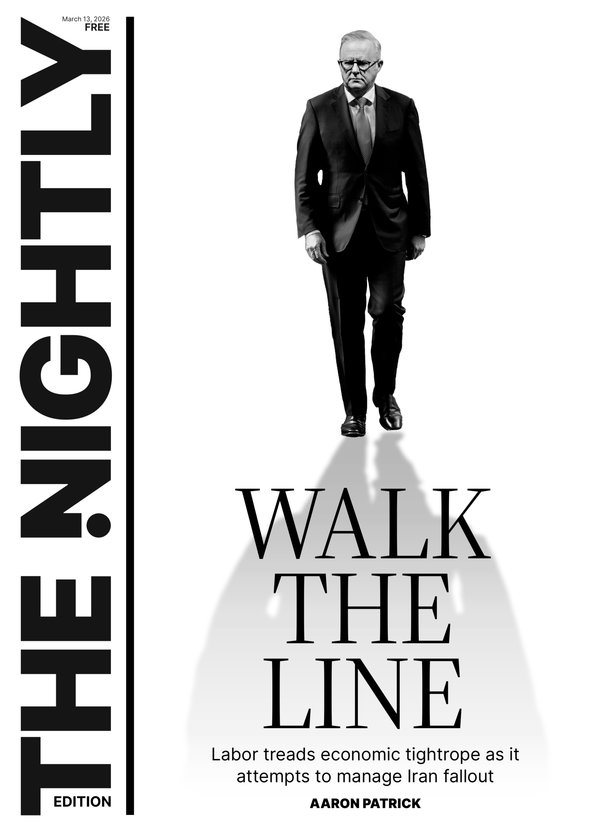

One tightrope the government must carefully walk is courting Mr Trump while steering clear of his anti-Chinese rhetoric. From a trade perspective, that would be disastrous.

The everything trade

For investors, a Trump win will give another likely leg up for America’s red-hot stock market. Up 24 per in the last 12 months, the Dow Jones is hitting record highs and traders will be expecting earnings to soar on corporate tax cuts.

Crypto traders are also rejoicing with Bitcoin up to a record high of US$74,505 ($115,000). With Tech-Bro-In-Chief Elon Musk in the White House, expect plenty of wacky ideas for how cryptocurrencies can revitalise the American economy.

Finally, gold’s run will continue to run. If deficits balloon under Trump’s policies as forecast, nervous investors will be further bidding up the safe haven asset. And China will play a part too. Having seen the impact of US sanctions on Russia, Beijing has been buying the yellow metal at a furious clip. With an adversary in the White House, they will continue accumulating reserves.