US markets ride tech resurgence as ASX follows suit - but local miners take a hit

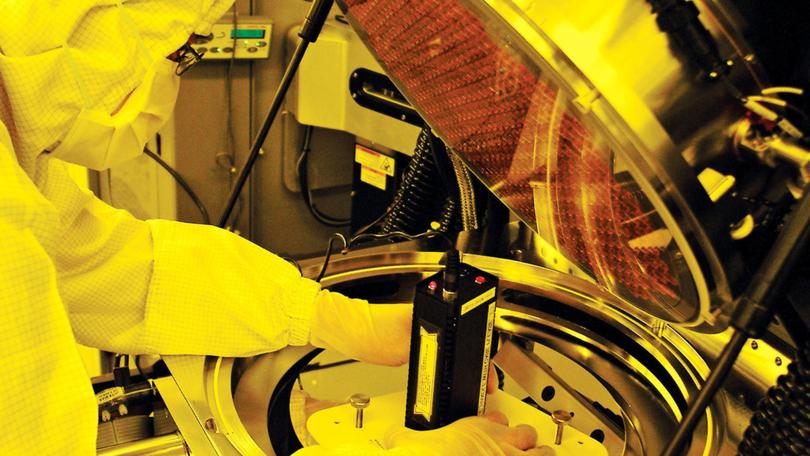

It’s not quite the tech boom, but a massive revenue projection by a semiconductor giant has inspired an upbeat mood for 2024 in the often unpredictable sector.

The local share market has marched higher after US markets climbed to record levels on Friday amid a tech resurgence.

At noon AEDT on Monday, the benchmark S&P/ASX200 index was up 57.8 points, 0.78 per cent, to 7,479, while the broader All Ordinaries was up 52.6 points, or 0.69 per cent, to 7,704.9.

Wall Street bounced back from a slow start to the year, with the tech-heavy Nasdaq index jumping 1.7 per cent on Friday to a two-year high.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Technology traders were in an optimistic mood after the Taiwan Semiconductor Manufacturing Company - which produces more than half the world’s semiconductors - announced it expects revenues to grow by more than 20 per cent in 2024.

Materials and utilities stocks were the only official ASX sectors in the red at noon.

Lithium miners tumbled amid warnings the price in the critical mineral will continue to fall.

Liontown shares plunged 22.2 per cent after lenders pulled a $760 million loan for its Kathleen Valley Lithium Project in Western Australia.

“Liontown remains confident in the long-term outlook of the lithium market and Kathleen Valley’s status as a Tier 1 long-life producer,” the board said in an announcement to the share market on Monday morning.

South32 dipped 2.8 per cent after the diversified miner reported weaker-than-expected production figures for the second quarter.

“We expect to see consensus reductions to financial year 2024 earnings and cash flow estimates on the back of this update,” RBC Capital Markets analyst Kaan Peker said.

The big iron ore miners were mixed, with BHP up 0.3 per cent, Fortescue 0.2 per cent higher and Rio Tinto down 0.1 per cent.

Tech stocks followed their US counterparts higher with accounting software provider Xero up 2.1 per cent.

It was less rosy for troubled artificial intelligence company Appen, which dived 37 per cent after Google cancelled an $82.8 million contract.

The news was “unexpected and disappointing”, the board said in an ASX announcement.

The company also unveiled a $20.4 million loss for 2023.

Buy now, pay later company Zip surged 11 per cent higher after announcing it would return to profitability in the first half of 2024 for the first time since 2021.

The Australian dollar was buying 66.09 US cents, from 65.77 US cents at Friday’s ASX close.