‘Inescapable fact’: Small changes to turbocharge retirement savings

Australians can almost double their superannuation balance through a bit of research and a $50 trick.

Young Australians could almost double their superannuation nest egg in retirement by taking advantage of two simple tricks, an expert has revealed.

The two strategies, which focus on being in the right fund and adding a little along the way, can make a huge difference in retirement.

MLC super chief executive Dave Woodall told NewsWire many young people are simply in the wrong fund for their needs.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.“The first super hack is working out the fund you are in and how it is that invested, if it is in 60 per cent growth and 40 per cent defensive, as a 25-year-old, you’re probably in the wrong fund,” Mr Woodall said.

“It’s an inescapable fact that the growthier you go (in your investment choice), the more money you will have,” he said.

“Strategic asset allocation, or what fund you are in, is the number one driver of outcome in retirement, or how much money you will have in retirement.”

A balanced fund is a mix of growth assets including shares and property as well as defensive options such as cash and bonds.

Each individual fund will choose its own percentages they allocate to growth or defensive assets.

A higher growth fund will have a higher allocation to shares and property.

The higher growth option also has higher risk and are more susceptible to market moves.

Using the example of a person who might have $100,000 in their superannuation and 25 years to go until they retire, Mr Woodall points out how different retirement options can impact how much a person will retire with. He says:

•A traditional balanced portfolio that might be 60 per cent growth assets, 40 per cent defensive and returns of around 6 per cent would see the retiree ending up with about $430,000.

•With an 80 per cent growth, 20 per cent balanced mix, the retiree finishes with $540,000.

•If the person is in a 90 per cent growth 10 per cent balanced portfolio, they would end up with $610,000.

The assumptions exclude any additional superannuation contributions from wages through the person’s working life.

“All I have done is pick a MySuper with a higher growth focus and it has made a huge difference.”

“If you’re trying to make a fund that is fixed for purpose for everyone, you’re trying to fit an average and nobody is average.”

“There’s no sort of right or wrong answer, but asset allocation is the biggest driver of result.”

He conceded individual circumstances and risk tolerance would play a part in some people’s investment assets, with a high focus on growth assets presenting a bigger risk for customers.

The second major change for a person’s results will be how much they add to their superannuation.

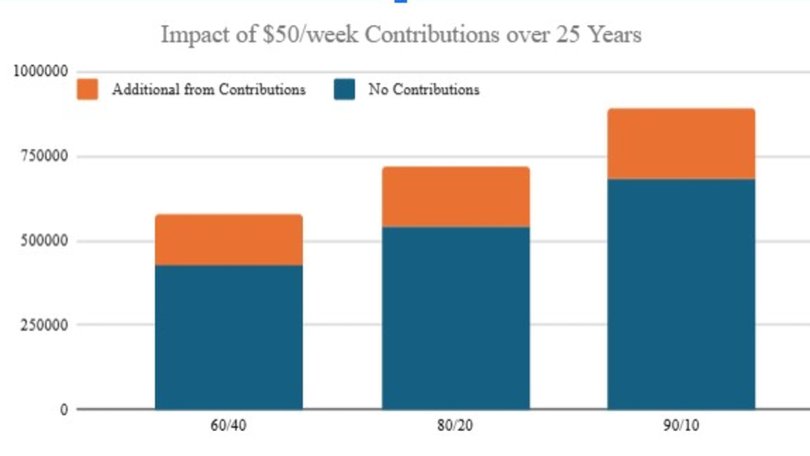

Using the same example of someone’s super fund starting with $100,000 in their superannuation and 25 years to go, but instead adding $50 a week to their super, Mr Woodall said:

•A mix of 60 per cent growth assets, 40 per cent defensive with returns of about 6 per cent turns $430,000 into $570,000 by adding the additional money to superannuation.

•With an 80 per cent growth, 20 per cent balanced mix the retiree finishes with $540,000, but with the contributions this would reach $710,00.

•If the person is in a 90 per cent growth 10 per cent balance mix they would end up with $610,000, but with the contributions of $50 a week, end up with $790,000.

Once again no addition from a wage is added to the starting $100,000.

“If you take those two decisions of going to a growthier superannuation option and adding $50 a week, the difference between the two outcomes is huge,” he said.

“How much money is being left on the table if you aren’t making the two decisions.”

How much super will you actually need

Separate research has revealed the staggering amount of money young Australians will need to save each year in order to retire comfortably.

A report released by Vanguard based on 1800 Australians surveyed showed a staggering amount Australians think they need to retire.

When 25 to 34 year olds were asked how much do you need, more than 59 per cent said they need at least $106,000 a year.

In 2023, the average retirement income for Australians under 45 was $89,000; in 2024, it was $97,000.

This is almost double the calculations from the ASFA, who say Australian couples who retire aged 65 now need $75,319 per year combined to achieve a comfortable retirement, with $53,289 required for singles.

This means couples would need $690,000 in their combined superannuation balance to achieve a comfortable retirement, and a single person would need $595,000 when they retire – and that’s all on top of owning your own home.

Couples looking to achieve a modest retirement who are still renting would need $385,000 in their superannuation and singles would require $340,000.

Originally published as ‘Inescapable fact’: Small changes to turbocharge retirement savings