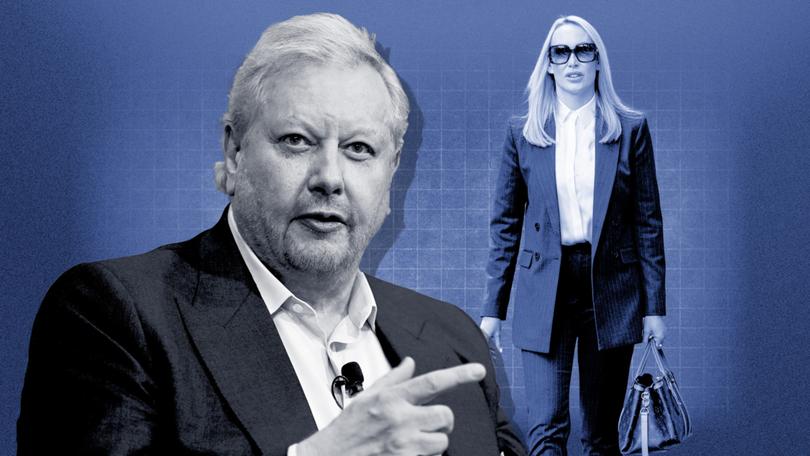

Wisetech Global chair, three directors resign in mass protest against founder Richard White’s new role

A walkout by the chairman and three directors of WiseTech has shaved more than $9b off the global logistics software company’s market capitalisation.

A walkout by the chairman and three directors of WiseTech has shaved more than $9b off the global logistics software company’s market capitalisation, prompting a ‘please explain’ letter from the Australian Stock Exchange.

The tech giant dropped the bombshell news in an announcement to the ASX on Monday, saying board leader Richard Dammery and fellow non-executive members Lisa Brock, iinet founder Michael Malone and Fiona Pak-Poy would quit after the company releases its half-year results on Wednesday.

The stock later regained some ground but was still down 21.3 per cent to $95.75 at 10.45am AEDT, wiping more than $9 billion off the company’s market capitalisation.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The company said the four had resigned over “intractable differences in the board and differing views around the ongoing role of the founder and founding CEO, Richard White.”

Mr White was still to sign a contract for a $1 million-a-year consulting role.

That prompted the ASX to issue an official query, asking the company why it did not disclose the fact that Mr White had still not signed a contract. The company responded by saying the issue was “not material” and an “administrative matter”.

Mr White has been working in a consulting capacity for the firm after being pressured to resign as chief executive in October last year over allegations he unduly used his influence to gain sexual favours, paid for a multimillion-dollar house for an employee that he had been in a relationship with, and awarded a lucrative contract to a then-lover.

He had also been accused of “sustained intimidation and bullying” by former director Christine Holman.

A legal and accounting review, released at the company’s annual general meeting in November, concluded Mr White did not act inappropriately, found he disclosed all close personal relationships in the workplace, did not misuse company funds, and said there was no evidence of bullying, intimidation, or unlawful behaviour. Shareholders waved through a bump in director’s salaries at that AGM.

But Mr White has been dogged by new reports in the Australian Financial Review earlier this month that revealed three more women had come forward with allegations of inappropriate behaviour against him, including one from an employee and another from a supplier.

The board departures leave WiseTech with a cadre of close contacts to Mr White in charge of company governance, including 30-year company veteran and co-founder Maree Isaacs and former chair and early investor Charles Gibbon of Shearwater Capital.

The leadership vacuum at the company will be on show when the company reports its half-year results on Wednesday, with interim chief executive Andrew Cartledge, interim chief financial officer Caroline Pham, and Mr White presenting the accounts.

The company also issued an update on financial guidance, saying revenue would come in at the lower end of previous guidance “due to further delays to the rollout of the three announced breakthrough products”.

“What started out as reputation risk has turned into governance risk which has resulted in a material impact in the company’s performance,” Capital.com senior financial market analyst Kyle Rodda said. “The business already told us last year that the misconduct allegations were impacting the company’s performance. This board exodus and subsequent guidance update shows the rot is getting worse. Investors want a clear and decisive resolution to the problem.”

Earlier this month, investment bank RBC Capital Markets said the “product release delays and management distractions”, while the absence of permanent CEO was “contributing to the uncertainty”. Longer-term they were bullish on the company’s prospects.

“Medium term, WTC should be a net beneficiary of tariffs which are likely to spur demand for CargoWise, particularly customs and compliance modules. We believe near-term sentiment remains negative, while medium term structural tailwinds remain solid,” the RBC analyst note said.