The Economist: How painful will Donald Trump’s tariffs be for American businesses?

If Mr Trump were to slap tariffs on Canada and Mexico the impact on American companies would be devastating

In the weeks after Donald Trump’s sweeping election victory, American companies sought to reassure investors that they were amply prepared for a new round of tariffs.

Some, like Stanley Black & Decker, a toolmaker, highlighted efforts to shift their supply chains away from China.

Others, like Lowe’s, a home-improvement retailer, pointed to processes they have put in place to deal with tariffs after Mr Trump’s first term, during which levies were imposed on about $US380b-worth of imports ranging from steel and aluminium to washing machines, mostly from China.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Yet the coming disruption may be more widespread and less predictable than many American businesses expect. On November 25 the president-elect announced on Truth Social, his social-media megaphone, that he would impose a 25 per cent tariff on all products flowing from Mexico and Canada and raise the rate on goods from China by 10 per cent.

Mr Trump’s intention to follow through with his threat against Mexico and Canada was then put into doubt by subsequent posts describing “wonderful” and “productive” meetings, respectively, with the leaders of the two countries.

That has not been comforting. If Mr Trump were to slap tariffs on America’s northern and southern neighbours, the impact on American companies would be devastating.

Businesses from Mattel, the maker of Barbie dolls, to Whirlpool, a home-appliance manufacturer, have factories in Mexico. Around three-fifths of America’s imported aluminium and a quarter of its imported steel come from Canada, with large volumes of steel also flowing from Mexico. According to Citigroup, a bank, Mr Trump’s tariffs would raise the price of steel for American manufacturers by 15-20 per cent.

Among the hardest hit by the tariffs would be American carmakers. General Motors, for example, imports over half of the pickups it sells in America from Mexico and Canada.

About 9 per cent of the value of parts for cars produced in America also comes from the two countries. According to Nomura, another bank, the tariffs proposed by Mr Trump on November 25 would wipe four-fifths from the operating profit of General Motors next year.

Foreign carmakers, such as Toyota, would also be hit.

Companies can respond to tariffs in three ways. The first is to stockpile goods. Microsoft, Dell and HP are among the American tech companies that are rushing to import as many electronic components as possible before the new administration takes office in January. Yet there are limits to that strategy.

Stockpiles may be depleted well before tariffs are lifted. And holding inventory requires warehouses and ties up cash.

Many big companies already expanded their inventories in the wake of the supply-chain mayhem of the pandemic, and may have limited appetite to increase them further, particularly as higher interest rates raise the cost of doing so.

According to JPMorgan Chase, another bank, the average ratio of working capital to sales among America’s 1500 most valuable listed companies last year was higher than at any point in the past decade except 2020.

The second option for companies is to pass tariffs on to customers by raising prices.

Several firms, including Stanley Black & Decker and Walmart, America’s biggest retailer by sales, have already indicated that they may do so. Again, however, there are limits. The excess savings Americans built up during the pandemic have been whittled away by inflation and there are signs the country’s jobs market is cooling.

The delinquency rate on credit cards is at its highest in a decade.

The third, and most difficult, response is to rewire supply chains. New suppliers, once found, have to be tested and negotiated with, a process that can take years. Many American companies have been diversifying their supply chains away from China.

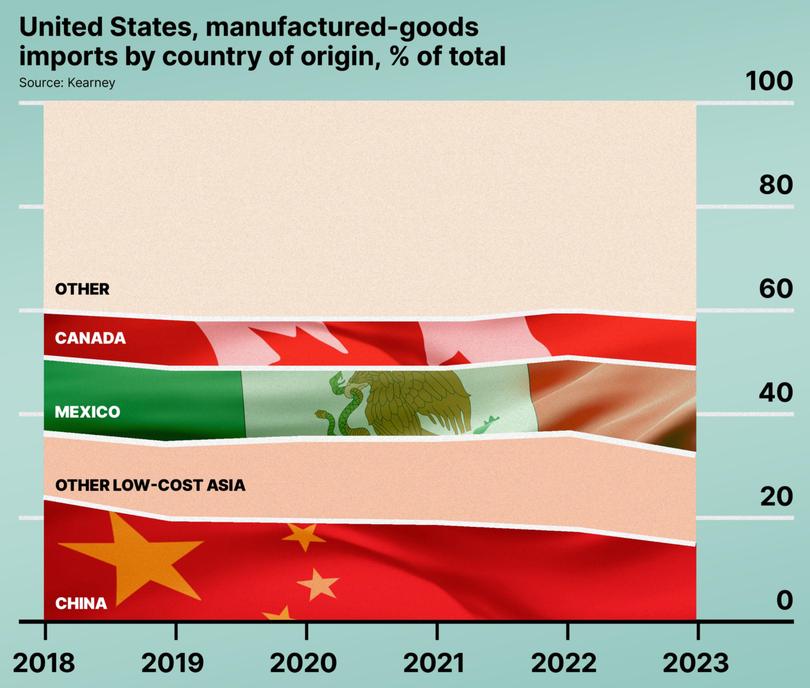

According to Kearney, a consultancy, China’s share of America’s manufactured-goods imports fell from 24 per cent in 2018 to 15 per cent last year.

Meanwhile, the share from other low-cost Asian countries and Mexico, respectively, rose from 13 per cent to 18 per cent and from 14 per cent to 16 per cent.

An analysis by Fernando Leibovici and Jason Dunn of the Federal Reserve Bank of St Louis shows that the fall in China’s share of imports has been biggest in industries where America has been most dependent on its rival, including communications and information technology.

Yet shifting production away from China may not be enough. The Biden administration, which kept many of Mr Trump’s original tariffs and added some of its own, has clamped down on Chinese goods entering America via circuitous routes.

In July it imposed a “melt and pour” rule on Mexican steel, which requires that the metal be produced in the country to avoid tariffs.

It may become increasingly difficult to source from Chinese companies, including makers of everything from televisions to seatbelts, that have set up factories abroad.

On November 29 the Federal Government imposed anti-dumping duties on solar panels produced in South-East Asia by Jinko Solar and Trina Solar, two Chinese companies, among others.

Mr Trump’s protectionist ire is directed not just at China, but at all countries with which America has a trade deficit. As a result, companies that have shifted their supply chains to Mexico, Vietnam or other low-cost countries may be in for a bruising.

Some may decide that the only safe option is to bring production back home. That is already happening in a few industries, including semi-conductors. Spending on factory construction in America was $US172b in the first nine months of this year, twice as much as in the same period in 2019, adjusting for inflation.

A self-sufficiency index compiled by Kearney, calculated as America’s manufacturing output (minus exports) as a ratio of imports (minus re-exports), has been ticking upwards since 2021, having fallen over the previous eight years. For many companies, though, making stuff in America will remain prohibitively expensive.

The coming wave of tariffs may thus prove even more painful for American businesses than the previous one.

According to research by Carlyle Burd of North Carolina State University, American companies that were exposed to tariffs levied on Chinese imports by Mr Trump during his first term saw their operating profit as a share of assets shrink by 5.4 percentage points, compared with those that were not. Some were hit harder.

Last month the chief financial officer of Stanley Black & Decker said that the first-term tariffs initially cost the company around $US300m annually, equivalent to a quarter of its net profit in 2017, and continue to cost it around $US100m a year.

Bosses will be watching Mr Trump’s Truth Social account closely.