63 regional suburbs join the million-dollar club for the first time

The million-dollar mark is no longer a symbol of property exclusivity.

Cotality's latest Million Dollar Markets report reveals a record share of Australian property markets now boast seven-figure medians, with a whopping one in three suburbs nationally recording a house or unit value of $1 million or more, up 30.3 per cent from this time last year.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Cotality economist Kaytlin Ezzy noted the million-dollar club has expanded rapidly, with many of the new entrants found beyond traditional 'blue chip' areas.

"Five years ago, just 14 per cent of Australian suburbs were members of the million-dollar club, with the majority concentrated in Sydney's prestigious Northern Beaches, Eastern Suburbs, and North Sydney and Hornsby regions," Ms Ezzy said.

"Since then, dwelling values nationally have risen by over 46.8 per cent or roughly $270,000 at the median level and membership in the million-dollar club has increased by 142.9 per cent.

"Today 41.9 per cent of houses and 13.5 per cent of unit suburbs nationally claim a spot on the once-prestigious million-dollar list, with seven-figure price tags becoming more commonplace."

Ms Ezzy said the "face of the million-dollar market" is changing as affordability pressures and pandemic-era migration patterns have shifted growth outward.

More regions making millionaires

Cotality saw 63 new entrants across the combined regions over the past year.

"The regions have shown fairly exceptional growth over the past couple of years, and so seeing more of those markets tick over into that million-dollar club is a natural consequence of that," she said.

"We're starting to see the regions play a bigger role across the country, which is quite interesting."

Many of the new entrants are suburban fringes or lifestyle regions that haven't traditionally been associated with prestige property.

"Newly minted million-dollar markets include more mortgage-belt suburbs like Sydney's Penrith and Melbourne's Taylors Lakes, along with Oxley in Brisbane's Ipswich region and Upper Coomera in the Northern Gold Coast," she said.

"Seven-figure markets are no longer confined to prestigious suburbs, with their reach expanding more broadly."

Here's where regional Australia's new million-dollar members are emerging.

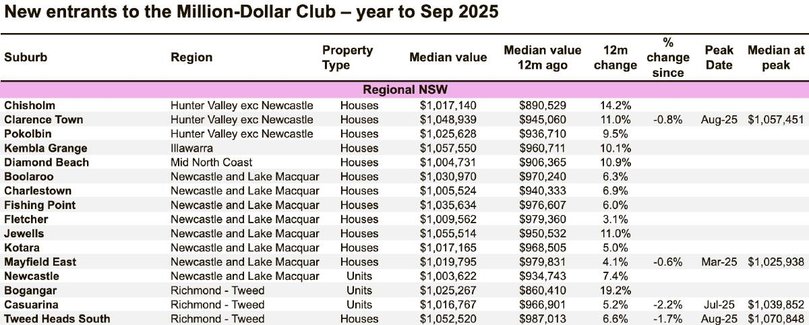

Regional NSW: comeback coastal and country stars

Regional NSW recorded the highest number of re-entrants to the million-dollar club, with 18 markets (14 house and four unit suburbs) reclaiming seven-figure status after dipping below in recent years.

While many of the state's prestige enclaves are already well past that milestone, the fresh round of million-dollar medians is appearing in emerging lifestyle belts - coastal towns within commuting distance of Sydney or tree-change areas that boomed during COVID and held their value.

New entrants to the club from regional NSW are concentrated in key areas such as the Hunter Valley, Illawarra, Mid-North Coast, Newcastle and Lake Macquarie, and Richmond-Tweed.

The only new entrants for units were Newcastle and Bogagnar, and Casaurina near Cabarita Beach in the Tweed.

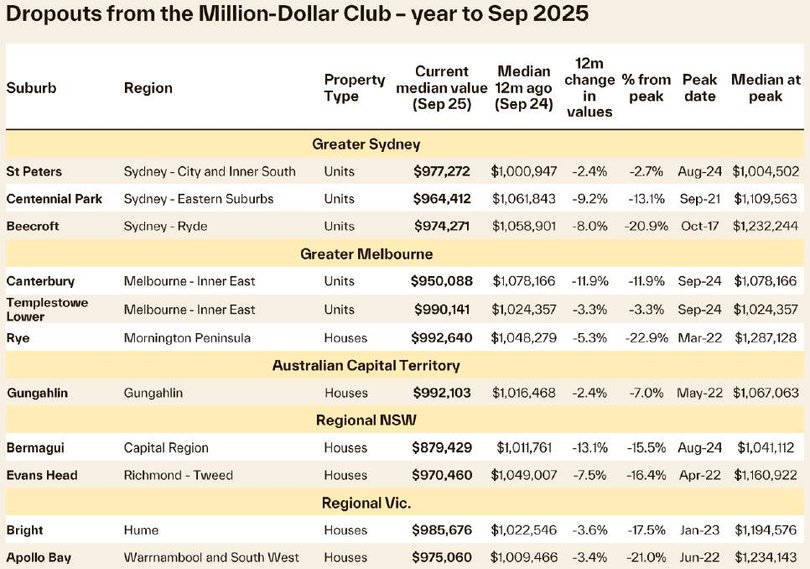

Regional Victoria: 'the odd man out'

Regional Victoria was the only area nationally to record a net decline in million-dollar markets.

Out of 278 regional suburbs analysed, just 11 still hold a seven-figure median; however, this is only down one from last year.

Houses in Wandana Heights near Geelong rejoined the club ($1.021 million), but Bright in the High Country and Apollo Bay on the Great Ocean Road slipped below the threshold.

"There are still pockets of growth, and we are seeing some markets rise above that million-dollar mark, but it has been the odd man out in terms of growth across the country," said Ms Ezzy.

"It's a mix of less favourable taxation conditions, seeing more supply added to the market than in the rest of the country, and lockdown.

"Overall, it has meant that prices haven't seen that same upwards inflection that the rest of the country has seen."

The figures reflect softer price growth in Victoria compared with other states, with many pandemic-driven hotspots now plateauing.

Even so, local agents say lifestyle demand remains strong in premium corridors like Daylesford, the Surf Coast and the Mornington - areas that could regain seven-figure status if prices continue their slow recovery in 2026.

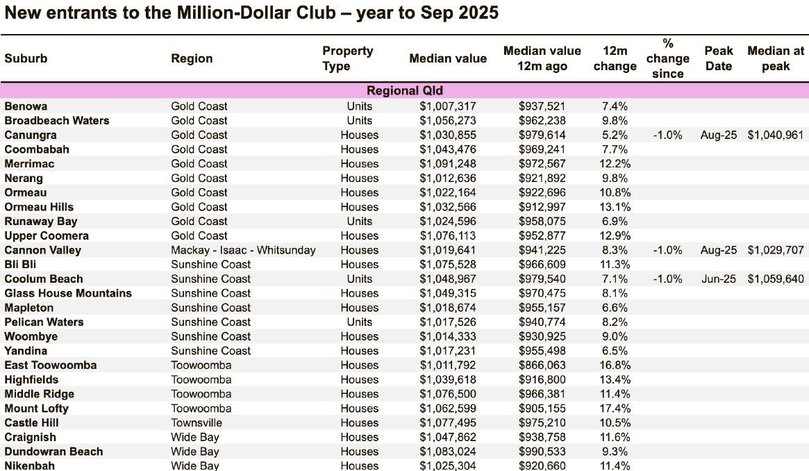

Regional Queensland: Growth spreads inland

"At their current quarterly rate of growth, more than 80 markets nationally are on track to join the million-dollar club by year's end - and Queensland is leading that charge," Ms Ezzy said.

Queensland remains the standout performer, with 37 new million-dollar markets across the state - the biggest increase in the country.

While much of that spike was in Greater Brisbane, regional Queensland is also surging, now home to 141 seven-figure markets.

The majority are in the Gold Coast (69) and Sunshine Coast (61), but for the first time, smaller inland centres are joining the ranks.

"Across regional Queensland, it is the majority of the southeast Queensland corridor that is claiming the most of those million-dollar markets - Gold Coast, Sunshine Coast, and then Brisbane, of course; they have been your token million-dollar markets across Queensland.

"However, most of the markets in those regions are now million-dollar markets, so the growth is coming from a little bit further afield."

Cotality's data shows four suburbs in Toowoomba, three in Wide Bay, and one each in Townsville and the Whitsundays have crossed the million-dollar threshold, marking the broadest geographic spread of new high-value regional markets Queensland has seen.

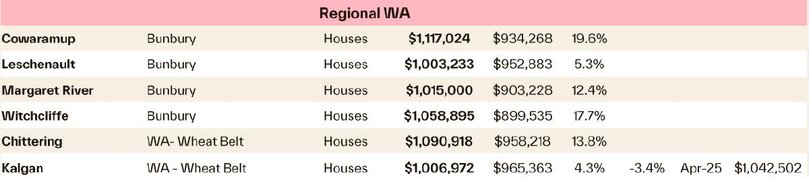

Regional WA: Bunbury and beyond

Regional WA has quietly doubled its million-dollar markets over the past year, even if from a low base, from six to 12.

The Bunbury region now claims nine of those placements, buoyed by strong local demand and relative affordability compared to Perth's inner suburbs.

Two more entries emerged in the North Wheat Belt: Chittering, with a median of around $1.09 million, and Kalgan, with a median of $1.007 million.

Western Australia's broad-based gains reflect robust mining-related employment and renewed intrastate migration from Perth to regional hubs offering larger blocks and lifestyle access.

"When we look at growth trends over the past couple of years, regional WA has really outperformed, along with Queensland, and particularly in those mining markets, which have driven the growth across the regional markets," Ms Ezzy said.

Regional SA, Tasmania and NT: Yet to break through

Despite Adelaide's strong growth, where more than 40 per cent of suburbs now exceed $1 million, regional South Australia still hasn't produced a single seven-figure market.

The same goes for regional Tasmania, where modest 3.6 per cent annual growth has kept values below the million mark, and the Northern Territory, where Darwin's Nightcliff sits just shy at $944,000.

Still, Cotality expects more regional areas will tip into the seven-figure club through 2026 as supply remains tight and migration from capitals continues.

Great for existing owners and investors, tough for first-timers

"For those in the regions that own a home in a suburb that now has a median worth more than a million dollars, it does mean that they've seen quite strong equity growth, and they're likely feeling some of that wealth effect," she said.

"Technically, they're millionaires now."

She cautions that while there is a psychological impact to crossing the seven-figure threshold, equity is locked up in the property, and owners looking to sell would still be buying in the same market.

And while the million-dollar milestone may now be more mainstream, Ms Ezzy warns it's making entry-level homeownership even tougher.

"A household on the average income of $106,000 with a 20 per cent deposit would need to dedicate more than 50 per cent of their pre-tax earnings to service a loan on a million-dollar property," she said.

"This increases to more than 60 per cent if they're using the First Home Guarantee scheme's 5 per cent deposit, a repayment-to-income ratio few brokers will approve."

The million-dollar market may no longer be exclusive, but for many Australians, it's never felt further out of reach.

Originally published as 63 regional suburbs join the million-dollar club for the first time