Is Melbourne housing becoming more affordable? Price falls and modest income increases say yes

Bucking the trend, one urban area has seen house prices fall and incomes rise.

Housing affordability is a hot topic across the country, but according to a new report it just got better in one of the nation’s biggest cities.

Overall housing affordability has improved in Melbourne, bucking national trends, according to a new report released by ANZ and CoreLogic.

A combination of home values moving backwards by 4.9 per cent in the Victorian capital, while incomes have risen modestly, has made housing more affordable according to the ANZ CoreLogic Housing Affordability Report.

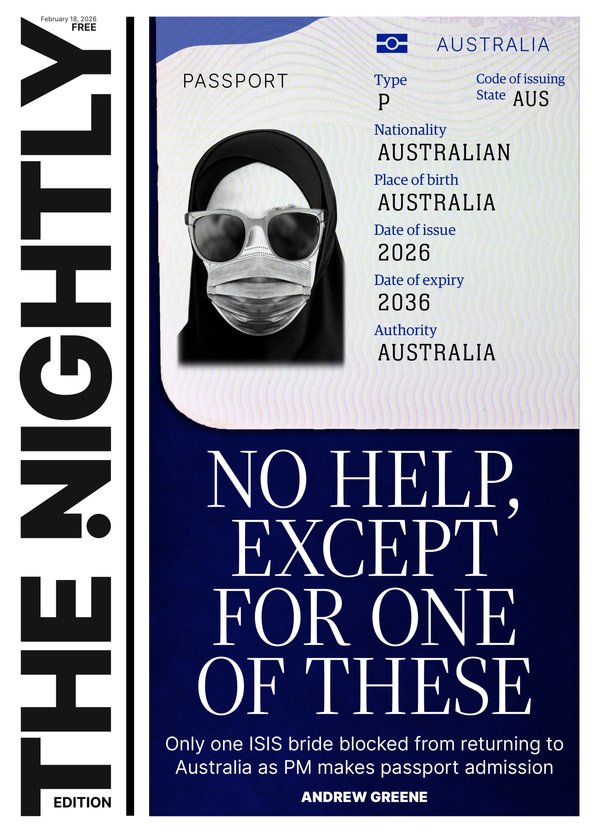

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.“The downturn in the Melbourne housing market is holding, with six consecutive months of decline through to August 2024,” Ms Owen said.

“As a result, we’ve seen a significant shift in affordability, with dwelling values falling by 4.9 per cent from the peak.

“Coupled with modest income growth growth, Melbourne has become one of the few markets where housing affordability is improving.”

Good news for buyers

While house prices may be dropping in Melbourne, this is a plus for those wanting to get into the housing market according to ANZ Economist Madeline Dunk.

“It’s good news for people wanting to buy into Melbourne because we know that for example the labour market is pretty strong in Melbourne.

“There are a lot of job opportunities and I think that does make Melbourne look a bit more attractive to younger people.”

However some of the largest improvements in affordability have occurred in some of the city’s most expensive markets.

This is because the greatest impact on affordability today is falling prices, rather than any structural or policy changes around property.

“It’s not affordability due to policy changes but is a reflection of market dynamics and those more expensive properties have seen larger price falls.

“What you’re seeing is an increase in affordability but not necessarily in the places where it is most needed.”

Some of the largest improvements in affordability over the past two years has been in some of the more expensive areas of the Melbourne market, such as Flinders on the Mornington Peninsula and the inner-south suburb of Beaumaris.

Still challenges

Ms Dunk said to maintain affordability, measures to support ongoing residential construction will be vital across the country.

“Nationally, the median dwelling value to income ratio has increased, making it more challenging for households to save for a home deposit.

“Elevated interest costs, low pre-sales, competition with the infrastructure sector for trades, and higher building costs could impact future dwelling approvals, commencements, and completions. This could lead to further declines in housing affordability across the country,” she said.

The national report also found that the median income household across Australia continues to require a near-record high of 10.6 years to save a 20 per cent deposit.

Meanwhile the portion of income required to service a new mortgage nationally has reached a high of 50.3 per cent nationally up from 49.4 per cent nationally in March 2024.

This article was originally published at view.com.au.

Originally published as In this major Australian city housing just became more affordable