Price dip: Why now could be the time to buy a Tassie country gem

Property prices are rising across nearly every Australian region, with one exception: regional Tasmania.

But rather than a sign of weakness, this dip could present a buying opportunity for those looking to get ahead of the next wave of growth.

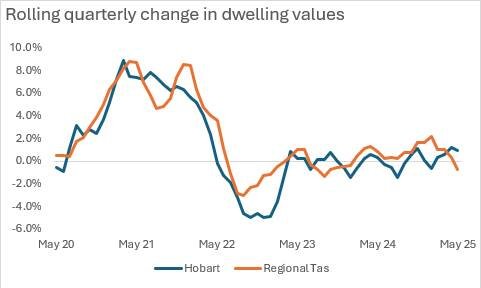

According to recent ANZ Research, house prices in regional Tasmania dropped by 1.1 per cent in May, making it the only region nationwide to post a monthly decline.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.While to some, that could seem concerning at first glance, economists say the drop is likely just a short-term fluctuation - and one that could open the door for savvy buyers.

ANZ economist Madeline Dunk said the fall may well prove to be a one-off, pointing out that over the past year, prices in the region are still up 2.3 per cent, and over the most recent three-month average, values have continued to rise by 0.2 per cent.

"It's possible the monthly decline was just a blip," Ms Dunk said, adding that Tasmania had already seen exceptional growth during the pandemic.

"Tasmania has seen softer housing price growth compared to some other parts of the country in the last year - likely a bit of COVID catch-up after the strong growth seen in the pandemic period."

Smaller market

CoreLogic research director Tim Lawless said the slight drop in May could be reflective of the region's smaller market size.

"The monthly change across a relatively small housing market like regional Tasmania can show some volatility," Mr Lawless said.

He noted that the three-month trend has actually been stronger than that seen in Hobart and that these shorter-term declines are not uncommon in smaller markets.

"It's worth keeping an eye on the trend, but I would put the month-on-month decline down to some noise across a small sample."

In the broader context, Australia's housing market is regaining strength after a soft patch at the end of 2024.

Price growth picked up in May, with every capital city now posting gains for the year to date.

National auction clearance rates cracked 70 per cent in June, and both consumer sentiment and investor lending are rising.

Ms Dunk said the recent rate cuts from the Reserve Bank had clearly helped restore confidence in the market.

"Rate cuts appear to have boosted sentiment in the market," she said.

"So far, we've seen 50 basis points of easing, and ANZ Research expects another 50 basis points of cuts in total - one in August and another in early 2026."

What next?

Mr Lawless agrees that the market is entering a new growth phase, pointing out that housing values are rising broadly across the country, and at a more consistent rate than seen in previous years due to a few handbrakes.

"We expect housing values to continue recording a broad-based rise through the rest of 2025 and into 2026," he said.

"Factors supporting further growth include lower interest rates and higher sentiment along with an ongoing undersupply of housing.

"However there are a few factors that are likely to keep a lid on value growth including affordability constraints, high household debt levels, less population growth and the fact that the rate-cutting cycle is likely to be a gradual and cautious one."

So, what does this mean for regional Tasmania?

The softening in May could be the signal of buyer-friendly conditions before the next upswing.

For those willing to act before the market regains momentum, it could be an ideal time to secure a country retreat, lifestyle property or long-term investment.

In a market where most areas are set to continue their rise, the regional Tassie pause might be the edge buyers have been waiting for.

Seven Tassie gems currently on the market

A price drop and four separate income streams (a 7.43 per cent yield) are on offer with this charming 1938 Tudor Revival residence.

A rare opportunity to snap up a former schoolhouse (circa 1897) with versatile living arrangements, so it's ideal for multi-generational living or Airbnb.

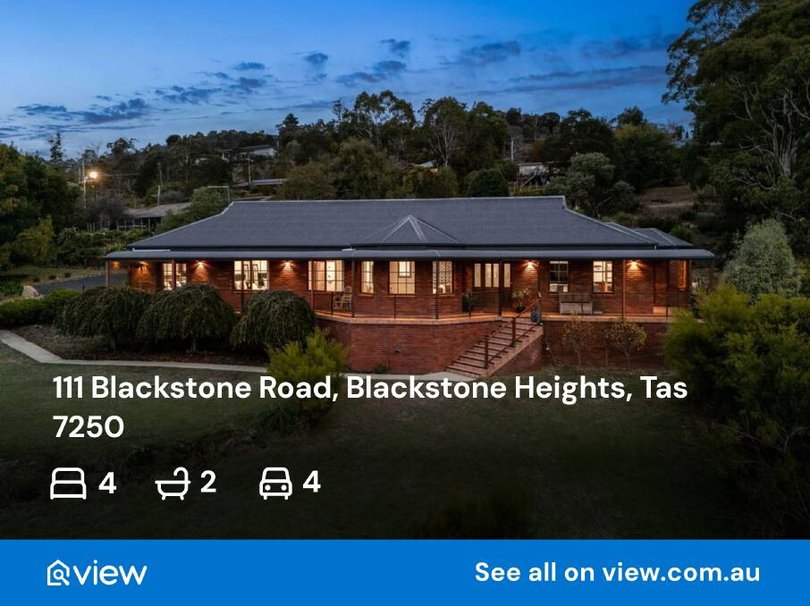

Elevated views of Lake Trevallyn are the order of business at this single-level beauty.

Historic charm, modern updates and a walk to the beach? Say no more.

Live out your cosy cabin dreams (complete with architectural extension). Motivated vendors.

Panoramic views over the Huon River and a gorgeous green stove on almost 47 acres, where neighbours are mostly of the four-legged variety.

A truly unique opportunity, you could nab three beautiful newly-built cabins (with locally sourced Tasmanian Oak cladding) in the northeast region renowned for mountain biking trails.

Originally published as Price dip: Why now could be the time to buy a Tassie country gem