RBA rate rise: how much extra your mortgage will now cost you across regional Australia

From Ballarat to Newcastle we look at what you will pay.

Australians with a mortgage are facing a tougher 2026 after the Reserve Bank of Australia raised the official cash rate in two years.

RBA Governor Michele Bullock made the move at the board's meeting in Sydney today, with the major banks expected to pass on that in higher rates for those with a mortgage.

The 0.25 per cent rise brings the official interest rate to 3.85 per cent, and is the first rise since November 2023.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.For the reported 30 per cent of Australians who have a mortgage that will mean increased costs in paying off their home.

It comes as a turnaround after three rate cuts in 2025, the first in February.

Graham Cooke, head of consumer research at comparison site Finder, said we could expect to see more mortgage stress following today's decision.

"Our research showed mortgage stress on average had started to subside - expect it to rise with a vengeance as monthly payments jump," Mr Cooke said.

"If inflation persists, expect more of last year's mortgage stress relief to be wiped away."

What you will pay

While those in capital cities are to face the highest mortgage hikes, in line with their elevated prices, those in regional Australia are also going to feel the pinch.

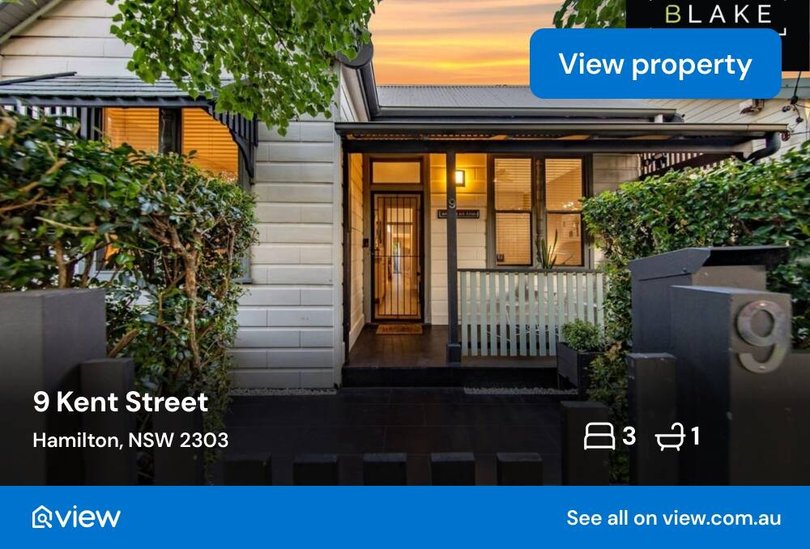

Those paying off a mortgage in Australia's largest regional city, Newcastle, can expect to see their monthly payments rise by $127.

It takes total monthly mortgage payments of $5,325 based on modelling by Canstar factoring in a cash rate of 3.95 per cent and an interest rate of 5.77 per cent.

This is based on a new loan of $844,800 , with a 20 per cent deposit, on a median-priced house of $1.056 million.

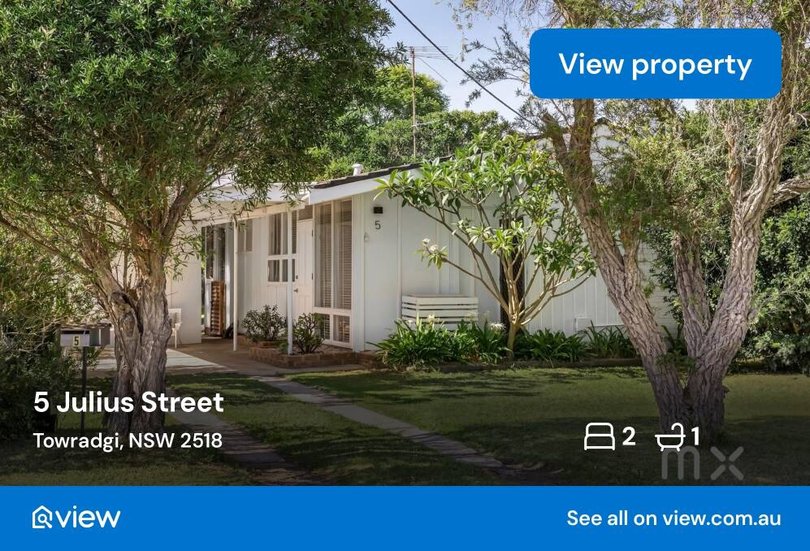

In the Illawarra, south of Sydney and with prices some of the most expensive in regional Australia, mortgage holders will have to put aside a further $138 a month to pay off a loan on a median-priced house of $1.148 million.

In Canberra, a median-priced house of $1.033 million, and a loan of $826,400 would incur an extra $124 in mortgage costs if the 0.25 per cent cash rate is passed on to customers in full by the banks.

Rate rise impact in Victoria

Major regional centres in Victoria, such as Bendigo and Ballarat can expect to see their mortgages increase, but those rises would be capped under the $100 mark.

In Ballarat borrowers who have taken out a new loan on a median house priced at $651,360 could expect a rise in monthly mortgage payments of $78 bringing total payments to $3,284.

In Bendigo there would be an $82 increase bringing total monthly repayments to $3460 on a loan for a median priced house of $686,265.

In the coastal centre of Warrnambool, there would be a $68 increase in mortgage payments on a new loan for a median-priced house of $564,491.

All loans modelled here are an 80 per cent loan amount, with a 20 per cent deposit.

Originally published as RBA rate rise: how much extra your mortgage will now cost you across regional Australia