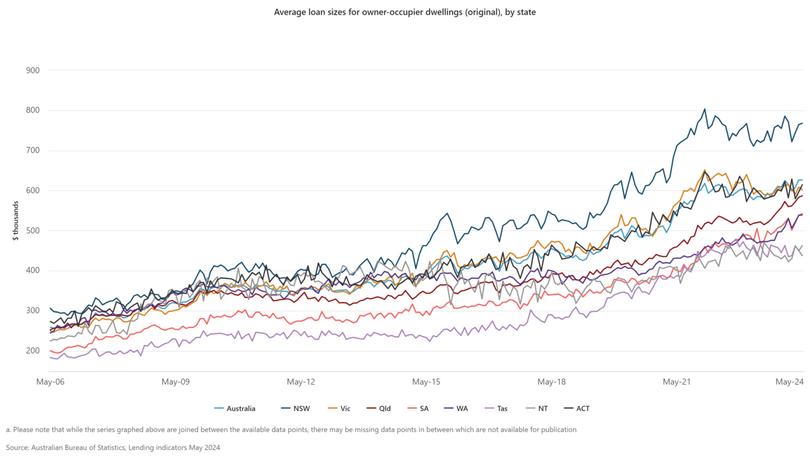

Shock cost: Average Australian mortgage hits eye-watering record high

Aussie homeowners are digging deep to buy — and keep — their homes.

Aussie homeowners are digging deep to buy — and keep — their homes, with the size of the average mortgage hitting record highs across the country.

Australian Bureau of Statistics (ABS) data for the month of May shows the average new owner-occupier mortgage for Australians clocked in at $626,055, the highest level in ABS records.

This is despite the cash rate also being at its highest since November 2011.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.State-by-state pain

While NSW leads the way with the largest average new owner-occupier mortgage of $767,584, it remains below the peak recorded in January 2022 of $803,235.

Queensland, South Australia and Western Australia — where property prices are now at their peak in their respective capital cities — all saw record highs in the average new loan size for owner-occupiers.

Meanwhile the average new loan size in Victoria fell to $601,891 this month, remaining significantly below the peak recorded in January 2022 of $651,364.

RateCity.com.au research director, Sally Tindall said it was astounding to think owner-occupiers were taking out larger loans than ever before, despite the fact the cash rate is sitting at a 12-year high.

“Over the last two years, buyers have seen their maximum borrowing capacity plummet, in some cases by hundreds of thousands of dollars, as a result of the RBA hikes, and yet the average new loan size has hit a new record high,” she said.

Stress tests

Ms Tindall said banks were stress-testing applicants at a rate of 9.27 per cent, however borrowers should make sure to test their finances themselves and ensure they are comfortable with the size of the debt they’re taking on when searching for a lender.

“It’s really important to understand exactly how much your monthly repayments might be if you borrow a certain amount, but also what those monthly repayments would look like if interest rates rose by a further three percentage points.”

“What the bank thinks you can afford to repay and what you think is reasonable might be two different things.

“You might find in two or three-years’ time that the debt is suffocating you.

“It can have massive repercussions on your daily life that extend well beyond your finances,” Ms Tindall said.

Feeling the pinch

Recent Finder data shows many homeowners are indeed feeling the pinch, with more than half-a-million Aussie mortgage holders having paid interest-only loans over the past two years.

The research found six per cent of borrowers are currently servicing interest-only loans to circumvent falling behind on their mortgage repayments.

“It ends up being a better deal for the lender if you do go interest-only for a while, because they charge you more. But it definitely offers you that short-term relief,” Finder’s home loans expert, Richard Whitten, said.

Both Ms Tindall and Mr Whitten said it was important for borrowers to “health check” their home loan every six months to ensure they were getting the best rate possible and while refinancing usually came with fees, both experts agreed the savings far outweighed the losses.

“You might find that you make back those switch costs within a couple of months of refinancing,” Ms Tindall said.

However, she urged borrowers to be wary of mistakenly refinancing to another 30-year loan.

Doing the numbers

If the average owner-occupier with a $500,000 debt and 25 years remaining refinanced to a 5.99 per cent interest rate and also extend out their loan term so that it resets back to a 30-year loan, they would see their monthly repayments drop by $575 a month, however, the long term damage of doing this can be significant, Ms Tindall said.

“Over the life of their loan, which is now five years longer, they would pay an extra $94,940 than if they refinanced and kept their loan term the same.”

RateCity.com.au data showed that if the average owner-occupier in this position has not negotiated or refinanced their rate since the start of the RBA hikes, they would likely be on an estimated variable interest rate of 7.11 per cent.

“If they refinance down to a rate below 5.99 per cent, they would see their monthly repayments drop by $351.

“While they would have to pay an estimated $1150 worth of switch costs, over the next 25 years they could save as much as $100,000 in interest charges,” Ms Tindall said.

This story was first published on view.com.au as Shock cost: Average Australian mortgage hits eye-watering record high.