"We moved back in with our parents and shared a bathroom between six of us just to afford a home"

Forty-something parents Matt and Connie Buhagiar never imagined they'd find themselves back under Matt's parents' roof with six people crammed into a three-bedroom home, sharing a single bathroom, all in the name of getting ahead in the property market.

"It's not ideal, it feels like being a teenager again, but it's for our family's future," Matt says.

The couple, who earn a combined income of $130,000, made the difficult decision to rent out their Altona home and move back into Matt's parents' place in Brooklyn. The short-term sacrifice was part of a long-term strategy to buy land in Ballarat and build an investment property.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy."We had to take the kids' emotional well-being into account," Connie says.

"Luckily, they saw it as an adventure. We've created a routine, being organised helps and honestly, we're not home much."

"We're out early, back late and it works. It's almost like how people used to live decades ago - close, connected, and sometimes chaotic, but it's actually kind of nice."

Despite being on stable incomes, the couple were knocked back by multiple brokers before finally securing finance with the help of property investment expert Anissa Cavallo, founder of Eda Property.

"It was so frustrating," Connie says. "We kept getting knocked back even after providing all the information. Living costs were rising, interest rates were rising and it felt like we were being punished for trying to plan ahead."

After months of rejection, Cavallo's team found a specialist lender willing to assess their application differently, factoring in the rental income from their existing home and their strong savings discipline.

"Anissa kept reassuring us to stay the course," Connie says.

"And finally, her recommended broker got it over the line."

Creative sacrifice strategies are the new normal

Cavallo says Matt and Connie's story is far from unique.

"What Matt and Connie are doing is increasingly common," she says. "We're seeing a wave of middle-aged, middle-income Australians forced into what I call 'creative sacrifice strategies'. They're moving back in with parents, house-sharing, or renting out their own homes just to keep investing."

She says rigid lending models have failed to adapt to modern realities.

"Traditional serviceability models assume dual full-time incomes and linear employment. That's not how people live anymore. Many households are financially disciplined but blocked by outdated algorithms. Ironically, these are often the lowest-risk borrowers in real life because they manage money so well."

In Matt and Connie's case, the couple's mortgage and living expenses were being assessed at rates roughly 3 percent higher than they were actually paying, part of the APRA-imposed buffer designed to protect against rate rises.

"It's a system that treats stability as risk if it doesn't fit the spreadsheet," Cavallo says.

Connie says their motivation was simple: "We don't want to rely on the pension when we retire."

Like many middle-aged Australians, the Buhagiars are increasingly conscious of the widening gap between wages and living costs.

"Seeing prices rise while wages stay the same is really concerning for our retirement comfort," Connie says. "We want a future where we can live comfortably and not just survive."

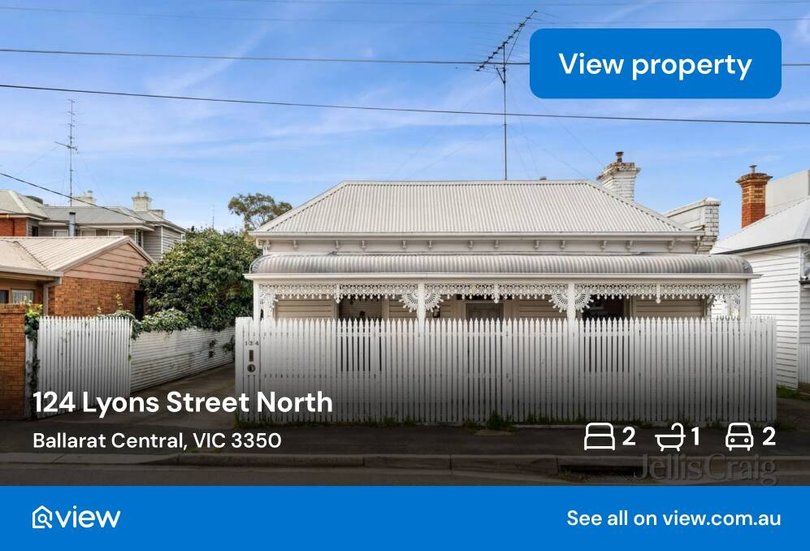

After consulting Cavallo, they decided Ballarat offered the right mix of affordability and growth. "It's more affordable than Melbourne, has steady growth, and gives us a long-term asset that can generate income."

Her advice to others? "Start planning earlier. We were lucky to find the right expert who helped us stay focused through all the hurdles."

The rise of the middle-aged "Boomerang Generation"

View.com.au Financial Expert Jessica Brady says the Buhagiars are part of a growing movement that's redefining what financial resilience looks like in Australia.

"I think this is the beginning of a really big cultural shift," she says.

"Yes, rising house prices and affordability are the main drivers, but this kind of multi-generational living has been normal in other cultures for millennia."

Brady says we need to challenge the stigma around adults moving back home.

"What if it's not a failure, but a smart financial strategy? It can mean shared bills, more family support, stronger community ties and it might stop people relying on the 'Bank of Mum and Dad' or the pension later in life."

She adds, "We once saw moving home as something shameful. But as affordability pressures grow, maybe it's time to see it as something that can strengthen families, financially and emotionally."

Lenders, limits and the 3 percent buffer wall

Chris Bates, CEO of Alcove, says lenders are facing the same tension as borrowers.

"Banks are eager to lend, but they're restricted by the APRA 3 percent buffer, which is making it really challenging for buyers, especially families trying to stretch into their forever homes," he says.

He's also seeing a major rise in multi-generational buyers; families combining assets and incomes to buy properties that suit everyone.

"This is a natural step in the next phase of the property market story," Bates says.

"As prices rise beyond what a single household can afford, we're seeing families pool resources, buying duplexes, split homes, or properties that can accommodate ageing parents or adult children."

He believes this shift could redefine what "family housing" looks like in Australia.

"Homes that were once considered too big for one family are now perfect for multiple generations. It's a real growth area."

Bates says the next logical step is for banks and policymakers to create more flexibility around multi-generational lending.

"Lower-interest, interest-only loans for multi-gen families, or allowing parents to buy with their kids and later step away, would make a lot of sense," he says.

Brady agrees, adding that structural reform, not just sentiment, is key.

"We need more housing, yes, but we also need smarter finance systems that reflect how people really live.

"Families shouldn't have to move back in together out of desperation, they should be able to choose it as part of a sustainable plan."

Back in Brooklyn, the Buhagiar household has found its rhythm - six people, one bathroom, and a lot of patience.

"It's not glamorous," Connie laughs. "But when we drive past our block in Ballarat, it's all worth it."

For this "Boomerang Generation", the journey home isn't about moving backward, it's about building something for the future.