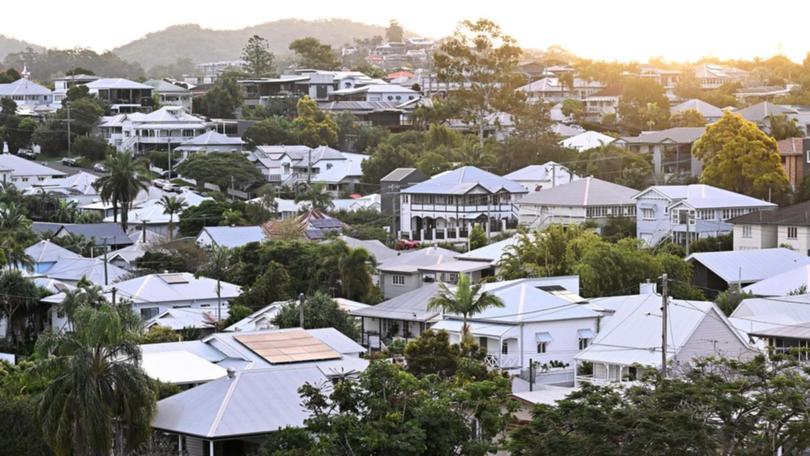

Where are the best suburbs for first home buyers around Australia?

First home buyers are well aware of how difficult it is to enter the property market, now a new report has revealed which suburbs in each capital city are within reach.

When Brisbane first-home buyer Hannah Bass started her property search, her sights were set on a two-bedroom unit close to the city.

“I quickly came to learn that my expectations were higher than my budget,” Ms Bass said.

It’s a common story around the country — first-home buyers are priced out or need to make extreme compromises to buy a home they can afford.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.However, a new report has revealed suburbs in each capital city where prices were within reach of first-home buyers — whether they wanted to buy a unit or a house.

Melton in Melbourne, Mount Victoria near Sydney, Russell Island in Brisbane, Medina in Perth and Bridgewater in Hobart were the most affordable suburbs in their respective cities for houses, the LJ Hooker First Home Buyer Report showed.

While most of the suburbs where houses were considered affordable — with median prices below thresholds for government shared equity schemes and stamp duty concessions in each state — were in greenfield areas far from city-centres, units and townhouses were a different story.

Inner-city options

Popular inner suburbs including Newtown in Sydney, Brunswick in Melbourne and Fortitude Valley in Brisbane became accessible to first-home buyers who were considering a unit or a townhouse, the report showed.

“So when we say units, it’s not not always about apartments and high density living, it can be your sort of smaller, three story walk-up older style apartment blocks or it can be townhouses,” LJ Hooker head of research Mathew Tiller said.

He said the key for first-home buyers was to decide what they wanted from their home and the suburb it was in.

“Do they want space and a backyard? Or do they want to be close to pubs and nightclubs and in the thick of it?”

Making compromises to get ahead

For Ms Bass, staying close to the Brisbane CBD was important, as well as staying relatively close to Ashgrove — the suburb she grew up in.

“It was not in the exact area I wanted and it was an older style, but it came in under budget — $405,000 and my budget was $495,000,” she said.

“I’m just super excited that I managed to get my foot in the door.”

It’s something Melbourne buyer’s advocate Wendy Chamberlain tells her first-home buyer clients all the time.

Getting into the market

“It’s your starter house — you’re not going to live in it forever so get your foot in the door if you can,” Ms Chamberlain said.

However, she said it was important for inexperienced property buyers to do their due diligence and get professional advice — no matter the type of home they were buying.

She said when considering a unit or apartment, it was better to look for older-style villa units rather than new multi-story buildings which may have building defects such as flammable cladding and high body-corporate fees.

“A townhouse trumps an apartment every time — you’re buying a patch of land and you can make improvements to the property like putting solar panels on the roof.”

When buying a house in a greenfield area, she said house and land package contracts should be combed over by a legal professional and that clauses could be added to protect buyers.

“The most important thing is to understand your budget and stick to it,” she said.

Originally published on view.com.au