Why regional homes are perfect for first-time buyers

First-home buyers are increasingly looking beyond capital cities.

In a property market where million-dollar price tags are becoming the norm, first-time buyers are increasingly looking beyond city limits to find their dream home.

According to the latest Million Dollar Markets report from Cotality, one in three Australian suburbs now has a median house or unit value of at least $1 million.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.In Sydney, that figure jumps to nearly 70 per cent, while Brisbane's median house price has officially crossed the seven-figure threshold.

For many first-home buyers, this shift has made capital city markets feel out of reach.

And while 63 regional suburbs entered that million-dollar club this year, the regions remain an affordable and lifestyle-rich option.

The affordability advantage

The Cotality report paints a clear picture of the growing affordability gap under way across Australia.

In Sydney, only 15 per cent of suburbs have a median house value under $1 million.

Meanwhile, regional NSW and Victoria still offer a wide range of suburbs with more accessible price points.

For example, while Sydney's median dwelling value sits at $1.24 million, regional NSW and Victoria offer homes well below that mark, with many suburbs still priced under $800,000.

For first-time buyers, the ability to enter the market without stretching finances is crucial.

Cotality's latest Home Value Index found the median combined regional dwelling value now stands at $700,688, significantly lower than the $941,457 median in the combined capitals, and this price gap remains a major drawcard for buyers looking to make a regional move.

Not only are prices lower, but buyers often get more bang for their buck with larger blocks, newer homes, and better value overall.

In fact, while 56.8 per cent of Sydney sales were over $1 million in the past year, only 24.7 per cent of regional NSW sales hit that mark.

That means three out of four homes sold in regional NSW were under $1 million, offering a much wider pool of affordable options.

Kaytlin Ezzy, economist at Cotality, says this affordability edge makes regional areas a compelling option.

"I think regions are a great option for first home buyers," Ms Ezzy said.

"They typically do have that lower price point compared to their corresponding capital city.

"For first-home owners looking to get into the market, they're a great option, particularly in markets around capital cities that can benefit from the Home Guarantee scheme's 5 per cent deposit, because they can access its higher price cap."

Home Guarantee Scheme: more help, more options

The updated Home Guarantee Scheme, effective from October 1, has made regional buying even more attractive.

The scheme now offers unlimited places and higher property price caps, allowing eligible first-home buyers to purchase with a 5 per cent deposit, without paying lenders' mortgage insurance.

"It gives first-home buyers more options to play with compared to the options that they would have inside the capital city," Ms Ezzy said.

The Home Guarantee Scheme provides the highest price caps for 'capital city and regional centre'.

In NSW, this translates to a price cap of $1.5 million.

Regions like the Illawarra and Newcastle fit the bill, where $1.5 million goes further than in Sydney.

In Victoria, the pricing cap for Melbourne and regional centres is $950,000.

Ms Ezzy notes Geelong as another prime example where you have access to lower price points and a higher cap, making these areas doubly appealing.

Further out, the affordability improves.

Ballarat is a regional centre that property expert and host of Pizza and Property podcast, Todd Sloan, said offers great scope for first-home buyers.

"Looking at Ballarat, you can quite easily buy something there from $400,000 if you're willing to roll up your sleeves a bit, and at $500,000 to to $600,000, the property is pretty much move-in ready," Mr Sloan said.

This reduces financial stress on the buyer.

"If you're looking at something along these lines, your repayments are pretty minimal," he said.

His advice? To jump on these schemes before they shift the market.

"Getting quick is the strategy," he said.

"What happens when these incentives are rolled out? It's not a guarantee, but it's a very high likelihood that everyone starts to utilise them, and those maximum price caps end up eventually becoming the minimum price of the markets in a lot of cases."

Character homes within reach

Mr Sloan also points out how utilising the scheme for regional centres could enable first-time buyers to access character homesa far-fetched dream in the capitals.

"There's no way you're ever getting a beautiful character home in Sydney in the $600,000s," he said.

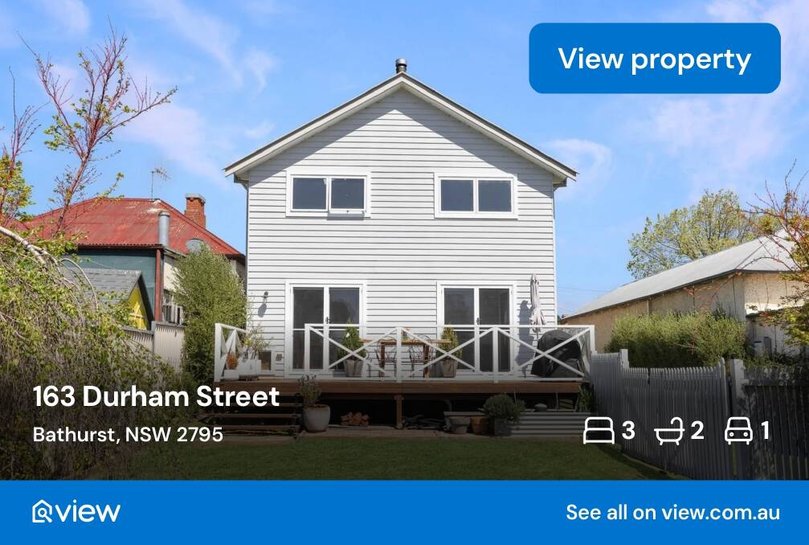

"Whereas, if you're happy to travel out to Bathurst, for example, there are stunning homes there in the fives, sixes and sevens.

"If you're spending under a million, say $900,000 in Bathurst, you can buy something beautiful."

Steady capital growth

Mr Sloan said the idea that capital cities provide a steadier investment is a myth.

Cotality's Home Value Index found that regional growth has steadily outpaced the capitals.

Over the past year to September, combined regional values increased 6.6 per cent, outpacing the 4.3 per cent rise seen across the capitals.

"If you're buying in a regional town and are interested in making your purchase both an investment and home, you absolutely can make money out of it," he said.

"There are a few very simple growth drivers that you can look into; one of them is the population growth, another is the supply of new houses coming to the market."

Strong population growth, infrastructure and a diverse job market help ensure a regional area is a stable property-buying option.

"You can actually make good money as a home owner buying in the right regional spot," he said.

Lifestyle and community perks

Beyond affordability, regional living delivers on lifestyle, with coastal towns, tree-lined streets, and tight-knit communities, whether it's the surf-friendly vibe of the Illawarra, the café culture of Geelong, or the scenic charm of the Southern Highlands.

Many regions also boast excellent schools, growing job markets, and improved infrastructure, making them ideal for both young families and professionals.

Mr Sloan said that trying to remain close to a city hub, such as Sydney, can mean that first-home buyers are pushed 40 to 50 kilometres out from the centre, which can dramatically impact their lifestyle.

"If you want to live in an incredibly expensive city like Sydney, to make it somewhat affordable, you're heading out to the fringe," he said.

"You might have a local shops, maybe there's a Bunnings nearby, but there's not really much going on.

"Whereas, if you were to take the same money and go into a regional centre (with a population around 50,000 to 200,000), like a Cairns or a Townsville, you get so much more for your money.

"Now, almost everything that you actually want as far as shops, restaurants, going out; it's all there, but it's a stone's throw away as opposed to an hour-long commute."

Lower cost of living

It's not just the purchase price that's lower.

Regional living often comes with reduced day-to-day costs, including cheaper childcare, lower council rates, and less pressure to keep up with the high costs of city living.

With remote and hybrid work now mainstream, many buyers are opting to live in areas where life is more affordable and enjoyable.

So, if you're dreaming of homeownership but feeling priced out of the city, it might be time to look at regional options.

You may find much more than a house - a community, a lifestyle, and a future to boot.

Originally published as Why regional homes are perfect for first-time buyers