What the experts say: Is now the time you should be investing in property?

Global financial turmoil is having an effect on the home front.

It’s been a rollercoaster ride following Trump’s on-again, off-again announcements on tariffs.

And while for now, there has been some pullback from completely overturning world globalisation, the volatility remains.

So is property now the way to invest?

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.This is what the experts have to say.

‘It certainly makes rate cuts more certain’

What is now expected on interest rates?

“The expectation for interest rate cuts was already established before the recent tariff uncertainties. The current volatility doesn’t change the direction - rates will continue to trend lower over the year - but it certainly makes these rate cuts more certain,” said LJ Hooker Head of Research Mathew Tiller:.

“How many cuts we see and how deep they go will largely depend on the decisions coming from the US president and how these affect global and Australian economies,” Mr Tiller said.

He said that historically, we’ve seen the Reserve Bank of Australia (RBA) approach rate cuts cautiously, just as they did during the Global Financial Crisis when rates gradually moved down from 7.25 per cent to 3.0 per cent.

“With unemployment still fairly low, the RBA won’t be in any hurry to dramatically cut rates, given the uncertainty around whether the economic slowdown will persist for a prolonged period.

“They’ll likely wait until clear signs emerge of a slowdown, like rising unemployment or weaker consumer spending,”

ANZ Economist Madeline Dunk said the bank had pulled back its call on the amount the RBA expected the RBA to reduce cash rates from its previously held 50 basis points to 25 points.

The call was made last week on April 4 before the latest up date by the Trump government on tariffs and it remained so after the most recent moves by the US government to wind back tariffs of many of its trading partners.

She said that the bank still expects the RBA to lower the official cash rate in May, July and August, by 25 basis points at each meeting. That would see the cash rate at 3.35 per cent come August.

Meanwhile Co-Founder of Flint Group Mortgage brokers Redom Syed said they are forecasting big cuts ahead.

“Rate cuts are expected in May, and be larger in size through 2025,” Mr Syed said.

“At Flint, we expect to see fixed rate offers with a 4 in front of it to be released in coming months.

“This is a very positive backdrop for property markets, particularly in Sydney and Melbourne.”

Is there a correlation between stock market volatility and property market volatility?

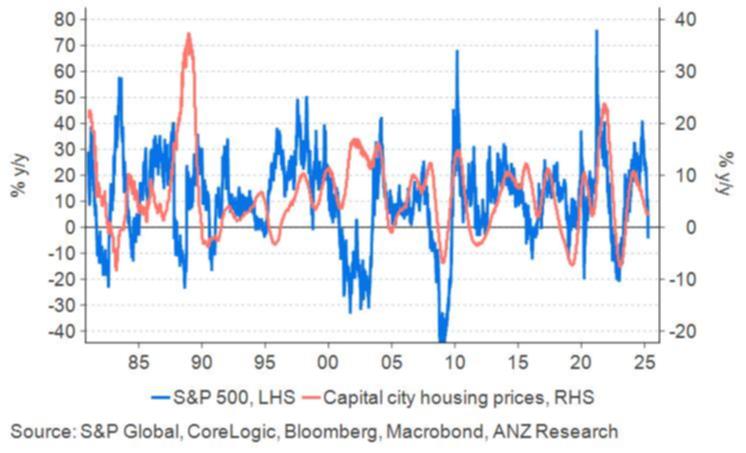

Past experience has shown a correlation between what happens on the stock market and what happens with property prices.

“There is a reasonably strong relationship between the S&P 500 and capital city housing prices,” said Ms Dunk.

However, property prices are expected to be rocked most in one sector according to one expert.

“Generally, stock market volatility does flow through to the property market, but mostly at the luxury end,” said Mr Tiller.

“When there’s significant stock market uncertainty, high-net-worth individuals who typically have substantial investments in equities tend to become cautious or pause major property decisions.

“We saw this clearly during the Global Financial Crisis and again at the onset of Covid, when high-end property markets in Sydney and Melbourne experienced larger fluctuations, while the mid-market remained more resilient and stable.”

Mr Syed said while there may be initial concerns around property that is expected to turn around.

“Global uncertainty is a double-edged sword,” Mr Syed said.

“The immediate feeling is fear. The fear playing out now is driving down stock values and usually slows activity in the property market down. After a month or two, the fear quickly turns into opportunity.”

‘Strong ongoing demand will continue to support prices’

Is property a safe harbour at this time of uncertainty and why?

“Property has always been viewed as a safer investment, particularly during times of economic uncertainty, because it provides more stability and less volatility compared to equities,” said Mr Tiller.

He noted that Australian residential property has historically offered consistent growth, averaging around 4-6 per cent annually over the last three decades.

There are also current conditions to take into account.

“Right now, Australia’s housing shortage remains significant, which means strong ongoing demand will continue to support prices,” Mr Tiller said.

“This combination of undersupply and consistent demand reinforces property’s status as a safe haven during uncertain economic conditions.”

Originally published as What the experts say: Is now the time you should be investing in property?