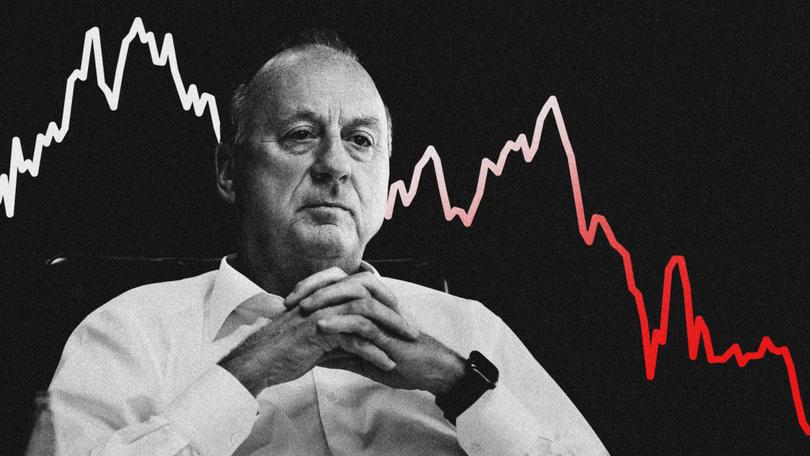

BEN HARVEY: Chris Ellison’s stocks are low but he knows how to pave his way out of trouble

Chris Ellison was likely hoping the wounds from 2024 had been cauterised but it appears he’s in for another annus horribilis.

Last year was a shocker for the Mineral Resources boss.

The rot started when the confidential settlement he reached with the Australian Taxation Office turned out to be anything but.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.His mea culpa over unpaid tax from years ago was quickly writ large over newspapers across the country, prompting a deep dive into his financial affairs.

The MinRes board uncovered business deals within the broader Ellison family that would have made inbred hillbillies from Appalachia blush.

He tried to fall on his sword but missed. Yes, he would step down as managing director of the company he founded but it would be a very, very long goodbye.

He’s still running the show, six months after details of his tax avoidance scheme became public and two years after his board began investigating him.

Ellison’s now grappling with a new problem — a dodgy road.

It’s a pretty vanilla problem compared with secret board inquiries, negotiations with the tax office and investigations into related-party dealings by ASIC, but a problem nonetheless.

The road in question is a 147km highway that connects Mineral Resources’ Onslow iron ore mine with its port.

The road’s history would make the drivers from Ice Road Truckers look for a detour.

Every day, hundreds of road trains laden with iron ore thunder along the bitumen.

At least they would if there was enough bitumen to drive on, which there clearly isn’t because there have been six truck rollovers since August.

The road is now closed, forcing the trucks to take a longer route to the coast.

Time is money for any company but especially so for Mineral Resources.

Ignore for the moment that the highway cost $2.6 billion to build, which means a lot of capital sitting idle in the Pilbara sun.

Also set aside the $230 million that it will cost to fix the damage caused by cyclonic flooding, which some say is throwing good money after bad.

Concentrate instead on the enormity of that freight operation.

Every extra litre of diesel burnt by those trucks because of the longer journey cuts into MinRes’s margin.

We’re talking about a lot of extra fuel. A 225-page report presented to MinRes by mining advisers AMC Consultants said a truck would have to leave every five minutes throughout the day to hit the miner’s iron ore export targets.

The company can ill-afford to take a haircut on profit in the Pilbara because iron ore is the about the only thing keeping the lights on.

It’s little wonder that Ellison, for so long the Bobby Axelrod of Australian resources, has lost his swagger.

For years he was the toast of Boomtown — a genuine rags-to-riches story.

He dropped out of school in New Zealand aged 15, working odd jobs until his late teens when he crossed the ditch to Sydney in 1977.

He made his way to the Pilbara region and obtained a heavy machinery licence.

His crane-hire business in Karratha was a good earner; the sale of the company an even better one.

The money didn’t last, though, and in 1992 he was soon down to his last $10,000. To keep the wolf from the door he started a pipeline contractor.

Fourteen years later that company listed on the Australian Securities Exchange under the ticker code MIN.

Three years after Mineral Resource’s ASX debut, Ellison broke property records by purchasing a riverfront home in Perth’s upmarket Mosman Park for $57.5 million.

He had all the trappings of immense wealth.

The house, the yacht, the getaway in WA’s famed South-West.

The company’s swanky headquarters in the light industrial area of Osborne Park made the suburb feel less like the Slough of West Australian business.

He even hired former Australian Foreign Minister Julie Bishop as a brand ambassador.

At its peak MinRes was worth more than $15 billion and Ellison was a mainstay of Australian rich lists.

Fast forward a few years, with ASIC commissioner Joe Longo played Chuck Rhodes to Ellison’s Axelrod, and things are far more somber.

The company is now worth less than $5 billion.

Investors were reaching for the sick bags this week as MinRes’s share price lurched up and down.

It surged on Tuesday after stockbrokers came out in support of Ellison, including a not-so ringing endorsement by scrip shuffler-to-the-stars Angus Aitken, who said Ellison “isn’t a drongo”.

Less than 24 hours later the stock was down by as much as 12 per cent when news emerged of that road closure.

Ellison is under pressure but is probably more comfortable with the current drama than people realise.

He isn’t coming unstuck because of things outside of its control — problems such as commodity prices or exchange rate fluctuations.

He’s got a problem with a road. And roads can be fixed.

It’ll cost more than he has in his ashtray but with iron ore at $US100 a tonne he has the capacity to pave his way out of trouble.

Ellison could still prove to be more rooster than feather duster.