DAVID KOCH: Here’s proof Jim Chalmers really is to blame for Australia’s economic crisis

DAVID KOCH: Jim Chalmers didn’t think my column last week saying he was to blame for our country’s economic woes was fair. Well Treasurer, here’s the proof...

Last week I bluntly challenged Treasurer Jim Chalmers to man up and help the RBA fight inflation.

I received some feedback from the Treasurer challenging my assumption the Government was to blame for prices rising, driving up inflation, and accusing the Government of making the economy both cold and hot at the same time. It has to be one or the other according to the Treasurer.

Maybe I was a bit too blunt, but I stand by my view and disagree with the Treasurer’s challenges. Let me explain.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.I’ve used a few graphs here to make the point because I find it easier to visualise economic data rather than just look at a bunch of numbers.

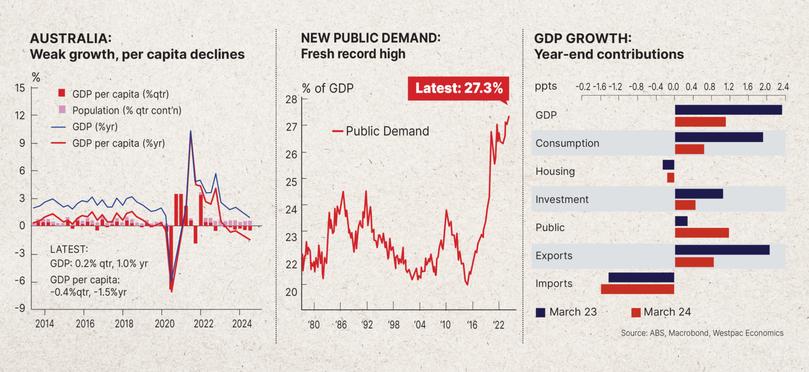

Last week’s economic growth figures showed an economy slowing to a crawl and in economic recession if you take out population growth from immigration.

The Treasurer is saying the Government is keeping the economy afloat and the situation would be a lot worse without its help. Well, yes and no.

This graph paints a clear picture of how government spending (economists call it “new public demand”) is at record high levels. Higher than even the huge economic stimulus spending during the COVID lockdowns which kept so many businesses afloat and kept the economy out of an economic depression.

My challenge to his argument is that we don’t want government spending to prop up an economy except in the most extreme instances — such as when the whole world shuts down because of a global pandemic.

A healthy economy is driven by households and businesses growing while Government spending is used to finesse the economy around the edges, not carry it on its back.

This graph shows the contribution to economic growth of the different major sectors. The black line is 2023 and the red line is this year. Annual economic growth has dropped from 2.3 per cent to 1 per cent.

Look at the dramatic drop in consumption (spending by Australian households), housing, investment by businesses and exports. But the public (Government spending) has more than tripled its contribution to economic growth over the year.

So yes, government spending has tried to plug the gap.

The question is whether the Government should be plugging the gap. Is it, in fact, creating both a hot and cold economy?

The Reserve Bank has wanted consumption and investment to cool as a slowdown would take the heat out of the economy by reducing demand and hopefully slowing price increases and inflation.

So the private sector of the economy is cold but the public/Government sector is hot.

The Government is countering the RBA’s cooling measures by adding its own heat through record spending. That’s why inflation is “sticky” and high interest rates will stay at these levels for longer. Government spending is directly countering what the RBA is trying to engineer.

The bottom line is that Australian households and businesses are going to find it tougher for longer because governments are spending like never before.

By the way, the reason the Government has so much to spend is because of near-record income tax receipts from all of us.

Admittedly a lot of the Federal and State government spending is on much-needed infrastructure and energy transition projects, along with the NDIS. But that spending has to be reined in for the time being until inflation is tamed. It’s Government spending which is keeping inflation sticky and high when it should be coming down because of the big drop in consumer spending and business investment.

The Treasurer says this spending is keeping the economy afloat. My view is that the spending is delaying much-needed interest cuts which would ease the financial pressure on average Australians and small businesses.

The US will cut its interest rates this month, following cuts in Europe and a number of other Western economies. Overseas inflation is slowing a lot quicker than ours.

The Treasurer also challenged my view that prices and price rises can be determined by the Government. Obviously, the price of direct government services is determined by governments and governments influence a wide range of other prices through the economic environment they create.

While the economy is currently slowing, it has been operating at close to full capacity which is reflected in the surprisingly low unemployment figures.

At a time when the RBA wants to reduce demand in the economy to slow price growth, a Government that is spending at record levels is actually creating more demand which pushes prices and inflation up. That is the influence of Government.

When the Government allows strong immigration numbers and doesn’t encourage more home building to accommodate these new Australians, this shortage of housing pushes up property values and the cost of rents. That’s the influence of the Government on prices.

When Governments spend big on infrastructure, which takes workers out of home building and construction, builders have to pay more to attract those workers back which flows through to higher building costs which have been a major driver of inflation. That’s the influence of the Government on prices.

Inflation in the services sector has been a worry for the RBA. Wages are a major cost component of service industries. So, when there are increases in the minimum wage, and in healthcare and childcare, that flows through to increased prices. That’s the influence of the Government on prices.

As I said earlier, much of the current record Government spending is important but it’s all in the timing. Slow the spending now to help the RBA tame inflation and start cutting interest rates, then ramp back up later when the inflation genie is back in the bottle.