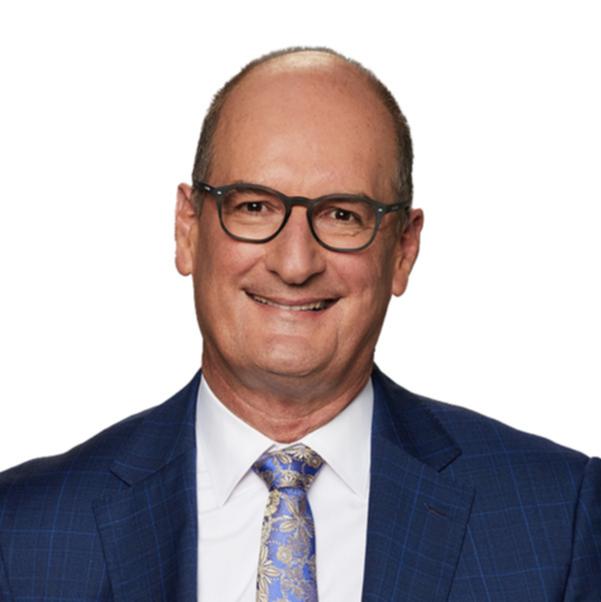

DAVID KOCH: No one wins in intergenerational war between millennials and boomers over money

DAVID KOCH: A little understanding on both sides is needed to cool money tensions between boomers and their millennial kids.

The inter-generational war has never been more heated as the baby boomer generation is accused of everything from inflating house prices, inflating inflation and living a privileged lifestyle they supposedly don’t deserve.

And the accusers are their own adult children.

Inter-generational wars have been occurring for decades but the cost-of-living and cost-of-lifestyle pressures seem to have accentuated the ill feelings.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.According to a survey from comparison platform Compare The Market, more than half of gen Z and almost a third of millennials had asked their families for help with money during the past 12 months.

One in 10 people said financial problems had damaged their relationship with their parents while 8 per cent said rising costs had caused a rift with their children.

And this week Equip Super found only 26 per cent of Australian workers aim to retire at the age of 65 with the rest delaying retirement by an average of six years, meaning many are choosing to work into their seventies.

The reason for the delayed retirement is cost of living — and living longer.

Nearly 50 per cent of 55 to 64-year-olds still have a mortgage, as do 15 per cent of 65 to 74-year-olds. Even 5.4 per cent of those over-75 have a mortgage.

So old and young Australians are feeling the financial pressure and it is fraying family relationships.

The problem is both parents and their adult kids have tainted views of the other’s financial position and behaviours. And that goes back to the generational environments they each come from and the lifestyles they’ve led.

To all the oldies, let’s clear up a few myths. The facts are that it is tougher to buy a property now than when you were paying 17 per cent interest back in the 1990s.

Property values and the size of the loans have risen much more than wages and that more than offsets the benefit of today’s lower interest rate.

On top of housing, there is the cost of living pressure compounded by wages not keeping up with inflation and the extra burden of extortionate child care costs.

I know child care can be subsidised by the Federal Government but when I did the calculations child care costs are more than private school fees for a Year 12 student.

For the adult children of baby boomers, understand your grandparents endured World War II and the Great Depression.

They had nothing to help your parents financially when they were your age. They didn’t expect any help, had to fend for themselves and took responsibility for building their own financial future for their family.

They got to where they are today by the old-fashioned way of living a lifestyle that allowed them to save for a home and build a family — which you were part of.

And that is the root of the current intergenerational tensions. Lifestyle.

Your parents grew up in an environment where sacrificing lifestyle, and going without was the way to buy a house, build wealth and provide a good lifestyle for the family. Your childhood was the beneficiary of their early lifestyle cutbacks.

They look at your lifestyle and ask: where’s your sacrifice to get ahead? I’m not saying this is right, but it is the reality.

You go out to dinner with friends. They wonder why you’re not having dinner parties at home.

You go overseas on holidays. They wonder why you don’t go up the coast and stay in a caravan park.

They get a so-called “bee in their bonnet” (to quote your grandmother) about your lifestyle compared to them at the same age.

You want them to help financially to buy a house or cope with the cost of living. They see it as you wanting them to also subsidise your cost of lifestyle.

The solution is calmly sitting down, talking about it and explaining each other’s expectations.

Boomers are proud of what they’ve built but as they retire, and live longer, they are scared that money is going to run out and impact their future lifestyle.

However, they want to — and do — help their children and grandchildren.

Almost three-quarters of Australian grandparents surveyed said they had been supporting their family financially, with 31 per cent gifting money and providing child care free of charge.

That day a week your parents look after your child saves $150 in childcare fees which over a year is worth about $7000.

Some other top ways they care for their kids and grandkids is by:

- Purchasing clothes, toys and essentials (31 per cent)

- Cooking for them (20 per cent)

- Lending money (13 per cent)

- Contributing to household bills (9 per cent)

- Helping with property purchases (9 per cent)

The data also showed that 7 per cent contributed towards the cost of school and day care, and a further 7 per cent had helped their kids or grandchildren buy a car.

So boomers are helping a lot. They just want to feel respected for the help.