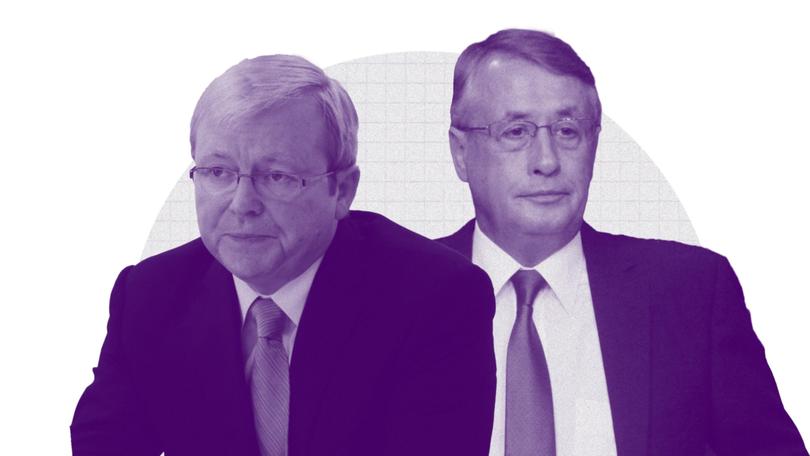

THE FRONT DORE: Kevin Rudd deserves a national apology - it was Wayne Swan who steered us into economic abyss

THE FRONT DORE: The ex-PM has been telling us all along his treasurer was an economic dud. Now Wayne Swan has proved him right.

Sorry, Kevin.

We got it wrong.

We owe you an apology.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.All these years, here we were thinking you were the useless prick who steered Australia into an economic abyss.

We always thought, and with good reason to be fair, that you were the problem. I mean, you kind of were.

But more than a decade later we discover that your old mate Wayne Swan, the guy who ran our economy for six years was the bigger problem — turns out he had absolutely no idea what he was doing the whole time.

Anyone who has watched Swan closely over the years always suspected he was a bit of a jerk. And sure, it wouldn’t have been a massive leap to conclude he was also probably economically illiterate and possibly incompetent.

But like most factional warriors, for Swan, numbers are everything.

The giveaway these past few days is that while he might be able to count to 45, his strength is 100 per cent not macroeconomics. How do we know? He opened his mouth to explain how the economy works.

Swan’s economic illiteracy is horrific.

Swan popped up, as he does, to give his unique political insights on the most unforgiving of platforms — breakfast TV.

Of all the places politicians front up, this is the most dangerous environment.

If you’re a Labor person, the ABC is a home game. Political scripts welcome and accepted.

FM radio is really the battlefield of ideas, where if you’re the current PM for instance, you can get some solid advice on when to have your wedding, and who to invite. For Anthony Albanese, it’s the perfect place to show a bit of spunk.

But commercial breakfast TV. Here, real anchors ask meaningful questions and refuse to accept bullshit answers.

Every dud politician who talks for too long, or trots out their party’s “talking points”, between 6am and 9am is a ratings killer.

Expect to be mauled, ridiculed or shut down. Or all three. You can shine. Or die.

For some inexplicable reason, Nine has identified Swan as a regular talent. This judgment might go some way in explaining why Sunrise rates better than Today.

But first, a lesson in economics that Swan could have picked up in Year 11.

In basic economic terms, when the government spends money, most of it accumulated either from collecting your taxes or from the resources industry, it increases overall demand for stuff, and that introduces competition for that same stuff, which forces prices up.

Prices up equals inflation.

The current Government is spending a lot of money. More than any other government in history, COVID aside.

When inflation first started to crank up, global factors were behind the shortfall in the supply of goods from overseas, which meant they were hard to get, and therefore in higher demand. That led to higher prices which flowed through to inflation.

That feeds a bit of a spiral, as one higher price, say for petrol, leads to another higher price, for anything and everything that requires delivery.

Another factor in driving demand, and therefore prices, is immigration, which again increases competition for say housing, and lo and behold, leads to higher rents. Inflation.

Yet another input cost into prices is the cost of energy. The more power costs, the more expensive it is to make almost everything, and it adds to the underlying cost of every business that has to turn the lights on.

And yet another driver of inflation is wages and salaries. The more workers are paid, the more businesses charge for the stuff your workers make or supply.

RBA boss Michele Bullock, an actual expert in economics, says inflation is smashing the economy.

More than higher interest rates. Higher prices for everything is hurting “everyone” including “the most vulnerable”. It’s a simple concept. Higher interest rates hurt homebuyers.

But, Bullock says, not as much as the price of everything else going through the roof, as measured by rising inflation figures.

Governments, State and Federal, hold almost every lever to control inflation. Decision after decision, government spending, migration, housing, energy, wages, is directly correlated to the cost of goods and services and therefore inflation.

But in politics, the easier thing to talk about is interest rates, and mortgage repayments. It helps that, out of pure self-interest, many in the media are mortgage holders and report on the topic with the zeal only felt by those personally suffering from rate hikes.

Bullock is required by law to adjust official interest rates up and down for the sole purpose of moderating inflation. Her only job. Keep inflation down. She has one lever to pull.

It’s likely, if she were the treasurer, and had other levers to pull, Bullock would not be mimicking Jim Chalmers’ work.

The reality is “fiscal” or spending policy under Chalmers, and the Reserve Bank’s “monetary” or interest rate policy have been at odds for the entire period of the Albanese Government.

The Treasurer has presided over record spending during the entire period the Reserve Bank has been lifting rates. Full stop.

Chalmers is spending more to prevent the economy from going into recession. If not for high immigration, the economy would already be in recession. If not for high immigration, inflation would also come down faster.

The relationship status is, as they say, complicated.

Put as simply as possible, the Government is undeniably driving inflation up, or slowing its decline, to stop the economy falling into the politically fatal recession, leaving the Reserve Bank no choice but to keep interest rates higher to temper household demand.

They want to force families to spend less money, in order to push down inflation. It’s the definition of monetary policy.

The Government and the RBA are completely at odds on economic management but are pretending they are on a unity ticket.

Enter Wayne Swan, Euromoney’s world finance minister of the year, 2011.

“The Reserve Bank is putting economic dogma over rational economic decision making, hammering households, hammering mums and dads with higher rates causing a collapse in spending, driving the economy backwards.”

Literally the Reserve Bank’s job.

“(This) doesn’t necessarily deal with the principal pushes when it comes to higher inflation.”

No, that’s because the Government is pulling, forcing the bank to push.

“I am very, very disappointed in what the Reserve Bank is doing at the moment.”

Its job.

“And if you look at markets they are all forecasting rate drops, they are going down around the world.”

Except inflation is not going down in Australia, because State and Federal governments, in the election cycle, keep spending.

“The drivers of inflation in this country are not going to be affected and not going to come down by hammering mums and dads with higher rates.”

Incorrect.

“The Government is doing a lot to bring down inflation, but the Reserve Bank is simply punching itself in the face. It’s counter-productive.”

The Government is spending more, which is increasing inflation. The Government is punching the Reserve Bank in the face.

“And it’s not good economic policy, and I am incredibly disappointed in what they are doing.”

Government spending at record levels — and policy settings from wages to energy prices to high immigration with no plan to improve productivity — when inflation is historically high is not good economic policy.

“It’s not government spending that’s causing this.” It 100 per cent is government spending causing this.

“Government spending is keeping the economy (out of recession) . . . they are spending a lot but they are also in surplus, two years in a row, something not achieved in this country for decades and decades.”

Ah. Maybe Swanny does know a bit about economics then. Government spending is indeed keeping the economy, technically, out of recession, for political purposes. The surplus is irrelevant. The Government is earning more from taxes, and still spending more, while staying in the black.

“There are inflationary pressures in the economy and they are not being caused by government spending.”

Except they are.

“I am saying (Jim Chalmers) is doing everything right. zzzzzzzz

“There has always been a group of people in this country who hanker for a recession and hanker for cuts in government spending which hurts people.”

Economists. And sensible governments who understand that runaway inflation is what hurts people the most.

Swan’s economic illiteracy is horrific.

We have previously, thanks to Rudd, had a bit of an insight into Swan’s economic credentials.

“In his period as treasurer he did not live up to the expectations of his colleagues in terms of being across the portfolio and a competent exponent of the government’s policy. I didn’t have that view at the time. I thought he would rise to the occasion and he had the best tutors available, namely the Australian Treasury.”

Like all good treasurers, Swan, who is now the president of the Labor Party and sits around the board table of some big businesses, was perfectly qualified to run our economy. He has an arts degree. And he worked as a political adviser from the age of 24 to the day he was elected to Parliament.

Rudd says Swan should never have been treasurer. Rudd was left with no choice but to make Swan, the factional heavy, treasurer.

“Mr Swan desperately wanted the position, there was a risk of grave political instability within the newly elected government if he was not given the position.”

That came to life two years later, when Swan knifed Rudd to hand the prime ministership to Julia Gillard.

Despite Swan winning international praise at the time for his handling of the global financial crisis that ground economies all over the world into recession, Rudd claims it was all his idea.

At the time, naturally, we thought it was Kevin being Kevin.

“The bottom line is if you look at the role I played in response to the global financial crisis it was not one of washing my hands, and saying this is one for the Treasury.”

Rudd: Swan had no idea. I saved the country.

But it’s 2024 now. And why would this possibly matter?

Well, all through that period when Swan, the dud, according to Rudd, was stuffing around not living up to expectations, the treasurer’s chief of staff was strapped into the front row learning how to run the economy alongside his dopey boss.

That adviser — Jim Chalmers — now runs the economy.

Chalmers is not Swan. Thankfully. But he must have learnt some economics from Swan. He didn’t learn it at university, where he studied politics and communications, and like his old boss, went straight from college into politics.

To be fair, no treasurer of note has ever had any formal training in economics or finance.

I-was-just-stating-the-facts Chalmers unleashed all this in a clumsy attempt to shift the blame for poor economic growth onto the RBA by, unusually but understandably, giving a few quotes, no interview, to the Canberra press gallery last Sunday night.

He thought he was being clever.

He put the hold on Bullock, and his old boss applied the squeeze. He’s been trying to release the grip ever since.

In his embarrassing attempt to back his protege, Swan has made Chalmers look like a bit of a dill for kicking it all off, an intervention that only prompted a sharp rebuke from every independent expert, highlighting flaws in Labor’s economic strategy and identifying the Government’s complicity in the precarious predicament every Australian household is experiencing.

Rudd’s old economics adviser is now also in Parliament.

Unlike Chalmers, Andrew Charlton, an economist, left politics upon the demise of Rudd and turned political misfortune into an actual fortune in the real world.

He’s a young millionaire, sitting up the back of the House of Representatives, presumably scratching his head in dismay.

Maybe Chalmers should give Charlton a call.