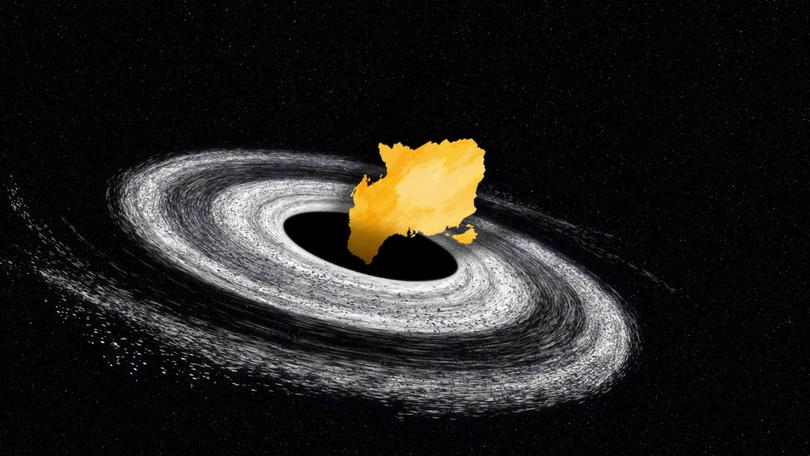

JACKSON HEWETT: Drip-feed of Budget downgrades ahead of MYEFO exposes $25b black hole of debt

JACKSON HEWETT: The slow, painful drip of Budget downgrades has exposed the long term structural issues that Australia must resolve if the country is to avoid becoming a nation of permanent government debt.

The drip, drip of Budget downgrades ahead of the MYEFO has exposed the long term structural issues that Australia must resolve if the country is to avoid becoming a nation of permanent government debt.

For too long the country has relied on the kindness of strangers, principally the last gasps of China’s increasingly ineffective infrastructure-led stimuli.

The boffins at Treasury have for years warned that Australia cannot rely on company tax receipts courtesy of the mining industry. But their messaging method — placing conservative estimates on iron ore and coal budget revenues — has backfired.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Since 2017, “unforeseen upgrades” have made the corresponding Treasurer look like a genius as he has delivered the May Budget from the dispatch box.

Dr Chalmers has been a beneficiary, always at pains to point out that Labor turned significant Coalition COVID-era deficits into surpluses in their first two years, and saving tens of billions of dollars in interest repayments through “responsible economic management.”

It is commendable that he has done so, and that he has tasked the Productivity Commission to deliver the kind of reforms that Australia needs to climb off the lowest rungs of output ladder.

But the Treasurer knows those reforms are a long time coming while the revenue cliff is happening now. Fully aware of the difficulty of unwinding government handouts for cost-of-living relief, he has signed off on permanent spending that will commit Australia to Budget deficits as far as the eye can see.

That might play well in the short term in outer suburban seats Labor needs to win where rents, mortgages and food prices are hurting. In the long term, it sets the country up for protracted pain where desperately needed root and branch reform will be consumed by the politics of envy.

Unfortunately, the political debate is already gearing up to be the opposite of what is needed.

Dr Chalmers is setting the scene for a version of Mediscare 2.0, framing the Coalition’s critique of Labor’s fiscal recklessness as “coming after Medicare, medicines and pensions”.

Medicare, medicines and pensions are just three of the numerous negative surprises Labor has been drip-feeding to the electorate to soften the $25 billion hole that will blow up tomorrow’s MYEFO.

Finance Minister Katy Gallagher described them as “automatic” — i.e., inflation’s fault, or “unavoidable”, i.e., the previous government’s fault.

“I don’t think it’s particularly helpful to label things as unavoidable or sort of automatic, that’s the nature of budgeting,” Stephen Smith, partner at Deloitte Access Economics said.

The Coalition has called for an end of tax and spend Labor, but are they willing to be the ones to reform the tax sector? Labor tried with franking credits and it helped lose them the election.

“It’s absolutely true that indexation exists within the Budget. But there’s also increases in spending as a result of policy. What we’ve seen is a permanent increase in the level of spending in the Budget. And so, by definition, what’s required is a permanent increase in in taxation or cuts to other areas of the of the Budget.”

Heading into an election year, it is difficult to see either party putting their heads on the block of tax increases or spending cuts.

The Coalition would not be drawn on cutting government support, leaving them open to a Mediscare-style attack.

If the Coalition chooses the reformist route, then they have to review the sacred cows of tax concessions for their core constituents.

Labor today also released Treasury’s 2024-25 Tax Expenditures and Insights Statement – an annual review of who gets what benefit from the ATO.

In 2024-25, Treasury predicts that $22b of tax revenue will be foregone via the application of the capital gains (CGT) discount for investors. Those tax benefits almost exclusively go to those in the highest income decile, improving the finances of over 800,000 of the country’s richest people who own assets inside trusts. Another $24.2b will be foregone in tax concessions for earnings on super, where 83 per cent of the beneficiaries have above the median income, while 43 per cent of the tax benefit goes to those in the highest income decile.

“It’s clear that the vast majority of tax expenditures go to people in in higher income brackets. That’s largely because a lot of them relate to things like superannuation or assets with capital gains discounts,” Smith said.

“Principal place of residence, housing and GST exemptions are a couple of good examples where governments are leaving money on the table, and the budget is in a structurally worse position than it otherwise would be.”

The Coalition has called for an end of tax and spend Labor, but are they willing to be the ones to reform the tax sector? Labor tried with franking credits and it helped lose them the election. But the revenue has to come from somewhere and it is time the electorate recognised that China won’t come to the rescue, according to Australian Institute of Company Director’s chief economist Mark Thirlwell, who describes it as like “being Japan in fast forward” from a demographic sense.

“We’ve got a bigger spending footprint. So challenge number one is, how you fund that? Just how do you close the gap? In the near term, we’re going to fund it by issuing debt, but eventually that stops being a viable thing.”