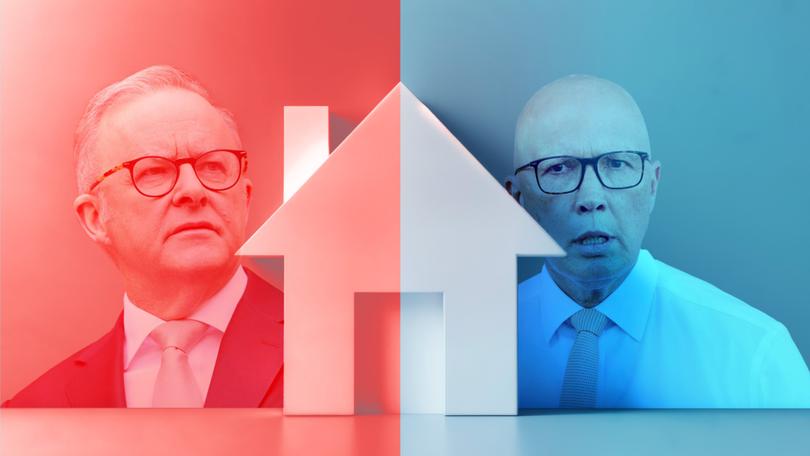

Federal election: Twenty questions for Clare O’Neil and Michael Sukkar on housing at Press Club debate

Labor and the Coalition will have a housing showdown on Wednesday, as both party's policies drawing the ire of housing experts and economists.

First home buyers rejoice! The next government has got your back.

Whether Labor or Coalition, both want to help you on the housing ladder.

Labor has pledged $10 billion to build 100,000 homes exclusively for first-home buyers over eight years and will expand the Home Guarantee Scheme by removing income caps and place limits, allowing purchases with a 5 per cent deposit and no Lenders Mortgage Insurance.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The Coalition’s plan includes allowing buyers to deduct mortgage interest on loans up to $650,000 from taxable income, raising income thresholds for the guarantee scheme, and enabling access to $50,000 from superannuation for a deposit.

On the supply side, Labor said its $10 billion Housing Australia Future Fund will create an additional 40,000 social and affordable homes, and the Coalition proposes a $5 billion infrastructure fund to unlock 500,000 homes in greenfield areas.

Both parties have drawn the ire of housing experts and economists, who lament the lack of detail on supply as well as the potentially inflationary impact of stimulating further demand.

With Minister for Housing Clare O’Neil and Shadow Minister Michael Sukkar debating their policies at the National Press Club today, we asked experts what answers they were hoping to hear.

Saul Eslake, independent economist and former chief economist at ANZ, described the weekend announcements from both parties as “a bad day for aspiring home-buyers”. He posed the following questions:

- Do Ms O’Neil and Mr Sukkar agree with Peter Dutton that it is important or desirable that house prices keep going up? If so, why? And how does that help improve housing affordability for people who don’t already own homes?

- What rate of house price inflation would be “too much”?

- If you both agree that banning foreign investors buying established properties (less than 2,000 annually) will reduce competition for first home buyers, shouldn’t you also agree that scaling back negative gearing and capital gains discounts would reduce competition from the 180,000 Australian investors who buy annually?

- When you say investors are adding to the supply of rental housing, logically, doesn’t that mean that the first home buyer who was outbid by an investor and now must rent is now increasing the demand for rental housing by the same amount as the supply?

- To Michael Sukkar: How will increasing the demand from first home buyers for new housing induce an increase in supply of new housing, given there will be a lag of at least a year (longer in the case of apartments) between the increase in demand induced by the Coalition’s tax deduction policy, and the increase in supply?

- Won’t prices surely go up quite a lot over that time? And if prices subsequently come down when that induced supply magically appears, won’t those who bought new houses in the first year be pretty pissed off?

- To Clare O’Neil: Is she worried that her scheme will encourage people to take on more debt than they prudently should?

- If she thinks the scheme won’t result in a ‘significant’ increase in prices, what is the definition of ‘significant’? Is it 5 per cent? 10 per cent? 20 per cent?

- To Michael Sukkar: A homebuyer who gets tax deductions for interest payments for the first five years will surely face a big increase in tax liabilities once those five years have passed. How will the Coalition resist widespread demands to extend the five years, perhaps indefinitely?

- How has the Coalition arrived at their costings? Are they assuming a delayed start to the scheme? Have they accounted for the fact that while there might be say 30,000 people who take up their scheme each year, if the number who are using it will increase by 30,000 each year by year 5, there will be 150,000 people claiming these deductions?

Maxwell Shifman, chief executive of developer Intrapac and former president of the Urban Development Institute of Australia, said the focus must return to actual housing supply. He posed these questions to Clare O’Neil:

- Why does the government keep saying you are building 1.2 million homes? The federal government doesn’t build homes and industry predictions are showing that the measures taken in the Accord will fall well short. Shouldn’t you fess up?

- What modelling has been done to show that 100,000 homes can actually be built for first home buyers with $10B? How will you ensure they are for first home buyers only? Will they be discounted? What happens if they want to sell them in future? Do you really think building first home buyer enclaves is how you solve housing for the broader community?

- What are you doing to reduce the cost of development which remains the biggest barrier to new supply?

- Just saying you are creating supply is different to actually doing it. Both parties claim they are increasing supply. What specific things are you doing to unlock land supply and feasibility for new housing beyond stating that you aspire to a certain number of homes being built?

Cameron Kusher, an independent housing economist for more than 20 years, raised fundamental affordability questions:

- What would it take for you to admit that the only way to improve affordability is for house prices to fall?

- What are you doing to reduce the overall cost of housing development, including infrastructure charges, approval delays, and local and state government fees?

- Will your party commit to incentivising councils to fast-track rezoning and planning approvals in high-demand areas?

- Given the risk facing developers, do you support offering cheaper finance or risk guarantees to help bring forward new housing supply?

- Would you consider partnerships with the private sector to co-invest in housing development, especially for low- and middle-income buyers?

- Will your party commit to a comprehensive review of property-related taxes, including negative gearing, CGT concessions, stamp duty, and land tax?

Ms O’Neil and Mr Sukkar will debate the merits of their housing policy at the National Press Club today at 12.00. Follow The Nightly’s live blog.