Scam victims to get compensation from social media companies, telecommunication companies and banks

Facebook owner Meta and other social media companies that fail to police scammers on their platforms will be forced to compensate victims under new consumer protections.

Facebook owner Meta and other social media companies that fail to police scammers on their platforms will be forced to compensate victims under new consumer protections.

The Albanese Government announced on Wednesday it would put $14.7 million into expanding the role of the Australian Financial Complaints Authority over two years to combat scammers.

The move would also establish “a clear single pathway for scam victims to seek compensation”.

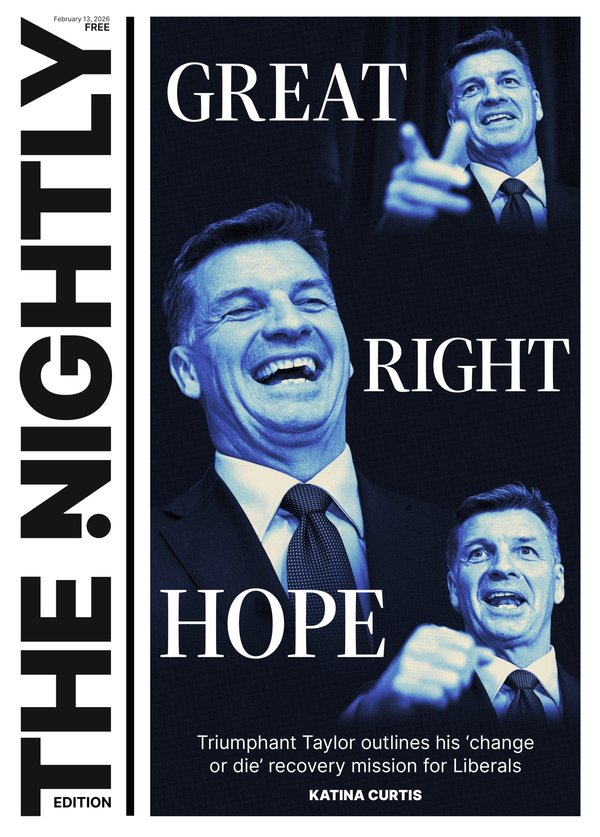

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Under the changes, if a person is the target of a scam on social media and loses money from their bank account, both the bank and the social media platform could be liable if they failed to put adequate protections in place.

Currently, social media companies have no internal or external dispute resolution mechanism and redress is close to impossible.

AFCA will operate the external dispute resolution scheme for complaints against banks, telecommunication service providers and digital platforms providing social media, paid search advertising and direct messaging.

A Government spokesman said scam victims will be able to seek compensation through a single door if they’ve been unable to reach a satisfactory outcome through internal dispute resolution.

Assistant Treasurer and Minister for Financial Services, Stephen Jones said the new protections will “cut off the avenues scammers use to target Australians by setting a high bar for what businesses must do to prevent them”.

“Scam victims will have a clear pathway for redress,” he said.

“We want victims of scams to know the Government has their backs, and we want businesses to understand that they have a responsibility to protect Australians from these often devastating scammers.”

AFCA already receives more than 100,000 complaints about financial firms each year. In 2023-24, approximately 11,000 of these were scam-related complaints.

According to the National Anti-Scam Centre, Australians have so far lost more than $208 million this year from 198,000 reported scams. West Australians have lost more than $19 million.

The Albanese Government has introduced a Scams Prevention Framework, which creates core obligations to prevent, detect, disrupt, and respond to manipulation tactics used by scammers to target Australians.

Initially, banks, telcos, and some digital platforms will be subject to mandatory sector-specific codes and face significant penalties for non-compliance.

Consultation on draft legislation supporting the framework concluded on October 4, with a final bill expected to be introduced to Parliament before the end of the year.

Originally published on The Nightly