Australian share market surges as Budget reveals $7b tax credit scheme for big mining companies

The local share market has gained ground this morning, with miners leading the way after the federal budget included billions in tax credits for the critical minerals industry.

At lunchtime AEST on Wednesday, the benchmark S&P/ASX200 was up 33.8 points, or 0.44 per cent, to 7,760.6, while the broader All Ordinaries was up 31.2 points, or 0.36 per cent, to 8,024.0

The mining sector was up 1.4 per cent after the federal budget unveiled Tuesday night included $7 billion in production tax credits for critical minerals and other incentives under Anthony Albanese’s Future Made in Australia plan.

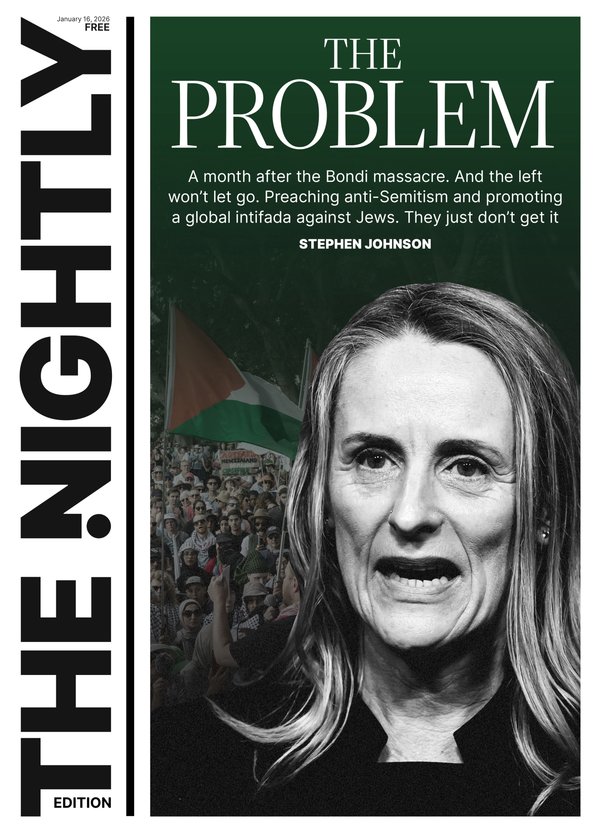

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.BHP was up 2.7 per cent to $44.30, Fortescue had gained 0.4 per cent to $25.92 and Rio Tinto had gained 0.9 per cent to $129.32.

The budget also included income tax cuts, rental assistance and energy bill rebates, which Equity Trustees Asset Management investment specialist Grant Mundell said would be marginally positive for retail stocks.

“We think this will be spent on more non-discretionary/essential services,” he said.

Pokies manufacturer Aristocrat Leisure was up 1.6 per cent, clothing retailer Premier Investments had added 2.1 per cent and JB HI-Fi was 0.9 per cent higher.

International education service provider IDP Education had gained 6.9 per cent to $16.98 after five straight days of losses, possibly on relief that a crackdown on overseas student visas wasn’t more severe.

Pathology clinics were doing badly following the budget’s promise to reform the sector, although the measures did include indexation to certain pathology services.

Healius had dropped 6.5 per cent, Sonic Healthcare had fallen 2.2 per cent and Australian Clinical Labs was 3.3 per cent lower.

The Big Four banks were mixed, with CBA up 0.4 per cent but ANZ down 1.0 per cent, NAB dipping 0.4 per cent and Westpac falling 0.3 per cent.

Traders were also looking ahead to April’s consumer price index figures from the United States, set to be released Wednesday night Australian time.

Producer price figures released overnight showed that US wholesale inflation rose more than expected last month, but Fed chairman Jerome Powell called the readout more “mixed” than “hot” and reiterated that a interest rate hike was unlikely.

The Australian dollar was buying 66.44 US cents, from 66.05 US cents at Tuesday’s ASX close.