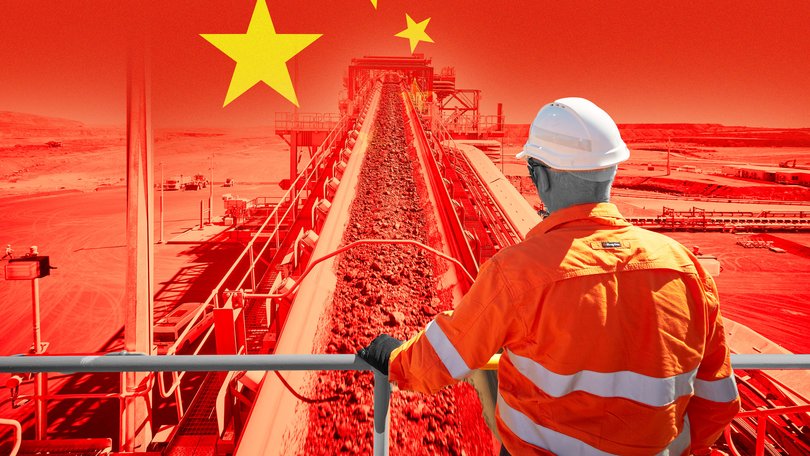

BHP China standoff: Beijing iron import impasse sparks Anthony Albanese’s call for resolution

Anthony Albanese has urged BHP and Chinese iron ore customers to come to a quick resolution on hardball price negotiations that have reportedly led to a halt on imports of Australia’s lifeblood commodity.

Anthony Albanese has urged BHP and Chinese iron ore customers to come to a quick resolution on hardball price negotiations that are feared to have led to a halt on imports of Australia’s lifeblood commodity.

China’s state-run iron ore buyer, China Mineral Resources Group Co, has reportedly asked domestic traders to suspend purchases of any dollar-denominated seaborne cargoes from the Australian miner after contract talks stalled.

If true, the stand-off would have significant ramifications given the steel-making ingredient’s importance as Australia’s largest export and cash cow.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.About 80 per cent of the iron ore BHP digs up in Western Australia is sold to China, and the commodity delivers billions of dollars of crucial royalty cheques for the Lucky Country each year.

“Well, I am concerned about (the report),” the Prime Minister told media on Thursday. “I want to see Australian iron ore be able to be exported into China without hindrance. That is important. It makes a major contribution to China’s economy, but also to Australia’s.”

“These measures are always disappointing. But let’s hope, certainly, that they are very much short term. I want to see this resolved quickly.”

The Bloomberg article was later contradicted by steel market analytics firm Mysteel, which said it had verified the rumours were not true, that no such order had been made and that the information did not originate from China Iron and Steel Association.

Sources suggested on Wednesday morning that BHP cargoes were continuing to be shipped from Port Hedland into China as talks progressed.

However, BHP has not quelled the speculation by confirming or denying whether the iron ore cargoes are subject to a ban, only advising that it does not comment on commercial negotiations.

It’s as yet unclear whether the stalemate represents a more substantial rift between the mutually reliant trading partners, or is simply a peek into the cut and thrust of negotiations between the mining giant and importing steelmakers.

At this stage analysts are broadly of the view that the matter will come to a resolution, based on their assumption that China still needs large volumes of the steel-making ingredient to fuel large domestic infrastructure projects. Imports to China stood at 1.17 billion tonnes in 2024 from all sources.

BHP’s share price finished 2.49 per cent lower at $41.47 in the wake of the Bloomberg report. Iron ore futures were off slightly on Wednesday to $US103.10 ($155.80) a tonne.

The commodity has been able to hold its own above the three-digit benchmark despite fears that the likes of Rio Tinto’s new Simandou mine in Guinea could throw supply-demand balances off course by adding another 120 million tonnes a year into the trading pool.

Addressing media in Perth, WA Premier Roger Cook relayed a briefing he’d received in Japan last week from BHP’s iron ore boss Tim Day, who said “negotiations are tough”.

“They are subject to a certain amount of strategic gamesmanship, for want of a better description, but I’m confident they’ll reach an agreement,” Mr Cook said.

“We have no role to play. But obviously we are watching very closely, because the iron ore that we ship to China is integral to our economy.”

Nationals Leader David Littleproud said he hoped China “the respects rules-based order and power” and wouldn’t use “undue influence over BHP in this instance”.

“What I would like to see is some transparency. There needs to be WTO (World Trade Organization) rules,” he said on Wednesday .

Opposition Leader Sussan Ley called on Mr Albanese to provide “clarity and leadership . . . not obfuscation”.

“The Prime Minister’s absence of leadership or a plan only fuels uncertainty for our exporters and for the thousands of Australians whose jobs rely on this industry,” she said.

Iron ore exports of about 892 million tonnes, mostly from WA, were worth about $115.2 billion in the 12 months to June 2025.

Director of Iron Ore Research Philip Kirchlechner said it was important not to jump to conclusions, but that it would not be the first time that iron ore majors have run into tough negotiations with China.

“I’m shocked by this weaponisation of trade by China, I think it will backfire on them,” he said. “Australia over the last decade has more than doubled production . . . without that the iron ore price would be much higher.”

“When China tried to do this co-ordination before it failed.”

China, the world’s largest iron ore consumer, buys about 75 per cent of global seaborne iron ore and established China Mineral Resources Group three years ago to buy ore on behalf of its steelmakers in a bid to gain more leverage as a large, single buyer and keep a lid on prices.

The Middle Kingdom has grown more willing to leverage its clout in raw materials markets in recent times, including bans on Australian commodities earlier this decade as well as export controls on rare earths this year.

RBC Capital Markets analyst Kaan Peker viewed the development as a “neutral event”, saying it was likely a negotiating tactic to secure lower long-term prices.

“On government instructions steel mills could try to offset BHP volumes via Fortescue, Rio, Vale, domestic ores, or stockpiles, but in aggregate it would be at higher cost and efficiency loss and this would be at the margin (competitors could currently only absorb a very small portion of BHP’s volumes),” he wrote.

“China cannot realistically walk away from BHP supply altogether.”

Analysts at Macquarie’s commodities desk reckon the ban could have positive upside for the iron ore price if confirmed, but took the view that “some form of agreement will be reached” to bring trade flows back to normal.

They said any iron ore cargoes not yet sold into contracts would likely be “resold to ex-China” or “be discharged and stockpiled at China ports.

“As for China, demand will need to be shifted from BHP ore to others, which is where there could be some support to prices, particularly as BHP products are part of the benchmark mid-grade fines basket with the mills should not be impacted.”