CNBC: How the unexpected success of concert films have super-charged the global cinema industry

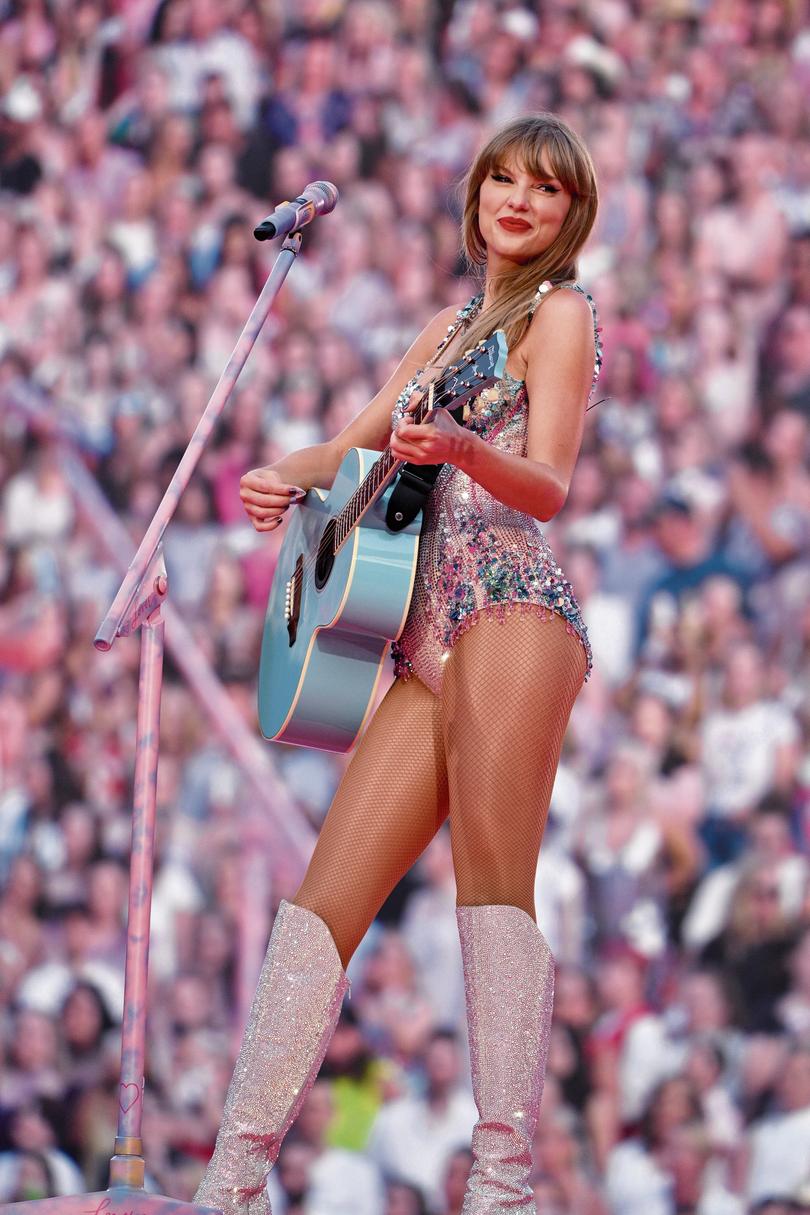

The phenomenal yet unexpected success of concert films from Taylor Swift and Beyonce are being credited with super-charging the global cinema industry.

Move over, Nicole Kidman. AMC has some new patron saints.

In the final three months of 2023, AMC saw revenue increase 12%, and operating profit by one measure nearly triple, compared with the same period a year before. “Literally all” that growth was tied to concert films from Taylor Swift and Beyoncé, AMC CEO Adam Aron told analysts Wednesday.

“These two movies added greatly, not only to AMC’s bottom line, but to movie theater success across our entire industry,” Aron said on the movie theater chain’s fourth-quarter earnings call. “Just these two films represented fully one-ninth of the complete fourth-quarter, domestic, industry-wide box office.”

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.AMC was behind “Taylor Swift: The Eras Tour” and “Renaissance: A Film by Beyoncé,” the first movie distributions in the company’s 103-year-old history. Those projects, both released in the final quarter of 2023, came near the end of a year culturally defined by the two pop stars’ tours.

U.S. market share for AMC, based outside Kansas City, expanded as a result of the two movies, Aron said. In the fourth quarter, AMC’s domestic box office receipts from the two releases alone beat out the distribution totals from most major studios, excluding Disney, he said.

Now, AMC’s phones are “ringing off the hook” as other artists look to the company to distribute filmed versions of their concerts in theaters in 2024 and 2025, he said.

“This is a stunning result, given that neither of these films were on anyone’s drawing board until midyear, and that they were the first movies ever distributed by AMC,” said Aron. “What a triumph for our company. To that end, it is no surprise that our praise for Taylor Swift and Beyoncé Knowles-Carter has no limit.”

A cultural and economic force

It’s little surprise that the two divas boosted AMC’s financials in the fourth quarter. Swift’s venture alone grossed more than $200 million, making it the highest-grossing documentary or concert film of all time, by AMC’s count.

Fans came out in droves last year to the see the global music superpowers in stadiums across the U.S. The tours were notable for high ticket resale prices as consumers proved willing to splash out for what was dubbed the “funflation” trend, and attendees’ outfits that matched the aesthetic of each star, including friendship bracelets and black fedoras.

The economic effect of these events caught the attention of Wall Street and even the Federal Reserve. While some questioned the true influence on nationwide economic data, others cited a clear benefit to tourism in cities where the tours stopped.

AMC wasn’t the only company reporting a boost from the concerts and films this earnings season.

Competitor Cinemark said average ticket prices increased 2% and domestic concession stand revenue grew 8% compared with the same quarter a year ago. Chief Financial Officer Melissa Hayes Thomas credited that bump to Swift’s movie and related merchandise, as well as to strategic pricing initiatives.

Ride-share platform Lyft said it saw a 35% jump in rides to stadiums in 2023 compared with the year before. Lyft specifically mentioned Swift and Beyoncé concerts as key drivers, in addition to sporting events.

Disney drew attention after CEO Bob Iger announced on its earnings call earlier this month that the movie studio’s streaming platform would exclusively house an extended version of Swift’s tour. “Taylor’s Version” of the film, referring to her re-recorded albums, hits Disney+ on March 15.

“Over the past year, we’ve all witnessed the creative genius and sheer power of a true cultural phenomenon, Taylor Swift,” Iger said on the call. Audiences are eager “to relive the electrifying ‘Taylor Swift: The Eras Tour (Taylor’s Version)’ whenever they want on Disney+.”

AMC still acknowledged challenges in 2023 tied to the actors and writers strikes that brought Hollywood to a halt at midyear and pushed back movie releases.

The company reported higher revenue than analysts polled by LSEG, formerly Refinitiv, anticipated in the latest quarter. But it also posted a larger loss in earnings per share than Wall Street forecast.

Shares of AMC, once a volatile “meme” stock that captured the interest of retail traders during the pandemic in 2021, tumbled more than 14% in afternoon trading on Thursday. The stock is down more than 28% thus far in 2024.

AMC also announced it would air new, shorter advertisements with Kidman, the actress whose first campaign for the chain became a cult classic. Rather than showing the same 60-second spot before each showing, audiences will instead see one of three different 30-second commercials starring the Australian-American actor beginning in March.