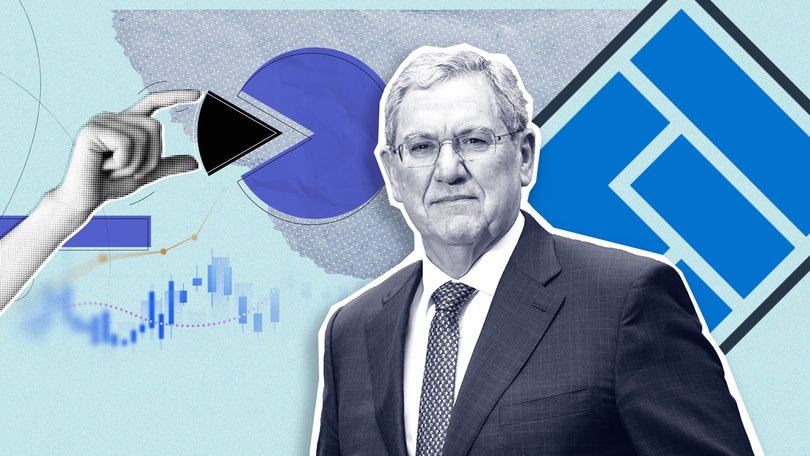

Copycat: ASIC wants to copy Wall Street’s formula to boost ASX listings and make Australia’s share market boom

ASIC is proposing Australian lawmakers consider adopting multiple US laws to boost share market listings and give founders more help creating wealth for all investors.

Corporate regulator ASIC wants Australia’s share trading and corporate governance laws overhauled in a copycat approach to US rules that have helped Wall Street attract the world’s best companies and generate more wealth for investors.

Supporters of the proposed changes argue the calls to mirror US-style laws would make Australia a more attractive place for fast-growing companies to list on the share market by simplifying regulation and allowing founders to sell stock under less onerous legal obligations.

The proposal is part of a plan by ASIC to attract more companies to the Australian Securities Exchange, which has lost companies every year since 2022 as de-listings outnumber floats.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Australia’s most successful privately held software business, Canva, is expected to sidestep the ASX in favour of Wall Street when it launches an estimated $60 billion share market listing within the next 18 months.

Replicating Wall Street

In response, ASIC is backing the overhaul of existing rules that require ASX company directors and chief executives to wait for trading windows — usually after a company reports financial results — before they can seek permission to sell stock.

ASIC suggested it favours US-style plans regularly used to sell stock by Atlassian co-founder Mike Cannon-Brookes and Sydney’s billionaire bitcoin brothers, Daniel and Andrew Roberts, the founders of Nasdaq-listed tech business IREN.

“Trading plans — known as Rule 10b 5-1 plans in the US — have a long history allowing executives and other insiders to establish pre-set trading plans that facilitate the orderly sell down of shares, even when they may otherwise be deemed to have ‘inside information’,” ASIC said on Wednesday.

A Bitcoin apostle and capital markets deal maker, Mr Roberts has previously complained the “brown cardigans” at the ASX rejected IREN’s application to list in Australia. According to him the local bourse took an anti-technology stance against the bitcoin group, which has created $US18 billion in wealth for its US investors since listing in 2021.

Sydney-based professional investor Martin Rogers supported ASIC’s plan on Wednesday. He is a former chief executive of Immutep, which is listed on the Nasdaq and ASX.

“If it’s good enough in the world’s most successful market it should be good enough for us,” he said. “But you know, the ASX is actually easier to list than the US, it’s definitely cheaper, and the rules to follow around accounting reporting are less complex.”

Make it easier to list

ASIC is considering loosening restrictions on what percentage of a company’s shares on issue must be the free float available to be publicly traded and not held or locked-up by insiders or large shareholders.

Currently an ASX-listed company’s free float must be at least 20 per cent of shares on issue, although in the UK and US it’s 10 per cent.

“Reducing the threshold could attract more listings, especially from larger companies in high-growth sectors like technology and life sciences, by allowing founders to retain larger stakes, while maintaining liquidity,” ASIC said.

Mr Rogers suggested the regulator should loosen “ridiculous” and “over the top” qualification restrictions on independent directors and focus more on alignment between shareholders and boards.

“ASIC’s first question should be why do so many directors not even own shares in the companies they represent?” he said.

“If you read the BHP annual report you’ll see non-exec directors have to apply at least 25 per cent of their annual fees in buying BHP shares until they have an equivalent shareholding of one year’s remuneration. Now that’s good, and something ASIC and other companies could think about.”

Giving founders control

However, ASIC also said it is unconvinced talismanic company founders should be allowed to own US-style dual class shares, which would give them voting rights to retain control of the company ahead of owners of non-voting stock.

Meta founder Mark Zuckerberg is an example of this. He forced through the $2.4 trillion social media pioneer’s acquisition of Instagram and regularly dismisses minority investors’ demands to limit loss-making bets on the virtual reality-based Metaverse or plans to build new data centres.

In Australia, the issue of shareholder rights is sensitive after the board of building materials company James Hardie forced through the $13 billion acquisition of building products group AZEK without seeking shareholder approval.

“To date, we are not convinced that adjustments to permit dual class shares are warranted,” said ASIC. “Interest in the subject of dual class shares has re-emerged globally and domestically, and we are open to reconsidering their potential where careful consideration of the merits and risks has been undertaken and appropriate safeguards proposed.”

The regulator has not set specific timelines in taking its recommendations forward, but said it’s open to assisting the government’s lawmakers in considering new policy settings.