Gold and silver price push has ASX miners riding high as investor appetite surges

Historic moves higher in the gold and silver price have fed a new frenzy sending gold stocks doubling or tripling in 2025 as investors eye more capital gains.

Dennis Karp the chairman of ASX-listed Manuka Resources says silver’s surging price means he’s getting closer to restarting the Wonawinta Silver Mine near the regional New South Wales town of Cobar.

The town sits in a mineral rich region 712 kilometres west of Sydney with a population of 3,400 and has relied for more than 100 years on swings higher in copper, gold, and silver prices to line the pockets of local workers and investors.

Silver’s spectacular 56 per cent surge from $US33.74 an ounce to $US49.77 an ounce on Friday, means its rise has matched gold’s record-breaking run as precious metal prices surge on worries around debt levels in the global economy and bets that central banks will lower interest rates over the next 12 months.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Mr Karp says strong metal prices means he expects Manuka can shrug off some balance sheet problems to get the Wonawinte Silver Mine back into production by early next year. The mining boss also has ambitions to get Manuka’s Mount Boppy Gold Mine, near Cobar back operational at later date on the condition he finds financing from investors.

“We’re making good progress now, we’ll be in production at Wonawinte around the end of the first quarter of next year,” he says. “We had about 85 people on-site processing gold at Mount Boppy before, and another 85 or so at Wonawinte, which has the production facility, so we want to get them back,” said Mr Karp.

Gold rush spreads wealth

Gold’s 53 per cent rise year-to-date puts it on track for its strongest calendar year rise since 1979 as the wealth effect spreads out across the economy from miners to the government and ordinary investors.

“Australia is no stranger to a gold rush,” said Justin Gilmour, the managing partner of Integro Private Wealth. “Many of Melbourne’s grand historic buildings stand witness to the wealth generated as prospectors flocked to the Victorian goldfields in the 1850s. Today, gold fever is unlikely to see many of us ditching office jobs for a pick axe and pan, but gold equities, exchange traded funds, and direct ownership of the precious metal are firmly on the radar.”

The metal is also now forecast by the Federal Government to top liquefied natural gas (LNG) as Australia’s most valuable export over the financial year ending June 30, 2026. Its total export value is tipped to reach $60 billion, with iron ore still comfortably ahead on a forecast export value of $113 billion.

“A resurgent gold price will bring tangible benefits to the local economy,” said Mr Gilmour. “It suggests more taxes, royalties, dividends, and wealth for Australians.”

ASX darlings

The share prices of ASX-listed gold miners have often doubled or more this year in a massive windfall for retail investors and fund managers booking spectacular wealth increases for themselves.

Among the mega-cap winners is Newmont Mining.

The dual ASX/New York Stock Exchange-listed miner is now worth $US94 billion ($143 billion) to make it the share market’s third most valuable company behind just BHP and Commonwealth Bank. On Friday its 2025 gain equalled 116 per cent to $133.10 per share.

Gold’s soaring price helped Newmont post a net profit of $US2.1 billion ($3.2 billion) in the June quarter to put it on track for a 2025 net profit in excess of $12 billion.

Meanwhile West Australian miner and Kalgoorlie Super Pit-owner Northern Star is now worth around $34.3 billion to put it among Australia’s top-20 most valuable listed companies.

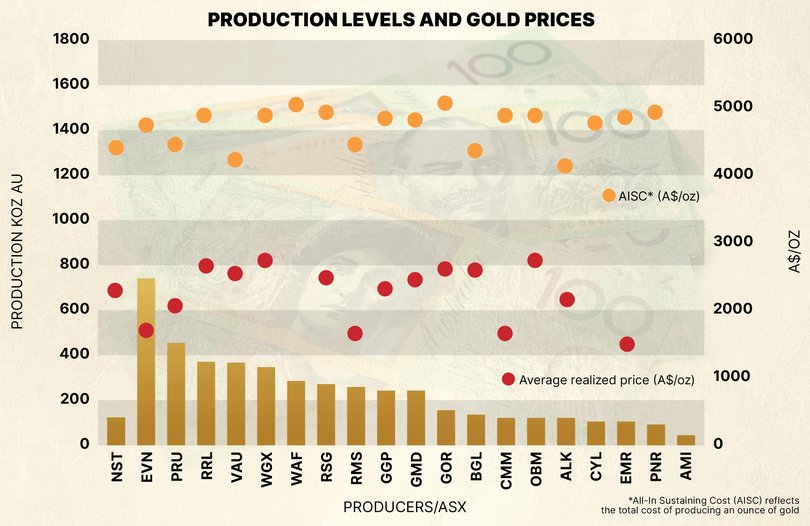

Northern Star shares have jumped 52 per cent this year to fetch $24.02 on Friday afternoon. On October 6, broker Bell Potter tipped them to reach $30. Over the 12 months to June 30, Northern Star’s cost to mine and sell each ounce of gold equalled an average of $2,164 to mean it could make a profit margin of close to $4,000 per ounce if prices remain above $6,000 per ounce.

Investors celebrate

Emmanuel Datt, the founder and portfolio manager of the Datt Small Companies Fund Capital, says the gold rush will encourage more exploration, mergers, acquisitions, and mine development across Australia.

“I think there’s scope for new gold projects to come online in this price environment, there’ll be a lot of development assets or bolt on acquisitions that will look more attractive,” Mr Datt says.

“Given the average price history of gold over the past five years there’s been a lot of gold sitting in the ground that was sub-scale, but all of a sudden with such a strong price movement it will be quite economic to be mined and sent to a nearby plant.”

The fund manager adds that he prefers to invest in miners producing and selling the metal, rather than more speculative explorers looking to drill and prove deposit sizes.

Some of his fund’s big winners included ASX-listed Genesis Minerals, Ramelius, Vault and Pantoro Gold, with their spectacular returns helping push Mr Datt’s fund 61.8 per cent higher, after fees over the 12 months to September 31.

“We’ve a bias towards Australian assets,” he says. “We’ve seen in West African Resources and frontier lower-tier jurisdictions that gold producing assets become more attractive for governments to muscle in on, so there’s more risk overseas.”

Mr Datt started buying gold stocks from late 2024 and remains bullish on their outlook as he thinks their margins should expand as sales grow in line with the rising price while costs remain relatively fixed.

“Our positive view was linked to Trump’s inauguration, while he’s a second-term President he had form around volatility to the markets, and we felt it was good setup for gold as a flight to safety asset and it’s played out beautifully.”

UBS, Goldman Sachs positive

On Wednesday, analysts at UBS Australia said gold equities still have upside assuming that prices for the metal hold around $US4,000 over the next 12 months.

“The rally has been fuelled by market confidence in a renewed Federal Reserve rate cut cycle, continued US dollar weakness, and persistent geopolitical uncertainty spanning the US government shutdown to the latest headlines from the Russia-Ukraine conflict. We believe...ongoing political twists will drive prices higher,” UBS told clients.

UBS added that evidence shows retail investors and central banks are buying the metal at a record pace.

Others like Goldman Sachs now call for the gold price to reach as high as $US4,900 by December 2026. On Friday afternoon the gold price had eased slightly to $US3,978.