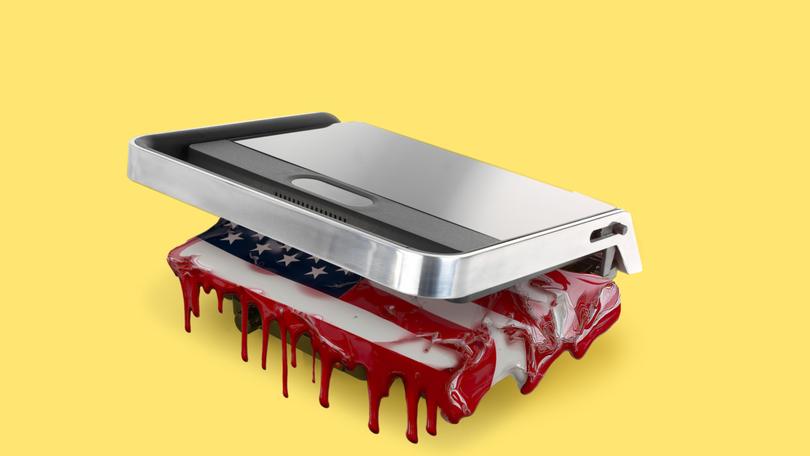

How Aussie espresso machine maker Breville hopes to survive Trump’s tariff jitters

At midnight tonight Australian time, the University of Michigan Consumer Sentiment survey will provide a snapshot of an American public completely blindsided by tariff turmoil.

Last month, the survey showed an 11 per cent plunge in confidence, bringing the index down 30 per cent since December.

Consumers reported multiple warning signs of recession, including deteriorating confidence in business conditions, personal finances, incomes, inflation, and jobs.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The tariff “act of self-harm,” as most of America’s trading partners have described it, seems to have finally reverberated up to the White House and is clearly a motivating factor in Donald Trump’s near-complete capitulation on tariffs on China.

One of Australia’s most successful brands, Breville, has been caught squarely in the crossfire of the US-China trade war.

The company does a roaring trade in espresso machines in the US and also makes air fryers, juicers, and other kitchen gadgets. Total revenue in the US last year for the Sydney-based company was $735 million, making up more than half of Breville’s total sales.

For Breville chief executive Jim Clayton — possibly the most charismatic CEO in Australia — the last few months have been a wild ride.

At first, he thought of it as a Brexit-like event, in that only one country was affected. But over time, he sees it more like COVID, where companies across the globe have no choice but to work together.

It will make or break reputations, he said, because some companies will be so focused on self-preservation that they burn their counterparties. That is particularly true for consumer brands that, like Breville, sit between China’s massive manufacturing base at one end and the giant companies serving 132 million American households across a retail sector worth $US8.5 trillion.

“This is where brands will be built or destroyed,” Mr Clayton told investors at the Macquarie Australia Conference last week.

“If you’re the player that kneecaps everyone around you, you will feel that bullwhip when it comes back around.”

Mr Clayton described a scenario where supply booked out of China had to come to an effective standstill. With tariffs having ratcheted up to 161 per cent (including Biden’s tariff), no supplier was willing to land an entire month’s or quarter’s inventory at a US port and pay millions in fees upfront.

So instead, brands such as Breville dialled production right back, only bringing in the bare minimum to keep retailers happy.

Mr Clayton described managing the process as a game of chess, where you can only move “one pawn, one square,” for fear that each move reduces the number of options available.

“There is a world where the 161 (per cent tariff) comes down to 60,” Mr Clayton predicted last week. “If that happens, you don’t want to be sitting on 30 weeks of inventory.”

The ‘air pocket’ of tariffs

That tariff uncertainty was creating an ever-expanding “air pocket” of supply that was about to seriously hit home for the American administration.

“This is like a slow-moving train wreck, and everybody knows that the crash is a certainty. You can’t see it, but it actually has happened. Containers are not clearing LA, orders have stopped, and now we wait for inventory to burn,” Mr Clayton said.

“For eight to 10 weeks it’s like nothing’s happening and the shelves are still full. Then, when we get into June and July, it’s like jack-in-a-box — surprise! This is when the press can start taking the pictures like they did during COVID, and the real (political) pressure is going to come.”

That’s why three weeks ago, desperate American retailers were pleading with Mr Trump to rethink the strategy.

“The CEOs of Walmart, Target, and Home Depot flew to the White House, got in the room with him, and said the shelves are gonna be empty. That was the day he (Trump) understood that, and realised ‘goodness gracious, that could happen’,” Mr Clayton said.

It appears that meeting between retail executives had an impact, heralding the beginning of the administration’s current U-turn.

In announcing the 90-day pause this week, Mr Trump has sent Chinese manufacturers into a frenzy, as US retailers try to book stock for Halloween and Christmas.

One manufacturer told the Chinese Global Times that they received half-a-month’s orders in a single day, equivalent to eight container loads. Ships are in short supply, with some retailers resorting to air freight to get products delivered within the 90-day window.

“Call 1800 China,” as Mr Clayton puts it, pushing supply chains back into post-COVID reboot, causing a bubble of rushed items, a shortage of cargo ships, and a “little insanity hump as we try to turn this whole global engine back on.”

Production might be resuming, but with 10 to 12 weeks’ lag between orders and delivery, consumers may still be confronted with empty shelves and the media will still get its pictures.

That might keep the President from raising tariffs once again.

Trump, the builder of nations

In backing down on tariffs, Mr Trump might have saved thousands of lesser-known brands that were completely reliant on selling low-margin homewares and electronics to American consumers via big box stores.

Mr Clayton said there “wasn’t a lot of oxygen in the room” for these companies, which would have struggled to make it through the next six months with next to no revenue. Their demise would have been good for Breville, which has the financial firepower, expensive logistics software, and global diversification to weather a tariff storm.

Tariffs have been all-consuming for Mr Clayton, who said if they go back to zero, or thereabouts, “then I’ve wasted my time”.

The ultimate beneficiaries will be manufacturing centres in other parts of Asia.

Mr Clayton said China is not the lowest-cost manufacturer — “not by a long shot” — because of the way Chinese factories operate.

“In China, after Chinese New Year, everybody comes from all over China down to Shenzhen to work, make money, and then go home. And they will only work at your manufacturing facility if you work them 18 hours a day, because they want maximum overtime,” he said.

“And if you don’t offer overtime, you won’t get anybody working there.”

It creates a high season for production, which increases costs.

Add the tariffs on top, and other destinations like Indonesia look much more reasonable. In Indonesia, villagers live near factories, meaning plants can run triple shifts without overtime. Islands like Batam, 30 kilometres from Singapore, are booming.

Breville has accelerated the diversification of its manufacturing base away from China “not because of Donald, but because of anger at Donald”.

By that, he means the Chinese companies that have been making these products are setting up whole new plants elsewhere.

“We were going to move it all out anyway. Now we just get to do it faster because we got everyone’s attention in the value chain,” Mr Clayton said. “So we’re going to get done in two years what I thought was going to take ten.”

In China, Donald Trump’s nickname is “Chuan Jianguo”, meaning “Trump the Nation Builder.” The sarcastic take supposed Trump was helping build China’s nation, advancing its self-sufficiency and raising China’s global status.

But it looks like countries such as Indonesia and Vietnam — despite their own tariffs — might have Trump to thank most of all.