JACKSON HEWETT: Big business places its bets on AI as thirst for data drives limitless appetite

JACKSON HEWETT: Goodman Group has supercharged its global building strategy, the latest company to invest heavily in AI infrastructure, as demand takes hold.

The largest Australian capital raising in three years, and the largest ever for a real estate outfit highlights the seemingly limitless appetite for unlimited data.

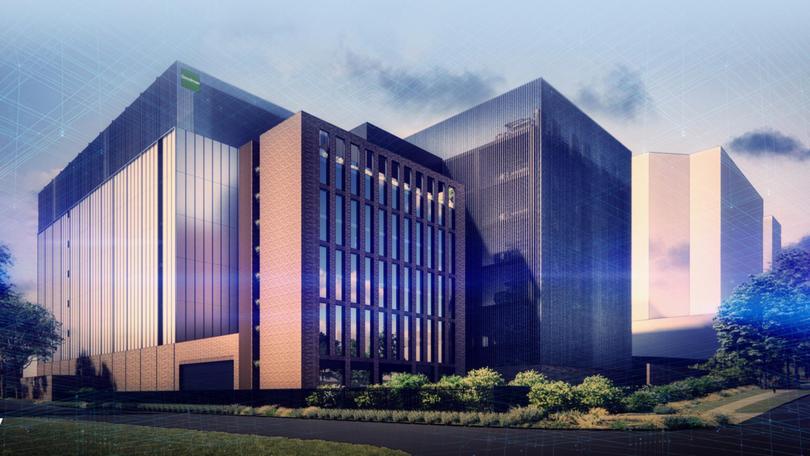

Goodman Group, an ASX darling that doubled in price by building logistics centres to support online retail, has also been using its engineering and real estate nous to build data centres for the digital revolution.

Now it is looking for $4 billion from investors to supercharge its strategy of building hyperscale AI data centres in Melbourne, Sydney, USA, Japan and Hong Kong.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.It’s a huge chunk of change that is expected to be globally transformative.

The last time anything like that money was raised by a listed company was by the Australian-based global biotech giant CSL in 2021 to fund its takeover of a Swiss rival.

The only real estate raising of that size was by Westfield for $3b in 2007.

It took mere hours for institutional investors to fully subscribe to the deal.

Infrastructure assets are highly favoured by superannuation funds thanks to their long-dated stable returns, so expect your Super Fund to be investing on your behalf.

But if you really want to bet on the digital transformation of your job, you can get in on it at $33.50 a share.

The timing is right. Two weeks ago, The Nightly reported that the world’s biggest tech companies, Microsoft, Amazon, Meta and Alphabet were collectively spending some $US250b on new data centres and hyperscale facilities to help train AI models.

One of Meta’s facilities, located in Louisiana, is so large it would take up a sizeable chunk of Manhattan.

In announcing a rise in net profit of 8 per cent to $1.2b, Goodman noted tepid demand for its logistics assets due to “moderate global growth”.

On the data centre side, things were very different.

“Demand for data centres remains strong across urban markets” the company said, as companies moved their data to the cloud to meet requirements “generated directly and indirectly by AI”.

AI feels ubiquitous as a concept but is still very much in the experimental phase.

Since ChatGPT launched just over two years ago, the adoption rate has been the fastest of any technology and is now used by 40 per cent of Americans.

Companies are tinkering with how it can eliminate low value tasks.

Commonwealth Bank believes AI should be answer 95 per cent of online customer queries, as well as speed up processing times for business loans and resolve 15,000 card disputes daily.

The bank believes that the more data it can harvest and process, the better the models will be.

It’s those back end jobs that are most at risk.

Sir Martin Sorrell, the ad guru who founded marketing behemoth WPP, said last week, that despite fears for creativity, AI will impact planning and back-office at least as much as generating new creative assets.

Banking and advertising are just two examples of the 40 per cent of global employers who anticipate reducing their workforce in areas where AI can automate tasks, according to a survey by the World Economic Forum.

An AI wage circuit breaker

AI coming for your job may be no bad thing, according to Callam Pickering, chief economist for hiring site Indeed.com.

He points to new data from the Australian Bureau of Statistics that shows wages are growing at the slowest rate in almost three years.

If fact, adjusted for inflation, wages have been plodding along at the same level as 15 years ago and have effectively fallen 6 per cent from the peak in 2019.

In an economy growing as slowly as Australia’s Mr Pickering doesn’t expect things to improve.

“Based on the latest wage and inflation forecasts from the RBA, purchasing power won’t improve at all in the next two years. It highlights just how damaging high inflation can be,” Mr Pickering said.

“The recovery from the cost of living crisis is not going to happen overnight and may take five to 10 years to recover.”

With unemployment at a record low, theoretically wages should be going up.

Historically such low levels of unemployment accompany strong earnings and profitability, prompting business to pay more to attract talent.

In the current economy, growing at just 0.8 per cent per year, the public sector had been doing the hiring, accounting for 83 per cent of jobs in the last year alone.

Without government spending, the economy would be in recession, Mr Pickering said but it had caused a “dsyfunction” in the labour market by “crowding out” the public sector.

“There’s a strange dynamic at play. Business wants workers but can’t afford to pay the wages to attract them to those roles. I don’t think we’ve seen that before,” he said.

Instead, businesses were not filling roles, muddling along at below normal staffing capacity and generally producing a more inferior product.

Where businesses were filling roles, the lack of available candidates meant they were making compromises on skills, education and experience.

It adds up to low productivity, the key factor needed to get the economy moving and generating wealth.

Raising productivity would lead to higher wages, and would also give the Reserve Bank confidence to cut interest rates further, without driving up inflation.

That’s where AI might make a difference, Mr Pickering said.

“There hasn’t been enough transformation and disruption in Australian business. That is reflected in the productivity statistics,” he said.

“AI promises to enhance workflows; if that eventuates, it can lead to much higher productivity.”

Mr Pickering expects that the increased adoption will lead to a two speed labour market where those with AI skills will out-earn those without but for now the data suggests those building the infrastructure are the ones making hay.

In the ABS figures released today showed the largest wage gains were for workers in electricity, gas, water and waste sectors.

That sector saw pay rises of 4.7 per cent compared to an annual average for all workers of 3.2 per cent.

With the energy needs for data centres expected to almost double in Australia over the next five years, and an estimated 60,000 people needed to build and maintain energy infrastructure over the next 20 years, electricity work might be a good alternative if AI is not for you.