ASX reporting season recap: All the news from companies reporting their results to the market today

Day two of reporting season got underway on Tuesday. But all eyes were looking to the Reserve Bank for a largely-expected rate cut, which Governor Michele Bullock delivered.

MARKET LATEST: OK, we eased into the week yesterday. Nothing too alarming, nothing too much to worry about ... all things considered.

JB Hi-Fi delivered a solid set of full-year results but investors showed their nerves when it was announced CEO Terry Smart was unplugging from the electronics giant and would exit at the start of October.

A beefed-up final dividend and a special payout of $1 a share weren’t enough to soothe shareholders and the stock closed down more than 8 per cent. Ouch.

But it was a btter day for lithium miners after the closure of a mine in China raised hopes of improved prices for the key battery ingredient. PLS, Mineral Resources and Liontown Resources all enjoyed double-digit gains.

But the main focus was on whether the Reserve Bank would cut official interest rates. The market was correct in seeming to think so, and the S&P-ASX200 hitting a record intraday high in early trade.

SGH (formerly Seven Group Holdings), Seven West Media and Life360 delivered their results.

SGH wants to hit $1 billion annual net profit, and the conglomerate is betting big on Australia’s growing economy and its need for more infrastructure and housing.

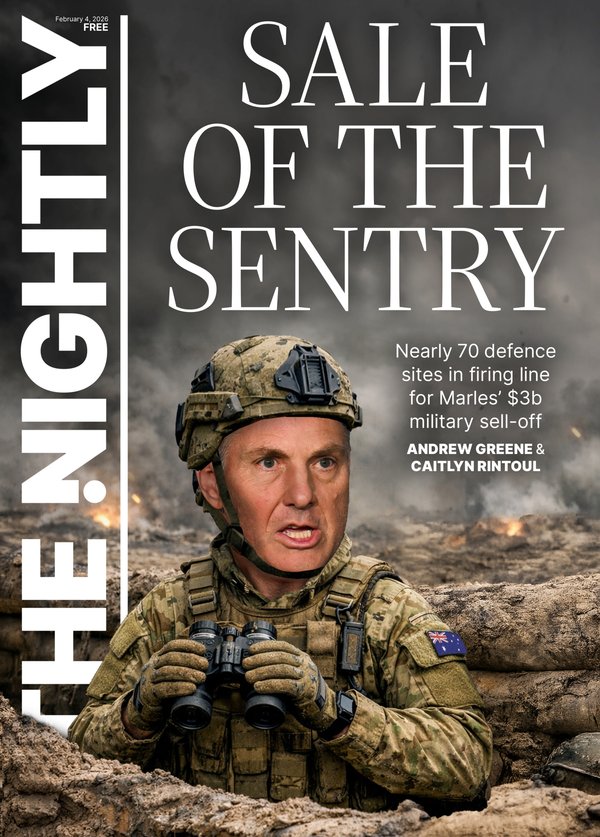

Meanwhile, Seven West Media chief Jeff Howard said audience growth for The Nightly had been going “gangbusters” and expects momentum from a positive second-half performance to continue into the 2026 financial year.

Join us tomorrow for all the latest reporting season updates.

Key events

12 Aug 2025 - 02:34 PM

And that’s a wrap for our RBA coverage

12 Aug 2025 - 01:18 PM

Vroom vroom for Veem shares

12 Aug 2025 - 12:58 PM

Market’s off like a shot!

12 Aug 2025 - 12:38 PM

RBA cuts!

12 Aug 2025 - 11:57 AM

Iron ore adds to yesterday’s gains

12 Aug 2025 - 11:13 AM

Aussie shares edge higher ahead of rates call

12 Aug 2025 - 10:36 AM

Boral the star performer for SGH in another record year

12 Aug 2025 - 10:13 AM

Casino giant rolls the dice on mega precinct sale deal

12 Aug 2025 - 09:43 AM

JB Hi-Fi rebounds after Monday’s rout

12 Aug 2025 - 08:57 AM

ASX200 climbs to yet another record high

12 Aug 2025 - 08:39 AM

CDC Data Centres unveils plans for $415m

12 Aug 2025 - 07:43 AM

Trump extends China tariff truce by 90 days

12 Aug 2025 - 07:20 AM

Norwegian fund sells shares in 11 Israeli companies

12 Aug 2025 - 07:13 AM

Oil markets await outcome of Trump, Putin meeting

12 Aug 2025 - 07:09 AM

SGH ups dividend with strong FY26 momentum

12 Aug 2025 - 06:56 AM

Mortgage holders flock to refinance on much needed rate relief

While you were sleeping ...

Here’s whathappened on US markets overnight.

Wall Street’s main indexes ended lower as investors anxiously await inflation data this week to assess the outlook for interest rates and eye US-China trade developments.

Investors expect the recent shake-up at the US Federal Reserve and signs of labour market weakness could nudge the central bank into adopting a dovish monetary policy stance later this year, fuelling much of the optimism.

July’s consumer inflation report is due on Tuesday, and investors anticipate that the Fed will lower borrowing costs by about 60 basis points by December, according to data compiled by LSEG.

“The inflation data is starting to embody the more direct tariff impacts on the consumer, raising concern that inflation will remain sticky,” said Eric Teal, chief investment officer at Comerica Wealth Management.

“Lower inflationary readings and slower growth numbers are needed to support the case for lower rates.”

The Dow Jones Industrial Average closed on Monday 200.52 points, or 0.45 per cent, lower to 43,975.09, the S&P 500 lost 16 points, or 0.25 per cent, to 6373.45 and the Nasdaq Composite lost 64.62 points, or 0.3 per cent, to 21,385.40.

Read the full wrap up here.

Originally published on The West Australian