Mineral Resources FIFO workers bolt after tough roster changes rolled out in major savings drive

Mineral Resources’ chief financial officer says a rollout of new FIFO swings requiring employees to choose between more time on site or leaving the business has led to high turnover.

Speaking to analysts on Thursday, Mark Wilson said the recent shift from two weeks on, two weeks off — to two weeks on, one week off — as part of huge cutbacks across the iron ore and lithium business had hurt staff retention.

“It doesn’t work for some people, and we understand that,” he said.

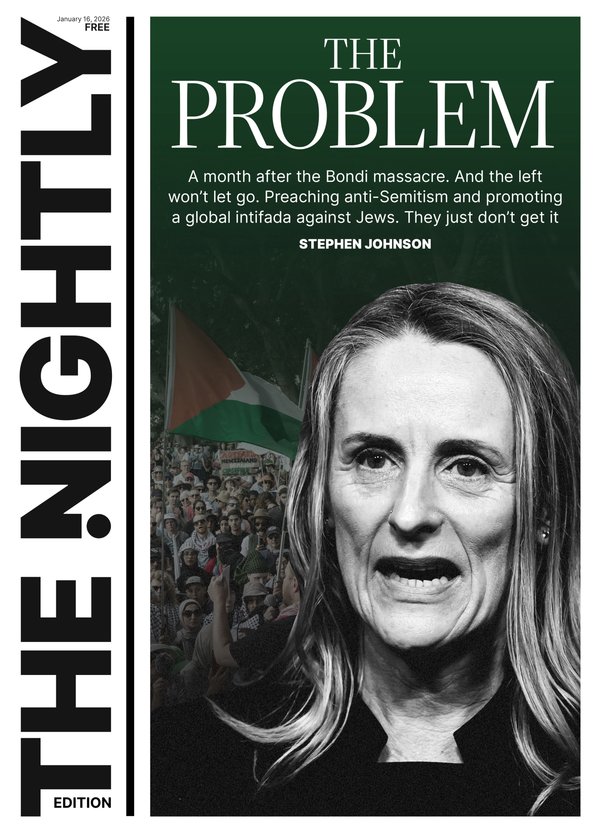

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.“We have, very openly, increased turnover over the last month or six weeks as a result of those roster changes, and we expect that to continue until people get down into the two and one . . . there is turnover, but we can manage it with the other capacity that we have in our businesses.”

He said MinRes was working through ways to redeploy workers from the wind down of its Yilgarn iron ore operation who were happy to take the less family-friendly shift.

More than 800 workers were believed to have been working the preferred two-on, two-off roster for several years, until they were given an ultimatum early September as MinRes tried to find ways to save cash.

MinRes was offering redundancies to workers who did not want to stay with the business under a new roster.

Mr Wilson’s comments come as the under-fire miner revealed a mammoth cash sale of its Perth Basin oil and gas assets to Gina Rinehart’s Hancock Prospecting worth up to $1.13 billion, and a quarterly update on the business.

An upfront consideration of $804 million will be paid to MinRes as part of the deal, alleviating concerns from analysts about the miner’s balance sheet.

And the company — in the spotlight amid revelations over founder Chris Ellison’s tax affairs — has pulled more levers to try and find more free cash as commodity prices take a hit.

Plans for an underground expansion at its struggling Mt Marion mine have been canned for the forseeable future, and production has been scaled back as prices stay subdued.

Plans to turn the Goldfields operation — half-owned alongside China’s Ganfeng Lithium — into an open-pit and underground one had been formally in the works since April. Ore mined was down 24 per cent on the quarter to 68,000 tonnes of spodumene concentrate. Total lithium production Mt Marion, Wodgina and Bald Hill was 157,000t.

MinRes was selling a tonne of the lithium-bearing ingredient for about $US815/t during the quarter.

The extent of rampant job cuts across its business were also laid bare, with 570 roles gone since the start of FY25 as part of reductions at its head office in Osborne Park, roster changes at Mt Marion and Wodgina, and as part of the Yilgarn closure.

MinRes said the changes had saved about $300m. The company maintained full-year cost and production guidance.

Meanwhile, MinRes has said the 150km haul road it’s building between the Ken’s Bore iron ore hub and the Port of Ashburton, has commenced “full operational use”.

Pressure had been on to get the road finished and ore moving before the end of October.

“The haul road has commenced full operational use by our road train fleet across the entire 150km route. The construction phase is now advancing into final completion stages which will facilitate a seamless transition to the autonomous ramp-up phase in the coming months,” MinRes said.

The road is an integral part of MinRes’ $3b Onslow Iron project in the West Pilbara and has been touted by the company as a piece of infrastructure that will unlock stranded iron ore deposits in the region.

Morgan Stanley secured a 49 per cent stake in the private road for $1.3b in June. MinRes said it received $1.1b in cash from the sale during the quarter.

It will get the remaining $200m if 35 million tonnes of iron ore — on a per annum run-rate basis — is transported across the road during any quarter before June 30, 2026.

The new Onslow iron ore mine remains on track for full ramp-up by the middle of next year.

Shares in MinRes rose more than 16 per cent during morning trade after the Hancock gas deal was announced to $41.87. The stock is down about 40 per cent since January.