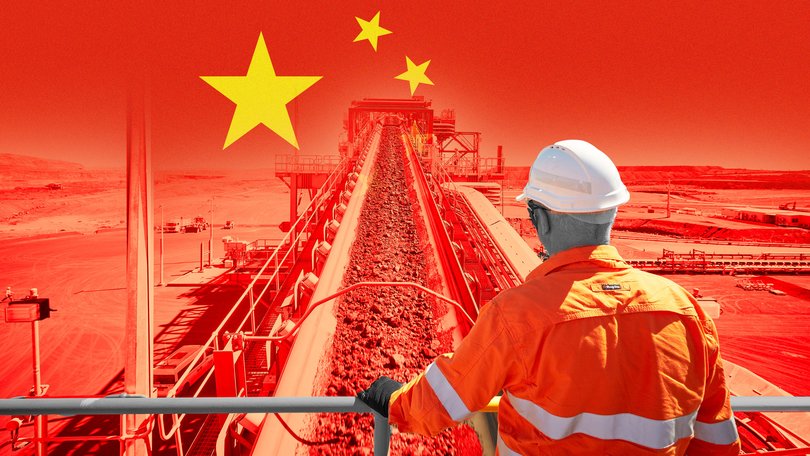

STEPHEN JOHNSON: Economists say China's Simandou mine in Guinea could hit global iron ore prices

STEPHEN JOHNSON: As China’s economic growth slows, Guinea’s Simandou iron ore could put downward pressure on prices, hurting Australian tax revenue.

A new iron ore mine in west Africa could pose a bigger threat to Australian Government revenue than slowing Chinese economic growth.

China’s economy expanded 4.8 per cent in the year ended September 30 which, while higher than advanced economies, is slower than previous years.

Despite a faltering property sector, there is still strong Chinese demand for steel to make electric vehicles and solar panels and water infrastructure in rural areas.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The Chinese manufacturing sector is holding up is in the face of US tariffs that look set to climb to 145 per cent next month when a trade truce with the United States expires.

But a Chinese-financed iron ore project in west Africa means West Australian miners will have a new supply competitor for the first time in decades.

Rio Tinto’s Simandou mine in Guinea is this month loading its first shipments of the commodity used to make steel.

The project, built with Chinese partners, is expected to export 60 million tonnes of iron ore a year, making it a threat to Western Australia’s Pilbara projects because Simandou is regarded as one of the largest undeveloped high-grade iron ore deposits in the world.

Rio owns a 53 per cent stake in the SimFer consortium, which holds the rights to half the vast Simandou site. A separate consortium led by Winning Consortium Simandou holds the other half and can develop Simandou’s blocks 1 and 2.

A mining industry insider, who specialised in making commodity price forecasts, said the prospect of more iron ore supply from the Simandou project would pose a bigger threat to Australian Government company tax revenue than a slowing Chinese economy.

“That is going to change market dynamics from the supply side,” he told The Nightly.

“Whether or not it is sufficient to give you a major step down in the iron ore price is up for debate but certainly, it’s going to have an impact once that new source of iron ore starts to flow because there hasn’t really been any new iron ore in the marketplace for a considerable period of time.”

A new supply of iron ore in another part of the world could potentially affect the price of iron ore after 2026, when production ramps up. A weaker iron ore price affects the Federal Government’s company tax revenue, with Treasury calculating that every $US10 fall in the price of iron ore would wipe out $500 million in revenue in 2025-26.

“So, a big project like Simandou isn’t something the market has had to absorb for a while and that will be a challenge for the market and all else equal, gives you a downward pressure on price,” the mining insider said.

“There’s calm in the market right now because things are balanced around $US100. The only thing that we’re really certain about is supply is up in 2026.

“The worst combination for Australia would be supply goes up at the same time demand drops: that’s something that might give you the big move in price and that is more likely than a situation where demand goes up and supply goes down. More supply means, all else equal, price would be lower.”

AMP economist My Bui said Treasury forecasts that iron ore prices will fall to $US60 by March 2026 look overly pessimistic while prices are above $US100 a tonne.

“They have a very conservative forecast. Our miners would be breaking even below $65 so there’s not really a concern for that at the moment for Australia,” she told The Nightly.

“I think above $US90 is feasible for now. It has been holding up throughout this year, even with all the negative headlines about China.

“Of course, if the property market crashes even further in China, there’s some negative headlines around steel production in China, it might still go down a little bit. Even if it goes to like ($US) 80 or 70, I wouldn’t think that it’s a massive issue for our economy.”

Western Australia is the world’s biggest supplier of iron ore, ahead of Brazil, China, India and Russia, and last year supplied 920 million tonnes of the commodity or 46 per cent of global production.