WA iron ore juniors who flew close to the sun sweating as price see-saws near $US100 a tonne benchmark

The iron ore price faces a fork in the road moment, one which could make or break the resurgence of WA’s bantam iron ore players just as they find their footing.

The iron ore price faces a fork-in-the-road moment, one which could make or break the resurgence of WA’s bantam iron ore players just as they find their footing.

Some corners of the market believe China’s ailing property sector and appetite for the exotic might squash the iron ore price, while other indicators point to the Asian powerhouse’s steel industry being on the verge of a hot run that will buoy the commodity’s value.

During Monday’s trade the iron ore spot price for Australian exports to China dropped under $US100 a tonne, after flirting with the psychological benchmark for weeks.

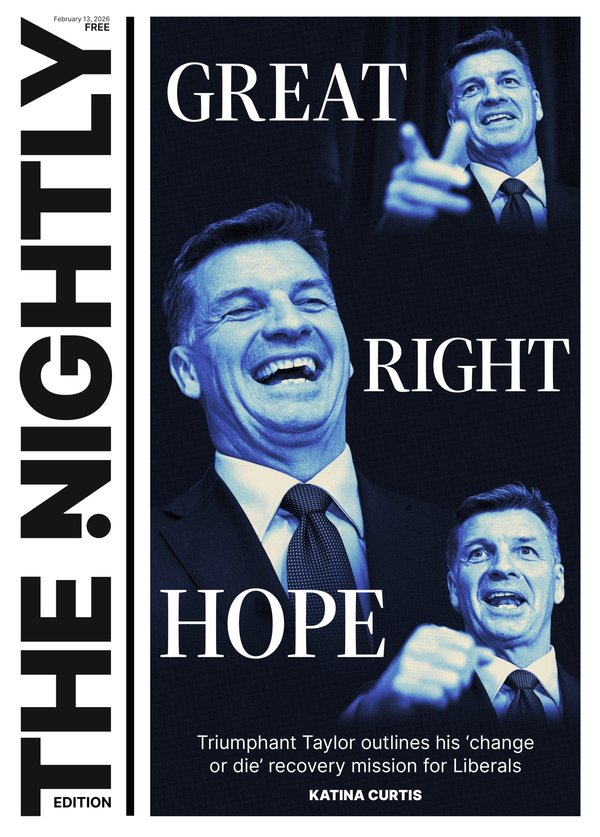

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Since then its rebounded sharply to $US108/t, but it’s still a far cry from the $US145/t levels experienced at 2024’s onset.

Analysts at Huatai Futures have pinned the recent price spike on improving steelmaking margins increasing the demand for iron ore.

Meanwhile, research from Citi suggests the price slide since the start of the year is a function of China’s volatile housing market coupled with the Middle Kingdom importing more iron ore from “non-traditional” sources, namely Russia, Ukraine, Canada and India.

Pressure could persist in the longer-term as China also discreetly pours billions into West African developments to further wean itself off Australia’s production. This is a move Macquarie told clients last month could push the steelmaking mineral below $US80/t in the medium term, even before the bulk of West African supply comes online towards the end of the decade.

A weaker price will put a manageable dent in iron ore giants BHP, Rio Tinto, and Fortescue — who all run low-cost operations thanks to economies of scale — while at the junior end of town it could mean the difference between life or death.

Last week, The West Australian revealed that iron ore lingering beneath the $US100/t threshold for a few months would likely lead to the closure of the Wiluna West project, which employs nearly 200 people in the State’s Mid West.

Yuzheng Xie’s Gold Valley bought the project for $30 million plus a $2 per dry metric tonne royalty in late December when the spot price was closing in on $US150/t.

But another Perth-based businessman hailing from China could be left on the hook by his motherland casting its eye for iron ore elsewhere.

In early January, Chuanshui (Frank) Yin’s Miracle Iron Holdings signed a deal to grab the 85 per cent stake that Mark Creasy’s CZR Resources held in the Robe Mesa project for $102m.

It came just a week after Miracle inked an agreement with Strike Resources to snap up the Paulsen’s East iron ore development — which like Robe Mesa is located in the Pilbara — for $20.5m.

Robe Mesa is still in development while the currently shuttered Paulsens East is a marginal operation even during the best of times.

About 66,000 tonnes of high-grade lump iron ore was shipped from Paulsens East to Hong Kong in August 2022, but less than a week after the maiden shipment exports were suspended while prices were on a downward trend, but still above $US100/t.

There are others that will also be keeping a close eye on the current price instability with bated breath.

Mt Gibson Iron is the biggest of the bunch via its ageing Koolan Island mine, which has underpinned a feast-or-famine existence for a number of years.

For the most recent half-year Mt Gibson delivered a bottom-line windfall of $138.7m, after eking out a $7.4m profit in the prior corresponding period, and crashing to a $65.6m loss for the first half of the 2022 financial year.

Mt Gibson offloaded its high-cost Shine operation in the Mid West in June last year to the John Welborn-helmed Fenix Resources.

Last month, Fenix signed a $70m iron ore haulage and logistics contract with Gold Valley to transport product from Wiluna West to port.

During a busy March the miner also shipped first ore from the Twin Peaks operation, which like Shine and its flagship Iron Ridge mine is in the Mid West.

Fenix has some breathing room with about 50,000t of production a month hedged until the end of June at a fixed price of about $US170/t.

The miner likes to spruik its logistics arm but, like its iron ore peers, over the longer-term Fenix will be starkly exposed to the whims of evolving Chinese demand.