Noni B, Katies owner Mosaic Brands enters ‘safe harbour’ amid financial struggles

Mosaic Brands has confirmed it has entered so-called safe harbour arrangements, allowing the board to remain control of the embattled fashion retailer as it seeks to trade out of financial difficulties.

Mosaic Brands has confirmed it has entered so-called safe harbour arrangements, allowing the board to remain control of the embattled fashion retailer as it seeks to trade out of financial difficulties.

The listed company behind budget clothing brands Noni B, Rockmans, Rivers, Millers and Katies emerged from a brief trading halt on Wednesday to confirm its “directors have and continue to take advice from advisors on their ongoing duties”.

This followed media reports this week the retailer had entered safe harbour.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.“These fiduciary obligations are matters the board has always taken seriously and we confirm that the advice provided has extended, from time to time, to considering the applicability of and compliance with the safe harbour provisions as outlined in the Corporations Act 2001 (Cth) for the directors,” Mosaic said in a statement to the market on Wednesday.

“The group confirms that during this time, Deloitte has been advising the company on refinancing considerations that have previously been announced to the market.”

The safe harbour insolvency regime allows company directors to implement a restructure without the risk of personal liability for debts incurred by an insolvent firm.

This is provided they take a course of action that will likely lead to a better outcome for the company and its creditors, compared with calling in an administrator or a liquidator.

Entering safe harbour arrangements means a company can address financial distress behind the scenes without the need to notify the market.

Mosaic shares have plummeted 15.2 per cent to 3.9¢ at 12.30pm on Wednesday.

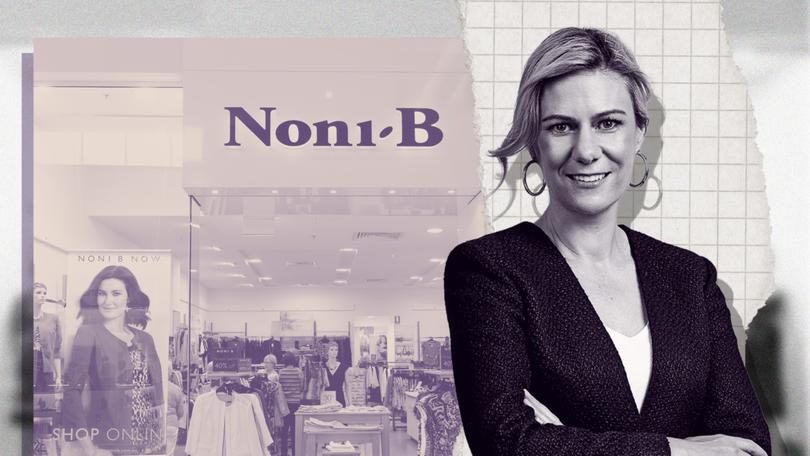

Mosaic — headed up by Erica Berchtold — also confirmed an undisclosed senior secured creditor of the group remains supportive and that it continued to work with suppliers to deliver for its customers.

“The group has suffered from operational issues in recent months that have adversely impacted trade,” the retailer said.

“These are being worked through by the directors, management and its advisors, and the group anticipates a recovery in its trading performance through the course of H1 FY25 once these operational issues are resolved.”

Mosaic operates more than 700 stores across nine brands, which also includes W Lane, Autograph, Crossroads and BeMe.

In a June trading update, Mosaic said the second half of the 2024 financial year had been challenging and that it was negatively impacted by disruptions as it migrated to a fully integrated logistical supply chain and distribution system.

The retailer at the time said delays in getting inventory for the key Mother’s Day trading period had “severely impacted” revenue and earnings in the fourth quarter.

Earlier this year, Mosaic appointed Ms Berchtold, the former boss of premium fashion retailer The Iconic, to replace its long-serving chief executive Scott Evans.

The Australian Competition and Consumer Commission has also commenced proceedings against Mosaic for allegedly breaching consumer laws by failing to deliver products to customers within the advertised delivery times on its websites.

Mosaic will report its 2024 financial year results on August 28, including an outlook for the first quarter of the new year.