RAIZ INVEST: Energy plans send stocks in uranium miner Deep Yellow Limited nuclear

The renewed focus on nuclear energy has led to a 358 per cent increase in this week’s trading for one of the country’s leading uranium miners.

Trading in one of Australia’s uranium miners has surged this week following renewed focus on nuclear energy.

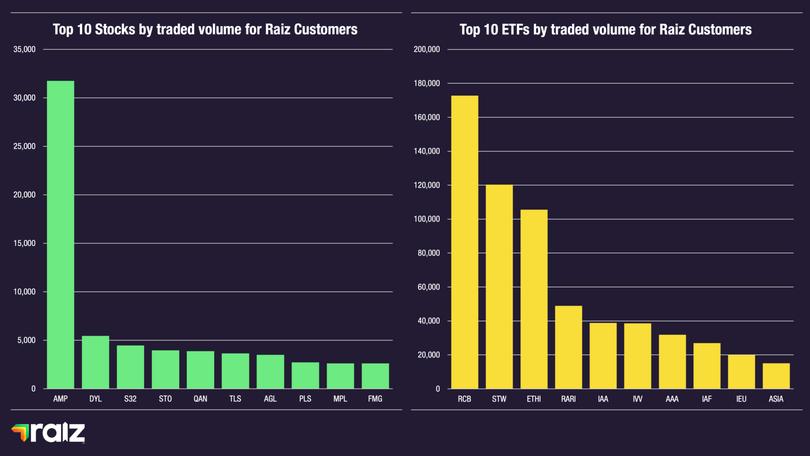

The boost to Deep Yellow Limited ($DYL) helped lift overall trading in the Raiz top 10 by 44 per cent, reaching 64,546 traded shares — just under 20,000 additional individual stock trades over the past seven days.

Deep Yellow saw a 358 per cent increase in shares traded for the week, totaling 5,457 shares, propelling the stock into second position in the top 10. This was partly driven by global events in the uranium market. Russia has announced it will consider export restrictions, leading to increased demand from other uranium providers. Additionally, Microsoft ($MSFT) signed a deal to revive a US nuclear power plant, fuelling hopes that growing demand could benefit nuclear stocks.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.At the start of the month, Deep Yellow provided an update on its Namibian project, which revealed stronger production potential than previously forecast. These factors together explain the surge in interest for the stock, and in turn, its share price, which has risen 39 per cent over the past month.

Also experiencing significant growth this week was Telstra ($TLS), which saw a 186 per cent increase in shares traded. The company just launched its new advertising platform, “Wherever We Go,” in an effort to revamp its corporate image. The campaign’s goal is to win over customers after recent price hikes, which were unpopular given the current cost-of-living pressures. Despite this, Telstra added half a million customers to its existing 26 million mobile services last year.

The advert is well-timed with the new iPhone launch, which may lead consumers to switch telecom providers for better deals.

South32 ($S32) took third place, with a 182 per cent increase in shares traded. The company, a consistent favoirite on Raiz, provided an update on its Arizona project. The US Department of Energy granted $166 million to South32 as part of the country’s effort to secure critical minerals for the clean energy transition.

South32 announced that the grant would accelerate the development of its manganese production facility and help establish a North American supply chain for battery-grade manganese.

The ETF market also rebounded, with trading up 7 per cent among the top 10. Once again, the most significant changes were seen in sustainable ETFs. Betashares Global Sustainability Leaders ETF ($ETHI) and Russell Investments Australian Responsible Investments ETF ($RARI), which were down last week, saw increases of 11 per cent and 28 per cent, respectively.

Making a notable appearance in the top 10 this week was the Betashares Asia Technology Tigers ETF ($ASIA), which surged 72 per cent. This increase may be primarily linked to positive media coverage, particularly from Motley Fool, which listed it as both a top ETF to buy this week and an ETF to buy and hold forever. The ETF provides investors with exposure to some of the best tech stocks in the Asian region, many of which have bright futures due to the growing middle class.

The information contained in this email is general information only and does not take into account your financial situation, objectives or needs.

Raiz Invest Australia Limited – Authorised Representative of AFSL 434776. The Raiz Invest Australia Fund is issued in Australia by Instreet Investment Limited (ACN 128 813 016 AFSL 434776) a subsidiary of Raiz Invest Limited and promoted by Raiz Invest Australia Limited (ACN 604 402 815). PDS and TMD are available on the Raiz Invest website and App. You should read and consider those documents before deciding whether, or not, to acquire and continue to hold interests in the product.