RBA interest rates live updates: Central bank delivers third rate cut to help struggling homeowners

After surprising everyone by showing signs of caution last month, the central bank has today said the time is right to deliver another lot of rate relief. And one bank isn’t wasting any time passing it on.

MORTGAGE RELIEF: After surprising almost everyone by showing signs of caution last month, the central bank has today said the time is right to deliver another lot of rate relief.

Scroll down for all the latest updates.

Key events

12 Aug 2025 - 02:30 PM

ANZ, NAB late-comers but also agree to cut

12 Aug 2025 - 01:52 PM

Westpac joins the party!

12 Aug 2025 - 01:43 PM

Commonwealth Bank first of big four to move

12 Aug 2025 - 01:26 PM

Macquarie first to move with rapid-fire cut

12 Aug 2025 - 01:11 PM

Is the RBA now close to neutral?

12 Aug 2025 - 01:07 PM

Flashback to April 2023 ...

12 Aug 2025 - 01:03 PM

Chalmers says Albanese Government economic plan on ‘right track’

12 Aug 2025 - 12:59 PM

Chalmers warns cut won’t fix Australia’s economic problems

12 Aug 2025 - 12:52 PM

‘Lowest rate for more than two years’: Chalmers responds to RBA cut

12 Aug 2025 - 12:49 PM

Equity growth to eclipse rate cut relief for homeowners

12 Aug 2025 - 12:38 PM

But once again, a note of caution

12 Aug 2025 - 12:36 PM

Here’s what RBA had to say ...

12 Aug 2025 - 12:35 PM

And, at last, it’s a cut!

12 Aug 2025 - 12:14 PM

Getting on with the jobs

12 Aug 2025 - 12:00 PM

Why RBA was right to hold in July

12 Aug 2025 - 11:37 AM

Should you fix your home loan rate?

12 Aug 2025 - 11:30 AM

We’re using more cash, apparently

12 Aug 2025 - 11:13 AM

Aussie shares edge higher ahead of rates call

12 Aug 2025 - 11:07 AM

Experts hedging their bets

12 Aug 2025 - 10:54 AM

Rush to refinance as homeowners race ahead of RBA

12 Aug 2025 - 10:49 AM

What RBA boss said at the last meeting ...

12 Aug 2025 - 10:24 AM

Have you sprung a savings leak?

12 Aug 2025 - 09:54 AM

Battered young homeowners deserve a cut, says Kochie

12 Aug 2025 - 09:30 AM

What to check with your bank if there is a cut

12 Aug 2025 - 09:21 AM

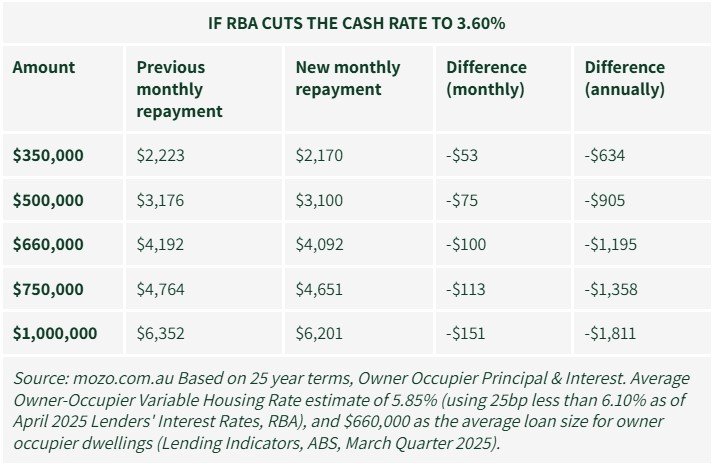

What you’ll save on your mortgage ...

12 Aug 2025 - 09:10 AM

How low can the RBA go?

We’re using more cash, apparently

A report published last week by the RBA showed there was an extra $175 million in bank notes circulating around the economy, taking the total to almost $104.1 billion.

Long-time physical currency advocate Jason Bryce, from lobby group Cash Welcome said it was a sign winthdraws remained strong.

“The RBA data is clear, cash withdrawals are strong, the value of notes on issue is booming, 2025 is the year Australians said NO to the ‘cashless society,” He said.

“The Australian Banking Association and banks say that Australians don’t want or need cash but these numbers tell a different story.

“I look forward to banks re-opening ATMs and bank branches to respond to changing consumer behaviour, because clearly Aussies want and demand access to cash.”

Is he right?

Aussie shares edge higher ahead of rates call

The Australian bourse was tracking modestly higher at midday AEST ahead of a local interest rate decision widely expected to result in a cut.

The S&P/ASX200 had gained 12 points, or 0.14 per cent, to 8856.8 at lunchtime on Tuesday, as the broader all ordinaries posted an increase of 8.9 points, or 0.14 per cent, to 9126.5.

US equities and yields were little changed overnight, with investors in a holding pattern ahead of an inflation readout expected to offer an early glimpse into the pass through of tariffs to consumer prices.

Economists and financial markets were all but certain of a 25 basis point interest rate reduction ahead of the Reserve Bank of Australia’s board decision on Tuesday afternoon, reflecting subdued inflation numbers.

Investors will also have fresh economic forecasts and analysis from the central bank, insights that could shape views on how many more cuts to expect.

The nine-member board shocked financial markets and economists in July when they kept the cash rate at 3.85 per cent, defying expectations of a reduction.

Interest rate-sensitive financial and discretionary stocks were leading the index higher at midday, with the latter up 0.8 per cent.

Read the full morning report here.

Experts hedging their bets

How can you tell today’s RBA rates call really is in the balance?

Journalists start getting fed prepared statements from economists - one for if they cut, one for if it’s a hold.

There’s still plenty of fence-sitting going on.

We’re getting closer to the decision, stick with us as we bring you all the latest news.

Rush to refinance as homeowners race ahead of RBA

Expectation of more than just one more cut in official rates have sparked a rush from homeowners to refinance their mortgages, as competition between the banks heats up again.

Fresh data released by Mortgage Choice shows there was a 22 per cent spike in the number of Australians looking to refinance over the June quarter thanks to a rate cut in May, and there is a chance of a fresh wave of refinancing if the RBA cuts again this afternoon.

Mortgage Choice chief executive Anthony Waldron says any cut to the cash rate would likely see a flux of mortgage holders looking to refinance.

“The Reserve Bank is expected to deliver another cut to the cash rate at its August meeting, which should encourage more borrowers to see if they can access a better rate on their home loan,” he said.

“This aligns with findings from the survey data, which show that 72 per cent of homeowners review their home loan at least once a year, up from 59 per cent a year ago.”

According to Mortgage Choice, 49 per cent of Aussies chose to refinance their mortgage to lower their interest rate, while 11 per cent wanted to consolidate debts and 10 per cent wanted to lock in a fixed rate or switch from fixed to variable (or vice versa).

Separate data released by the Australian Bureau of Statistics shows over the first quarter, $60 billionn worth of home loans with an estimated 97,835 loans were refinanced with a new lender.

What RBA boss said at the last meeting ...

Last month’s rates hold came as a shock to many.

But governor Michele Bullock has remained steadfast since she took the reins from Phillip Lowe: the central bank would be governed by data alone, not market sentiment.

Speaking at the post-meeting media scrum, Ms Bullock said there was “really good, active debate in the boardroom about the pros and cons of holding and easing.”

The disagreement, which saw six board members vote in favour of staying on hold, while three called for a cut, wasn’t over direction — but timing.

“I would characterise it as saying that the difference between the two camps really was down to a slightly softer reading of the data for those who wanted to cut,” Ms Bullock said, “and also a little bit more concern about the downside risks, particularly on the international side.”

Has there been enough of a shift in the board’s thinking over the past five weeks for members to believe the time’s now right?

We’ll find out in a little over 90 minutes.

Have you sprung a savings leak?

It’s time to fess up. Be honest.

Those lies you’re telling yourself about how much you REALLY spend are stopping you building wealth and creating a better future.

With a little extra money in your pocket (if the RBA cuts) it might be time to take stock and think about where all those savings from three rounds of rate relief are going - could they be put to better use?

Those little treats, those everyday expenses you don’t consider part of your overall budget add up. They’re the costs that don’t fall into any particular category and you kid yourself it’s spare cash.

It’s not, and it’s stopping you saving. Here’s how to get out of the habit ...

Good question ...

It’s also worth noting wages data from the Australian Bureau of Statistics is out tomorrow.

Battered young homeowners deserve a cut, says Kochie

Young homeowners with mortgages have “carried the nation through the cost-of-living crisis”, according to new research from comparison site Compare the Market.

Someone with an average loan of about $600,000 would have seen monthly repayments rise from $2218 to $3694 as the cash rate increased to 4.35 per cent between May 2022 and November 2023.

That’s $1477 a month, or about $17,700 in extra repayments over a year.

Compare the Market’s economic director David Koch said it was time to give people with a mortgage a “bigger break”.

“Young homeowners paying off a mortgage have carried the nation through the cost-of-living crisis,” Mr Koch said.

“They’ve had the worst of everything – higher prices at the supermarket, higher rates at the bank, plus the cost of everything from insurance to council rates going up.

“And of course, they had to spend much more to purchase a home in the first place.

“It’s thanks to their efforts that inflation is back in the Reserve Bank’s target range. They’ve tightened their belts, cut back on spending, and reckon its time some of that pressure came off.”

Cut or no cut, Mr Koch said homeowners should still be shopping about for the best loan deal, with the website finding there can be a 50 basis-point difference between some advertised rates from the big banks

“If you haven’t refinanced in a few years, it might be time to take a look and see if you can save with a lower rate,” he said.

“If you’ve paid down your loan, and your home has increased in value, you might be able to achieve an even bigger discount.”

What to check with your bank if there is a cut

Assuming the RBA does offer a third cut today, the cumulative effect of 75 basis points of cuts could save the average borrower almost $300 a month in repayments since February.

But not all mortgage holders will be eligible for an automatic reduction.

Of the big four banks, only Westpac automatically lowers a customer’s payments if they have it set to the minimum.

Commonwealth, NAB and ANZ customers must contact the bank if they want their direct debit amounts reduced.

Regardless of who they were with, Canstar data insights director Sally Tindall urged mortgage holders to weigh up what was best for them.

“For those managing to hold their budgets together, consider keeping your repayments exactly the same,” she said.

“Every rate cut is another opportunity to invest back into your mortgage and potentially be debt-free months, if not years early.”

If a mortgage holder who was sitting on a $600,000 loan in February kept their repayments steady, they would be paying $272 more a month in repayments than if they had lowered them to the minimum rate.

But it would also mean shaving off three years and three months off the length of their mortgage.

The average variable rate for owner-occupiers would fall to 5.54 per cent, assuming a cut is delivered and lenders pass it on in full, Ms Tindall said.

But that shouldn’t stop customers shopping around for an even lower rate.

“Your mortgage rate is one number where you want to be aiming for well below average,” Ms Tindall said.

“After this next cash rate cut, ambitious owner-occupiers should be able to set themselves a stretch target of 5.25 per cent.”

What you’ll save on your mortgage ...

... if the RBA decides to cut by 25 basis-points today. Will it? We’ll find out at 2.30pm AEST.

If your bank passes on any cut in full, you can expect a pretty decent whack back in your pocket each month.

But how will you spend it? Do the responsible thing and keep repayments the same and rebuild that mortgage buffer, shaving years off your loan.

Or a jetski?

Like today’s RBA call, it’s a coin toss.