Silver tops 45-year record high, leading explosive rally in precious metals

Gold and silver prices surged again on Tuesday as the gains spread across the share market and boosted national wealth.

The silver price jumped 3.5 per cent to a record high of $US52.21 on Tuesday, taking its gains this year to 73 per cent, outpacing gold’s 56 per cent gain and the S&P/ASX 200 stock index’s rise of 8.6 per cent.

Tuesday’s silver price surge saw it top a 45-year-old price record set in 1980 during the last big bull run for precious metals. This year’s run is being attributed to a silver supply shortfall as demand suddenly rises amid worries over the soundness of the global monetary system.

“You’ve got a bucket load of demand for silver as an investment tool in a similar way to gold as an inflation hedge,” said Patrick Walta, chairman of ASX-listed silver miner Broken Hill Mines. “But silver is different to gold, as its industrial use is strong in high-end tech, electronics, and solar panels so there’s demand growth.”

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.Mr Walta said his company’s Broken Hill mine is among a handful producing silver in Australia, and survived years of soft silver prices until this year’s dramatic upswing. The company plans to mine two new deposits and increase miners from 130 to 200 by next year.

“The new silver supply just isn’t there right now,” said Mr Walta. “So, it’s a classic supply and demand gap, gold’s had a record breaking run and the pair typically track each other in the gold and silver ratio.”

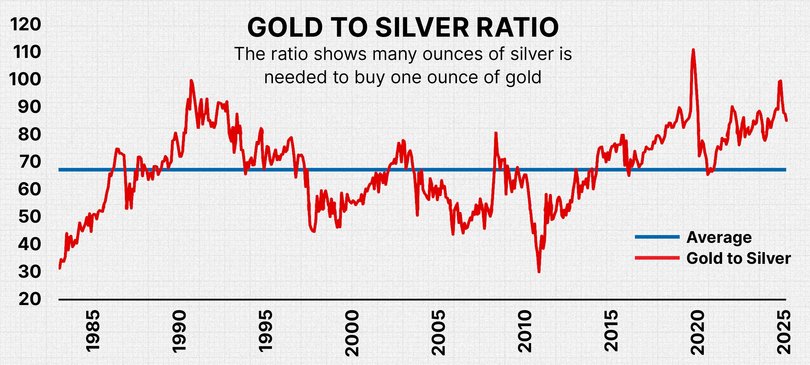

According to Morgan Stanley, one ounce of gold in US dollars has traded at a historical average of around 70 times the value of one ounce of silver as gold’s price action is a primary driver of investor sentiment towards silver.

However, silver has failed to keep up with gold’s last three-year bull run to mean around 80 ounces of silver is required to buy one ounce of gold at $US4,100 today.

According to Mr Waltz, silver should rise more to $US59 an ounce if it was to hit its long run average of 70 ounces to one ounce of gold in terms of nominal value.

“So now silver is catching up to get that ratio,” said Mr Walta. “The ratio blew out as gold outperformed, but now silver’s snapping back to get it into balance.”

Demand soars

Physical demand for silver has also grown so rapidly that news reports suggest bullion dealers in London - where most gold and silver is stored - are struggling to shift it fast enough to buyers, as its transport often requires time-consuming logistical, security and insurance complexities.

“There’s physical tightness in the London market which sets benchmark prices for precious metals and forces prices higher,” said Justin Arazadon an investment strategist at BetaShares.

“This lack of liquidity stems from a long-running supply deficit due to lacklustre silver production, but also because earlier in the year traders sought to arbitrage [US President] Trump’s potential tariffs and shipped large amounts of silver to US-based warehouses. The traders are reluctant to relocate those silver inventories as the US’s Section 232 probe into critical minerals, which allows them to set tariffs, including on silver has yet to conclude.”

Mr Arzadon also flagged soaring demand from Indian buyers for silver and gold ahead of the Diwali Holiday Festival on October 20, which traditionally sees families, friends and spouses gift each other jewellery and other precious metals.

On Tuesday afternoon queues to buy physical gold outside the ABC Bullion store in Sydney’s central business district stretched close to 100 metres as the mum-and-dad mania for the metal is matched by strong buying from central banks across Asia and Eastern Europe.

Silver miners also rallied, with Silver Mines Limited up 7 per cent to 22 cents, Mr Waltz’s Broken Hill Mines adding 6 per cent to $1.04 and Manuka Resources jumping 18.4 per cent to 9 cents.

Gold hits another record high, ASX miners surge

Speaking at the Citi Australia and New Zealand Investment Conference on Tuesday, Jake Klein the billionaire founder and non-executive chairman of $23 billion ASX-listed gold miner Evolution Mining said gold’s jaw-dropping run in 2025 is due to investors’ worries about ballooning global debt, alongside a new cold war between the US and China.

“There’s also a lack of social cohesion in democracies at the moment,” argued Mr Klein. “Maybe its driven by social media, maybe AI and tech. I think the gold price should make us nervous about where the world is at.”

The South African-born mining engineer and serial entrepreneur - who’s amassed a net worth estimated at $2.5 billion on gold’s record run - added that he believes the erratic trade policies of President Trump are also behind the latest surge higher in prices.

“I think it’s obvious the US dollar as a reserve currency is under threat,” said Mr Klein. “It feels like a paradigm where you keep waking up and thinking and hoping it can’t get worse and then the next day it does. China’s view would be that the US dollar shouldn’t be the only reserve currency, so other asset classes including gold will become increasingly desirable for central banks and investors.”

Gold has rallied all week since President Trump threatened 100 per cent tariffs on China last weekend and benchmark spot prices hit a record $US4,179 an ounce on Tuesday lunchtime before easing slightly to $US4,130 in the afternoon.

The gold miners all jumped again, with market heavyweight Newmont rising 4.5 per cent to $138.99, Northern Star gaining 2.8 per cent to $250.04 and Mr Klein’s Evolution advancing 1.9 per cent to $11.42.