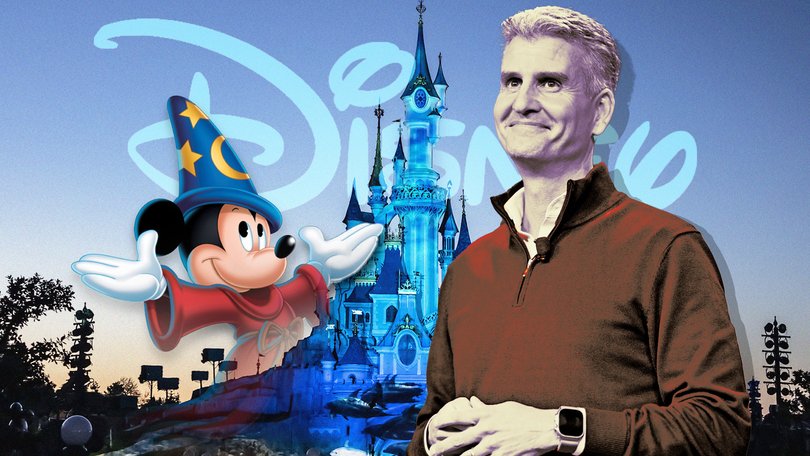

THE ECONOMIST: Josh D’Amaro, Disney’s new boss, faces a tricky balancing act

Josh D’Amaro must not forget the creative magic on which the House of Mouse relies.

As head of Disney’s “experiences” division, Josh D’Amaro is responsible for the theme parks that style themselves as the happiest places on Earth. Can he have the same cheering effect on investors?

On February 3 Disney’s board announced that Mr D’Amaro would be the entertainment giant’s next chief executive. He inherits a company whose rollercoaster share price is back to roughly where it was a decade ago.

Disney has taken its time to find a successor to Bob Iger, who has run the company for most of the past 20 years. Mr Iger’s first stint in the top job, from 2005 to 2020, was a blockbuster success, as Disney bought franchises such as Star Wars and Marvel and turned them into hit after hit.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.But his chosen successor, Bob Chapek, struggled in the job and within three years Mr Iger was back at the helm. His second act has been far less successful, as the 100-year-old company has grappled with digital disruption.

The appointment of Mr D’Amaro was widely expected in Hollywood. The 54-year-old, who has spent most of his career at Disney, runs the division that in recent years has provided the bulk of the company’s profits.

Yet even as Disney doubles down on its successful parks, it must not ignore the entertainment side of its business. Without Disney’s creative content, the parks will lose their magic — and their profitability.

In 1957 Walt Disney drew a diagram of his company’s business model, complete with drawings of Mickey Mouse, Donald Duck and other characters. At the centre of the diagram was the film studio, churning out movies.

Around it were the various ways of monetising the studio’s creative output: from television to merchandise, publications, music and, at the bottom, the then-new Disneyland theme park.

Since then Disneyland and its five sister parks around the world have come to be the main profit engines of the company. In its latest financial year, ending in September, the experiences division — which includes cruises and merchandise as well as the parks — accounted for 37 per cent of Disney’s revenue and 57 per cent of its operating profit. The day before Mr D’Amaro’s appointment the company announced that experiences brought in 72 per cent of Disney’s operating profit in the final three months of 2025.

Their dominance is relatively new. A decade ago parks and related businesses accounted for only a third of company profits, while television brought in the lion’s share. Ten years on entertainment has changed beyond recognition. Cable TV has collapsed. The cinema box office has taken a big hit. Streaming, which to a large extent has taken their place, is now profitable for Disney, but far less so than its old cable business was.

And Disney+ faces new competition: not just from Netflix (which is trying to gobble up Warner Bros Discovery, another legacy giant), but from social platforms like YouTube and TikTok that absorb ever more of people’s waking hours.

Amid this devastation, parks have thrived. As people spend more time on screens at home, they seem to be looking for new ways to let off steam (and spend money) in real life. Disney has ruthlessly taken advantage of this: tickets for a single day at its California park on a summer weekend can cost a family of four more than $US1,000 ($1400); once inside, they have the option of paying more to get to the front of queues. To keep up with demand, it is investing $US60 billion in its parks and cruises over the decade to 2033. Its latest cruise ship, the Adventure, will set sail in March. A seventh park is being built in Abu Dhabi.

Mr D’Amaro, who takes charge next month, will face two big challenges. One is Donald Trump, whose presidency appears to be repelling foreign tourists. Disney’s share price slid by 5 per cent after it said on February 2nd that its parks faced unspecified “headwinds” in attracting international visitors.

The other, longer-term risk concerns Disney’s creative magic, on which all of its entertainment empire relies. Movies may no longer contribute much to Disney’s bottom line. But the ideas within them are what draw people to Disney’s higher-value experiences. Visitors pay through the nose to ride the Millennium Falcon or explore the Avengers Campus because they love the movies on which these are based.

Yet the creative engines seem to be sputtering. The Mandalorian and Grogu, expected in May, will be the first Star Wars cinema release in nearly seven years. Fans seem to be cooling on the Marvel superhero franchise. And fresh ideas are scarce: this year’s Disney slate includes a live-action remake of Moana and a fifth Toy Story movie.

For now, Disney’s busy parks and cruise ships mean that investors can look beyond a limp performance at the box office. But Mr D’Amaro, who has little experience on the entertainment side of the business, will need to rekindle the creative brilliance at the centre of Walt Disney’s diagram.

Parks may be where the profits are made these days. But you can only go on charging $US275 (plus tax) for a light sabre if visitors love the films.