THE ECONOMIST: Nvidia invests $5 billion in Intel as AI chip partnership shakes up global tech market

THE ECONOMIST: A historic partnership between the two chip giants raises questions about the growing incestuousness in the AI economy.

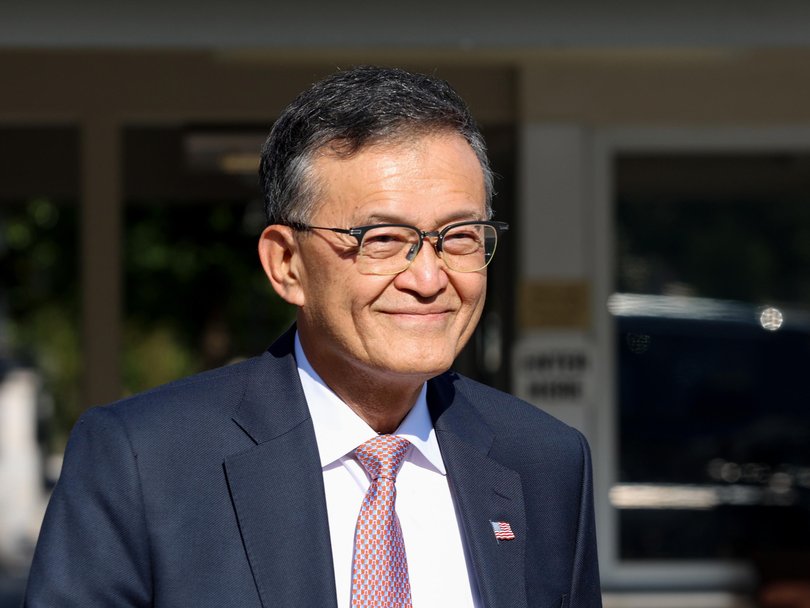

Before Nvidia’s Jensen Huang and Intel’s Lip-Bu Tan started a press conference to announce an “historic” partnership between the two American chipmakers on September 18, they were caught in an apparent hot-mic incident. Huang gushed about an “excellent” 1912 Cognac he had savoured at a state banquet the night before with Britain’s King Charles and President Donald Trump. There wasn’t enough of it, though, he joked.

Huang is in a celebratory mood. Hobnobbing with kings and presidents is one sign of his extraordinary ascent, thanks to Nvidia’s pivotal role in generative artificial intelligence that has made it the world’s most valuable company, worth $US4.3 trillion. He is also using his position to play a shrewd political game.

His announcement that Nvidia would make a $US5 billion ($7.57b) investment in Intel comes less than a month after Trump’s government took a 10 per cent stake in the same firm. Intel’s shares surged as much as 28 per cent on the news, increasing the value of Uncle Sam’s stake by almost $5 billion.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.That is something Mr Trump, who orchestrated the government’s deal, will no doubt savour as much as Huang did the Cognac. It also makes Intel look less like the national embarrassment that it was fast becoming.

The deal is not just about investment. Nvidia and Intel agreed to jointly develop chips for data centres and personal computers, which Mr Huang said represented a market opportunity of up to $US50 billion a year.

It will enable Intel to more seamlessly integrate its x86 central processing units (CPUs) into Nvidia’s state-of-the-art data centres, which will benefit Intel’s cloud-computing customers.

It will allow Nvidia to integrate its graphics processing units (GPUs) into Intel’s x86-powered personal computers.

The backbone of the collaboration is Nvidia’s NVLink, which speeds up communication across GPUs and between GPUs and CPUs, and which Nvidia recently made available to third parties. This helps reinforce Nvidia’s position as a partner of choice in the world of AI.

“The AI economy will run on systems where NVLink is the standard, and Nvidia decides who gets to plug in,” said analysts at Futurum Group, an IT-research firm. Nvidia’s shares climbed almost 3.5 per cent after the announcement.

The deal, about a year in the making, marks a badly needed vote of confidence in Intel, which has struggled in the AI era against rival CPU-makers such as Arm (mostly owned by Japan’s SoftBank), and Advanced Micro Devices (whose shares slid on the news).

But even if the partnership bolsters Intel’s CPU business, it does nothing for its contract manufacturing—or foundry—business, which is another key pillar of its survival.

Neither Mr Huang nor Mr Tan suggested Nvidia had any immediate interest in Intel’s foundry business. In fact, they heaped praise on TSMC, the world’s biggest contract chipmaker, based in Taiwan, which counts both American firms as clients.

Nvidia’s investment may help paper over that awkward detail; after all, it remains possible that the partnership will evolve. Yet it raises questions about the growing incestuousness in the AI economy. Nvidia is making a habit of doing deals with companies in which it holds big equity stakes.

For instance, it recently struck a $US6.3b cloud-computing deal with Coreweave, an up-and-coming data-centre firm, of which it owns 6.6 per cent. There is a fine line between seizing commercial opportunities and throwing lifelines.

If the AI bubble bursts, this interconnectedness could pull everyone down.

But for now bullishness persists. Huang says Nvidia is delighted to be a shareholder in Intel. That is not surprising. Before the partnership was announced, his firm bought Intel shares for $US23.28 each. By the market’s close, they were worth $US30.57. Worth a Cognac, surely?

Originally published as Nvidia’s $5bn stake in Intel is a shrewd political move