THE ECONOMIST: Race to the bottom as even cheaper Chinese electric vehicles spark trade fears for China

THE ECONOMIST: China is concerned about ramifications of cut-throat competition within its electric vehicle market.

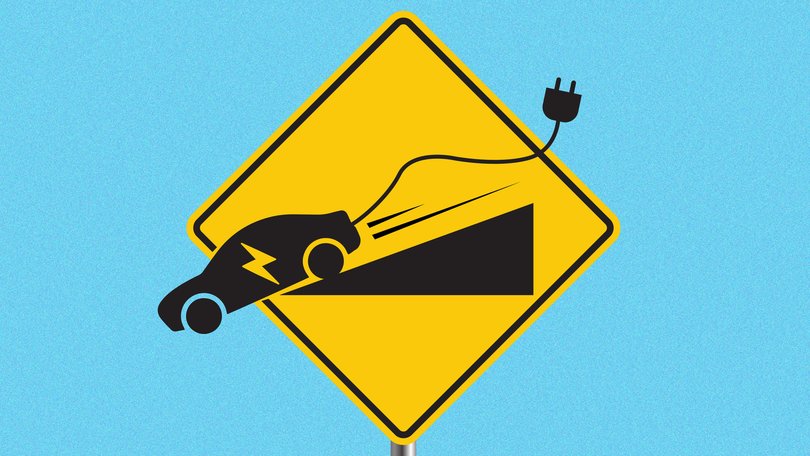

China’s ability to make electric vehicles (EVs) cheaply has caused angst in countries with big carmakers, prompting governments to investigate China’s subsidies for the sector and to erect trade barriers.

Now, though, it is China’s own government that is worrying about how cheap its producers’ EVs are. The race to the bottom shows no sign of letting up, and the industry has become emblematic of some of the broader problems facing the economy.

On May 23 China’s biggest ev manufacturer, BYD, caused shockwaves when it slashed the cost of 22 electric and hybrid models. Now the starting price of its cheapest model, the Seagull, has fallen to a mere ¥55,800 ($12,000).

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The move came just two years after BYD had originally unveiled the electric hatchback, at a then astonishingly low cost of ¥73,800. ($15,800)

The latest move triggered official concern about how low prices could go in the world’s largest car market. On May 31 China’s industry ministry told Xinhua, the state-run news agency, that “there are no winners in the price war, let alone a future”.

The ministry vowed to curb cut-throat competition, which it said harmed investment in R&D, and could cause safety problems. On June 1 People’s Daily, the Communist Party mouthpiece, argued that low-priced, low-quality products could harm the reputation of “made-in-China” goods.

The backlash comes as leaders crack down on unproductive, self-harming competition between firms and local governments that has created overcapacity and lowered profits.

Their moves are part of a broader effort to rebalance the economy.

“Recent developments suggest the old supply-driven model remains intact,” Robin Xing, Morgan Stanley’s chief China economist, wrote in a note.

BYD’s shares fell after the price cuts and the official pronouncements, amid concerns that the price war will be unsustainable.

But to cling to market share, other carmakers cut their own prices. Wei Jianjun, chairman of Great Wall Motor, one of the largest, called the industry unhealthy and invoked the collapse of the property market as a cautionary tale.

“Now, the Evergrande of the automobile industry already exists, but it just hasn’t exploded yet,” he told Sina Finance, a news outlet, referring to the world’s most-indebted developer. A BYD executive responded that Mr Wei’s comments were “alarmist”.

The situation is not helped by the fact that there are 115 Chinese EV brands, according to Jato Dynamics, a research firm.

Only a few, including BYD, make any money and are expected to survive in the long run. Brutal price wars are a common affliction across Chinese industries.

By the end of last year’s third quarter, nearly 25 per cent of China’s listed firms were in the red, more than double the proportion five years ago.

Panic in Detroit

Consolidation will take time and will be painful. BYD is well positioned, given its scale and vertical integration.

The firm controls everything from mining rights of minerals it needs to build its own batteries to cargo ships for transporting its cars to foreign markets.

In November it sparked fears of even fiercer competition when it pressed suppliers to cut prices by 10 per cent. Suppliers may now be squeezed further.

That could mean layoffs and less money for car workers to spend, at a time when the government is playing up the need to boost weak domestic demand to help absorb the shock of the trade war with America.

An increasingly tough market at home will fuel Chinese car exports.

Reuters reports that BYD plans to sell over half of its cars overseas, especially in Latin America and Europe, by 2030.

That would be a big jump. China accounted for about 90 per cent of the firm’s 4.3 million car sales last year.

But the higher prices that EVs command abroad could offset the ever-smaller margins in China.

And it is making inroads in spite of stronger trade headwinds. In April, despite the European Union’s increased tariffs on Chinese EVs, BYD sold more of them in Europe than Tesla, an American rival, for the first time, according to Jato Dynamics.

Though the price war is at its worst in China, its ramifications will be felt worldwide.

Cheaper EVs would be a silver lining, but that will be little comfort for governments already anxious about China exporting overcapacity to their markets. More trade tensions are inevitable.

Originally published on The Economist