The Economist: Streaming deals and investor interest are pushing new sports leagues to the masses

Interest from fans and investors has led to a surge of new sports. But is it a winning strategy?

The Barclays Centre usually hosts the Brooklyn Nets, a popular basketball team. But on a recent afternoon in August the arena was instead covered with 750 tonnes of carefully manicured dirt. It was the debut outing of the New York Mavericks, a new franchise in the Professional Bull-Riding (PBR) Teams league.

After an invocation was intoned and the national anthem belted, the lights dimmed and a flashy “PBR 101” video played on the gargantuan screen overhead. It is not just city folk who needed this primer. Teams are new in bull-riding. Athletes have to cling to a bucking bull for eight long, chaotic seconds, as they do during rodeos. But instead of riding by themselves, five cowboys compete together in a “head-to-head battle” against another squad. Viewers cheer their chosen teams through a two-hour-long match that has all the tension and drama of a good Western.

This fully “sportified” version of bull-riding is popular, with about 1 million viewers tuning in to each PBR Teams event on television in the 2023 season. The expansion in New York signals the league’s ambitions to lure new, urban fans. Franchise value is also growing fast: the first eight teams were sold for around $US3 million ($4.5m), but two new teams making their debut this year sold for around $US23m ($34.5m) each.

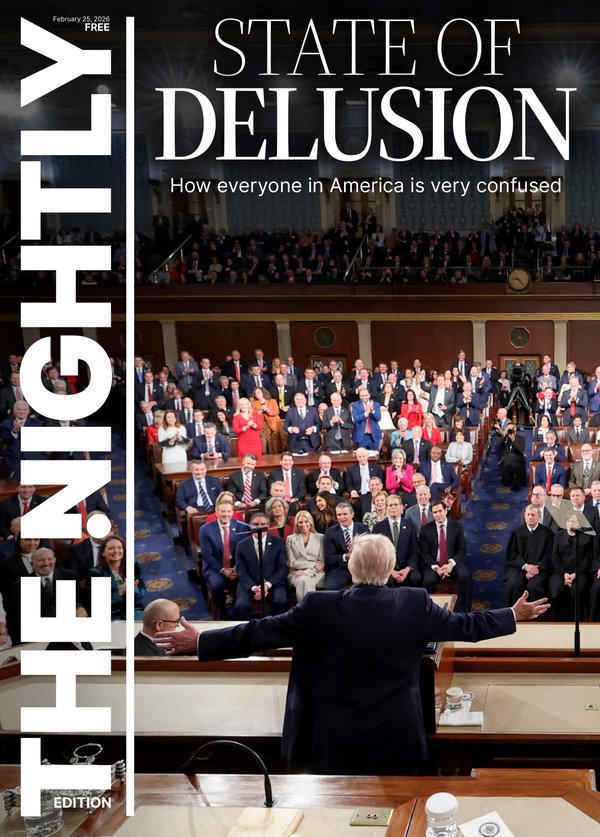

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The bulls are now running and kicking their way across America, including Kansas City on September 6th-8th and ending up at the Teams world championship in Las Vegas in October.

PBR Teams is one of at least 26 new leagues that have sprung up in the past decade in America. Some leagues are focused on popular pastimes, such as cornhole, the most-played game in America. (A longtime staple of university parties and country clubs, it involves throwing a bean bag through a hole on a board, in a feat of casual athleticism akin to bowling.)

Pickleball, the country’s fastest growing sport, now has several professional leagues. Slap fighting, in which contestants hit each other as hard as possible, also has one. Other leagues have restructured traditional sports to boost their appeal, like SailGP, a new and fast-growing sailing tour modelled on Formula One (F1), the popular international car race.

New leagues are not just storming the field in America. They are a global phenomenon, with the exception of China, where professional sport has struggled in recent years, with a major corruption scandal rocking football. The Kings League, for football, was founded in Spain in 2022 and has expanded to Latin America and will soon launch in Italy. That same year investors launched a baseball team in the United Arab Emirates, which aims for sport to account for 0.5 per cent of its GDP by 2031.

Saudi Arabia is spending billions on sports and founded LIV Golf, a tour that includes teams in what is usually a solo game; next the country will reportedly invest as much as $US2 billion ($3.5b) in a professional boxing league. In the past decade India has brought its A-game, with new leagues for badminton, cricket, kabaddi (an Indian contact sport), kho kho (a traditional tag game), tennis, table tennis and volleyball.

Investors are rooting for many of the upstart leagues, and it is not hard to understand why. Teams have appreciated handsomely over the past few decades in America, with valuations outperforming the S&P 500. A sports franchise also offers diversified income streams, with revenue from broadcast deals, sponsorship, ticket sales and merchandise.

Traditional teams are few and expensive, especially since private-equity firms and sovereign-wealth funds got in the game in recent years; startup leagues are cheaper, but still come with bragging rights for wealthy owners. A professional baseball squad costs about a hundred times more than a bull-riding outfit, but a PBR Teams event can have as many viewers as some baseball teams, according to Marc Lasry of Avenue Capital, a hedge fund that owns the New York Mavericks and has invested in SailGP and pickleball. “There’s a huge arbitrage there,” he insists.

Rapidly appreciating media rights have boosted the value of teams and given an assist to new leagues. In a business full of uncertainty, sports enthusiasts are probably the biggest fans of live entertainment. Broadcasters are paying ever more for the privilege of distributing it to them.

The entry of streamers like Amazon Prime Video, Apple TV+ and Netflix into the scrum has further punched up prices for sports rights. Once leagues had to compete for limited airtime; now there is a platform for everyone and everything. Visually arresting, fast-paced events like bull-riding and SailGP are also particularly well suited to distribution via social media.

“I don’t think this would have happened 20 years ago without the advances in technology. There’s just more eyeballs out there,” says Mike Keenan, who runs the sport practice for PwC, a professional-services firm.

Intense fan culture, which has swept the world of entertainment writ large, has given new teams a boost. Athletes such as Megan Rapinoe and Caitlin Clark (champions of football and basketball, respectively), are bona fide celebrities, helping create momentum for women’s sports that has boosted established leagues and led to the creation of new ones for volleyball and hockey.

So strong is appetite for watching sport that viewers want to turn on shows about athletes even when they are off the pitch. PBR was the subject of Netflix and Amazon series. Next year Brad Pitt will star in a Hollywood production about F1, which has already featured in a hit show on Netflix. In other words, there are more ways than ever to find fans — and to be one.

That does not mean that a golden age for leagues will translate into gold for everyone. “Historically there is a lot of roadkill in this space,” warns Scott Rosner, who teaches a class on emerging leagues at Columbia University. It is too early to say if Saudi Arabia’s sports experiments will succeed; a recently proposed European Super League for football faltered after teams and fans rebelled. Several new American leagues, including the United Football and Arena Football leagues, are reboots of failed ventures, and may well strike out themselves.

Securing effective media distribution deals and “consumer share of mind and consumer share of wallet” remains a big challenge, says Mr Rosner. Winning a match or a medal is up to athletes. But it is ultimately the support and interest from fans that determines whether a new league wins or loses.