THE ECONOMIST: The trouble with Elon Musk’s robotaxi dream

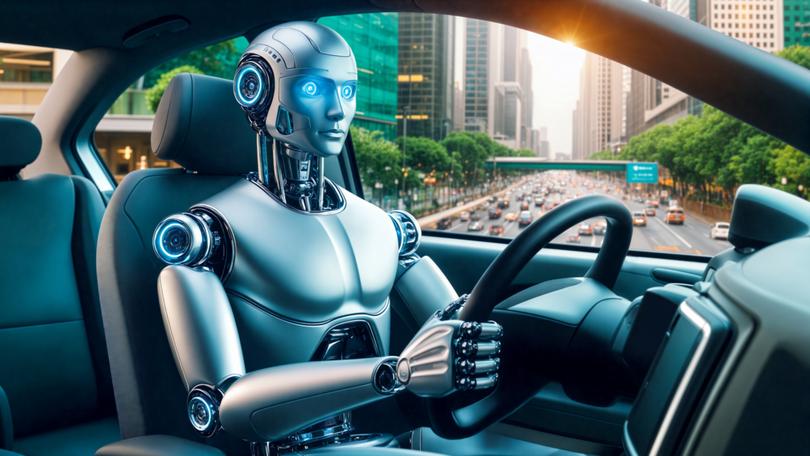

Elon Musk is serving up a vision of an autonomous Cybercab so cheap that it will serve as ‘individualised mass transit’. But his promises, like many Hollywood movies, are long on bombast and short on reality.

Elon Musk’s choice of Warner Bros Studios for the long-anticipated launch of his robotaxi on October 10 was entirely appropriate.

Hollywood’s film studios are as much a dream factory as Tesla, his electric car company.

The vision he served up, accompanied by whoops of delight from the super fans in the audience, is an autonomous Cybercab so cheap that it will serve as “individualised mass transit”. But Musk’s promises were, like many Hollywood movies, long on bombast and short on reality. The road to self-driving taxis will be long, and Tesla will have tough competition along the way.

Sign up to The Nightly's newsletters.

Get the first look at the digital newspaper, curated daily stories and breaking headlines delivered to your inbox.

By continuing you agree to our Terms and Privacy Policy.The Cybercab, a two-seater without a steering wheel or pedals, will be on sale “before 2027”, according to Musk, though his timelines often slip—he once promised a fleet of 1 million robotaxis by 2020.

He also showed off a Robovan, which will carry 20 passengers, and pledged that his humanoid robot will be the “biggest product ever of any kind”. Yet the event, which was light on details, disappointed investors; Tesla’s share price slumped 9 per cent the following day.

In recent years robotaxi services have popped up in a growing number of cities.

Waymo, a division of Alphabet, has raced ahead in America. After 15 years and perhaps $US30b of investment it now has a fleet of 700 self-driving cabs running in Los Angeles, San Francisco and Phoenix, and will soon launch in Atlanta and Austin.

Farther back is Cruise, whose biggest investor is General Motors.

It also operates in Phoenix and is resuming tests in San Francisco after regulators put on the brakes following an accident last year. Zoox, Amazon’s contribution to driverless travel, is testing vehicles in five locations including Las Vegas and Miami.

China has also become a hotspot for autonomy. Apollo Go, the robotaxi unit of Baidu, a Chinese tech giant, launched its service in Wuhan in 2022 and has since expanded to ten other Chinese cities. It aims to double its Wuhan fleet to 1000 robotaxis by the end of the year.

Other Chinese firms including Pony.ai, WeRide, and Didi, the country’s biggest ride-hailing firm, are also trying out robotaxis in several big cities.

But a series of pilots in a handful of cities are far from the go-anywhere vision that Musk has espoused, and there is still no guarantee of meaningful profits in the foreseeable future.

Waymo and its competitors so far mostly operate in places where the weather is fine and the roads are straight and wide. Expanding to trickier cityscapes will take time and money. To deploy its service in a new city, Waymo has to invest significant sums upfront to compile detailed 3D maps and build other necessary infrastructure.

The cost of the self-driving cars themselves—around $150,000 a piece for Waymo—also remains a problem. Around two-thirds of that is estimated to come from hardware. To run their vehicles autonomously, Waymo and others are relying on a battery of expensive sensors including cameras, radars and lidars, which use lasers to create a 3D image of the vehicle’s surroundings, as well as lots of in-car computing power to make sense of it all.

Human drivers account for well over half the fare of ride-hailing services such as Uber and Lyft, which suggests a big opportunity for self-driving cabs.

Yet Waymo still employs remote “safety drivers” to keep an eye on its vehicles. Significant amounts of real estate are also needed close to city centres in order to charge, clean and maintain robotaxis.

Bernstein, a broker, calculates that once all costs are considered, self-driving taxi fares will remain higher than human ones for some time. What is more, replacing the fleet of Uber and Lyft cars in America with robotaxis would require up to 400,000 vehicles, Bernstein reckons. At the current cost of a Waymo vehicle, that would mean an investment of around $60b.

Tesla is betting it can make a cheaper option work. Its “Full-Self Driving” system, which will be the underlying tech for its robotaxis, relies only on cameras to collect information.

Data from these will go into an “end-to-end neural network” — an algorithmic black box trained on 9bn miles of driving data from six million Teslas already on the road — to produce driving commands.

As a result, Tesla says its robotaxis will cost under $30,000 and will be easier to transfer from one city to another.

Even if Tesla can make the technology work, it will still need to convince regulators of its approach.

Its neural network will be far less transparent than the modular systems used by Waymo and others. And regulators may not trust that relying solely on cameras will be sufficient to deal with rare and unusual “edge cases”.

Officials are already wary of safety after Cruise’s accident last year, in which one of its vehicles dragged along a pedestrian thrown into its path by a human hit-and-run driver.

Mr Musk believes his approach will gain regulatory approval once it proves it is safer than human drivers. But any incidents that do occur could still turn off would-be passengers.

And some cities may also resist robotaxis if they are perceived as a threat to public transport and local jobs or a source of traffic congestion.

Also unresolved is the question of who will own and operate these robotaxis. Ride-hailing firms are one possibility. Uber has signed deals with Waymo and Cruise to make their vehicles available on its platform in some locations. It has also invested in Wayve, a British autonomy startup.

But the company, which has only just begun to turn a profit after years of torching cash, may be reluctant to pour vast sums into acquiring a self-driving fleet.

During his presentation, Mr Musk speculated that “an Uber or Lyft driver today” could end up operating a fleet of self-driving cabs “like a shepherd tends their flock”.

Such wishful thinking is why JPMorgan Chase, a bank, does not expect “material revenue generation...for years to come” from Tesla’s robotaxi efforts. Standing expectantly by the roadside for a driverless lift will, for most people, involve a long wait.